- Australia

- /

- Consumer Durables

- /

- ASX:BRG

The Compensation For Breville Group Limited's (ASX:BRG) CEO Looks Deserved And Here's Why

The performance at Breville Group Limited (ASX:BRG) has been quite strong recently and CEO Jim Clayton has played a role in it. Coming up to the next AGM on 10 November 2021, shareholders would be keeping this in mind. The focus will probably be on the future company strategy as shareholders cast their votes on resolutions such as executive remuneration and other matters. We think the CEO has done a pretty decent job and we discuss why the CEO compensation is appropriate.

See our latest analysis for Breville Group

Comparing Breville Group Limited's CEO Compensation With the industry

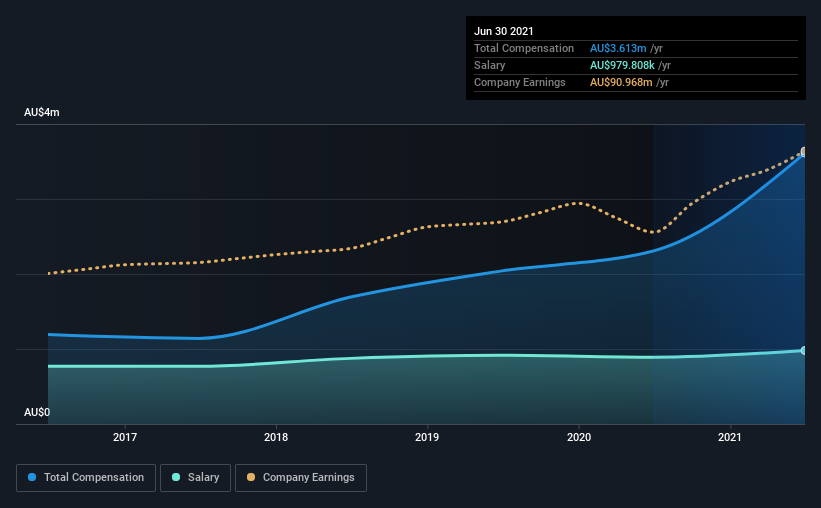

Our data indicates that Breville Group Limited has a market capitalization of AU$4.2b, and total annual CEO compensation was reported as AU$3.6m for the year to June 2021. We note that's an increase of 57% above last year. We think total compensation is more important but our data shows that the CEO salary is lower, at AU$980k.

On examining similar-sized companies in the industry with market capitalizations between AU$2.7b and AU$8.6b, we discovered that the median CEO total compensation of that group was AU$3.6m. So it looks like Breville Group compensates Jim Clayton in line with the median for the industry. Moreover, Jim Clayton also holds AU$7.0m worth of Breville Group stock directly under their own name, which reveals to us that they have a significant personal stake in the company.

| Component | 2021 | 2020 | Proportion (2021) |

| Salary | AU$980k | AU$889k | 27% |

| Other | AU$2.6m | AU$1.4m | 73% |

| Total Compensation | AU$3.6m | AU$2.3m | 100% |

On an industry level, around 48% of total compensation represents salary and 52% is other remuneration. Breville Group sets aside a smaller share of compensation for salary, in comparison to the overall industry. If non-salary compensation dominates total pay, it's an indicator that the executive's salary is tied to company performance.

A Look at Breville Group Limited's Growth Numbers

Over the past three years, Breville Group Limited has seen its earnings per share (EPS) grow by 13% per year. Its revenue is up 25% over the last year.

Shareholders would be glad to know that the company has improved itself over the last few years. This sort of respectable year-on-year revenue growth is often seen at a healthy, growing business. Looking ahead, you might want to check this free visual report on analyst forecasts for the company's future earnings..

Has Breville Group Limited Been A Good Investment?

Boasting a total shareholder return of 151% over three years, Breville Group Limited has done well by shareholders. So they may not be at all concerned if the CEO were to be paid more than is normal for companies around the same size.

In Summary...

The company's solid performance might have made most shareholders happy, possibly making CEO remuneration the least of the matters to be discussed in the AGM. However, investors will get the chance to engage on key strategic initiatives and future growth opportunities for the company and set their longer-term expectations.

CEO compensation is a crucial aspect to keep your eyes on but investors also need to keep their eyes open for other issues related to business performance. That's why we did some digging and identified 1 warning sign for Breville Group that you should be aware of before investing.

Switching gears from Breville Group, if you're hunting for a pristine balance sheet and premium returns, this free list of high return, low debt companies is a great place to look.

Valuation is complex, but we're here to simplify it.

Discover if Breville Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About ASX:BRG

Breville Group

Designs, develops, markets, and distributes small electrical kitchen appliances in the consumer products industry in the Americas, Europe, the Middle East, Africa, and the Asia Pacific.

Flawless balance sheet with acceptable track record.