Here's Why We Think Atlas Pearls (ASX:ATP) Might Deserve Your Attention Today

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it currently lacks a track record of revenue and profit. Unfortunately, these high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson. While a well funded company may sustain losses for years, it will need to generate a profit eventually, or else investors will move on and the company will wither away.

In contrast to all that, many investors prefer to focus on companies like Atlas Pearls (ASX:ATP), which has not only revenues, but also profits. Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide Atlas Pearls with the means to add long-term value to shareholders.

Check out our latest analysis for Atlas Pearls

Atlas Pearls' Improving Profits

Over the last three years, Atlas Pearls has grown earnings per share (EPS) at as impressive rate from a relatively low point, resulting in a three year percentage growth rate that isn't particularly indicative of expected future performance. Thus, it makes sense to focus on more recent growth rates, instead. In impressive fashion, Atlas Pearls' EPS grew from AU$0.011 to AU$0.021, over the previous 12 months. Year on year growth of 97% is certainly a sight to behold. That could be a sign that the business has reached a true inflection point.

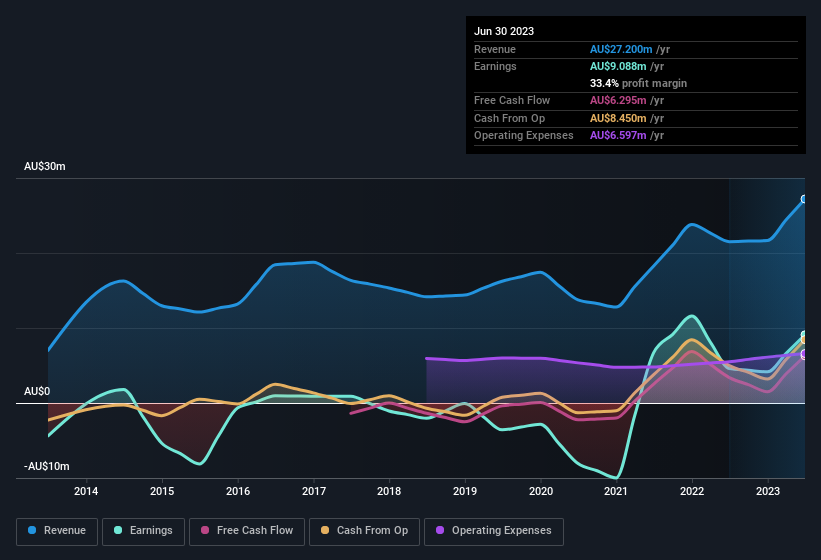

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. Atlas Pearls shareholders can take confidence from the fact that EBIT margins are up from 18% to 35%, and revenue is growing. Both of which are great metrics to check off for potential growth.

You can take a look at the company's revenue and earnings growth trend, in the chart below. Click on the chart to see the exact numbers.

Since Atlas Pearls is no giant, with a market capitalisation of AU$68m, you should definitely check its cash and debt before getting too excited about its prospects.

Are Atlas Pearls Insiders Aligned With All Shareholders?

Insider interest in a company always sparks a bit of intrigue and many investors are on the lookout for companies where insiders are putting their money where their mouth is. Because often, the purchase of stock is a sign that the buyer views it as undervalued. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

In the last twelve months Atlas Pearls insiders spent AU$67k on stock; good news for shareholders. While this isn't much, we also note an absence of sales. Zooming in, we can see that the biggest insider purchase was by Non-Executive Director Timothy Martin for AU$56k worth of shares, at about AU$0.055 per share.

It's reassuring that Atlas Pearls insiders are buying the stock, but that's not the only reason to think management are fair to shareholders. Specifically, the CEO is paid quite reasonably for a company of this size. The median total compensation for CEOs of companies similar in size to Atlas Pearls, with market caps under AU$303m is around AU$447k.

Atlas Pearls' CEO took home a total compensation package worth AU$307k in the year leading up to June 2023. That seems pretty reasonable, especially given it's below the median for similar sized companies. CEO remuneration levels are not the most important metric for investors, but when the pay is modest, that does support enhanced alignment between the CEO and the ordinary shareholders. It can also be a sign of good governance, more generally.

Should You Add Atlas Pearls To Your Watchlist?

Atlas Pearls' earnings have taken off in quite an impressive fashion. The company can also boast of insider buying, and reasonable remuneration for the CEO. The strong EPS growth suggests Atlas Pearls may be at an inflection point. For those attracted to fast growth, we'd suggest this stock merits monitoring. Still, you should learn about the 2 warning signs we've spotted with Atlas Pearls (including 1 which is potentially serious).

There are plenty of other companies that have insiders buying up shares. So if you like the sound of Atlas Pearls, you'll probably love this curated collection of companies in AU that have witnessed growth alongside insider buying in the last three months.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:ATP

Atlas Pearls

Produces and sells south sea pearls in Australia and Indonesia.

Flawless balance sheet, good value and pays a dividend.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)