- Australia

- /

- Commercial Services

- /

- ASX:MAD

Exploring 3 Undervalued Small Caps In Australia With Insider Activity

Reviewed by Simply Wall St

In the last week, the Australian market has remained flat but has shown a robust 16% increase over the past year, with earnings projected to grow by 12% annually in the coming years. In this context of steady growth and positive outlooks, identifying stocks that are perceived as undervalued with notable insider activity can be an intriguing opportunity for investors seeking potential value plays.

Top 10 Undervalued Small Caps With Insider Buying In Australia

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Magellan Financial Group | 7.7x | 4.9x | 36.37% | ★★★★★☆ |

| GWA Group | 17.0x | 1.6x | 39.98% | ★★★★★☆ |

| Collins Foods | 18.1x | 0.7x | 8.15% | ★★★★☆☆ |

| Centuria Capital Group | 22.3x | 5.0x | 43.74% | ★★★★☆☆ |

| Bapcor | NA | 0.9x | 43.94% | ★★★★☆☆ |

| Tabcorp Holdings | NA | 0.5x | 19.73% | ★★★★☆☆ |

| Dicker Data | 21.5x | 0.8x | -76.47% | ★★★☆☆☆ |

| Corporate Travel Management | 21.4x | 2.5x | -0.26% | ★★★☆☆☆ |

| Abacus Storage King | 12.4x | 7.8x | -31.86% | ★★★☆☆☆ |

| Credit Corp Group | 22.6x | 3.0x | 35.87% | ★★★☆☆☆ |

Let's explore several standout options from the results in the screener.

Credit Corp Group (ASX:CCP)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Credit Corp Group is a financial services company specializing in debt ledger purchasing and consumer lending across Australia, New Zealand, and the United States, with a market capitalization of A$2.16 billion.

Operations: Credit Corp Group generates revenue primarily from Debt Ledger Purchasing in the United States and Australia/New Zealand, as well as consumer lending across these regions. The gross profit margin has shown fluctuations, peaking at 93.79% in March 2015 before declining to 87.09% by June 2024. Operating expenses have been a significant component of costs, with general and administrative expenses consistently forming a large part of these expenditures over multiple periods.

PE: 22.6x

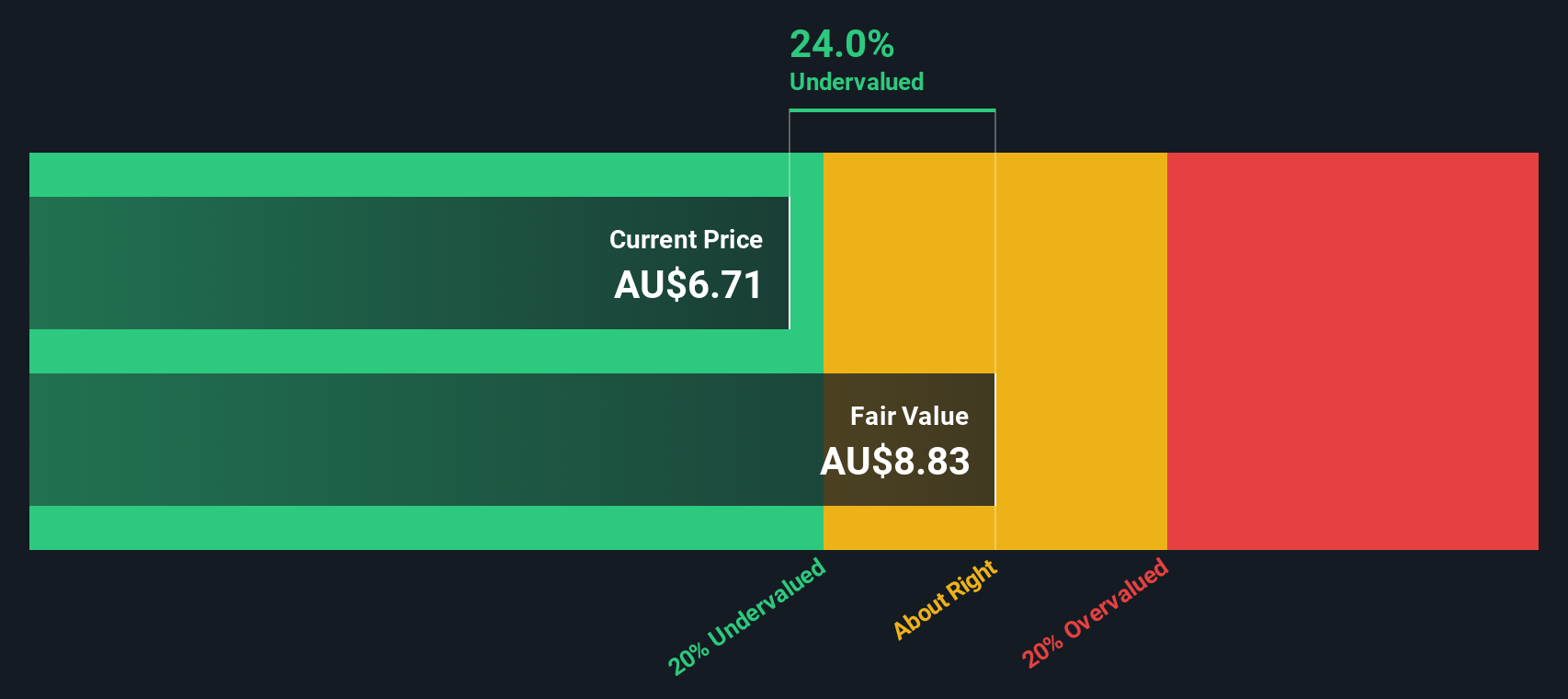

Credit Corp Group, a smaller Australian company, recently appointed Sarah Brennan as a Non-Executive Director, reflecting ongoing Board renewal. Despite reporting a drop in net income to A$50.71 million for the year ending June 2024 from A$91.25 million previously, they project fiscal 2025 earnings between A$90 million and A$100 million. Insider confidence is evident with recent share purchases over the past year. With profit margins at 13.4%, they remain poised for potential growth amidst financial challenges.

Mader Group (ASX:MAD)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Mader Group is a company that provides staffing and outsourcing services with a market capitalization of A$1.03 billion.

Operations: The company generates revenue primarily from staffing and outsourcing services, amounting to A$774.47 million. The gross profit margin has shown a notable trend, reaching 22.92% as of June 2024, while operating expenses are consistently significant within the cost structure.

PE: 21.5x

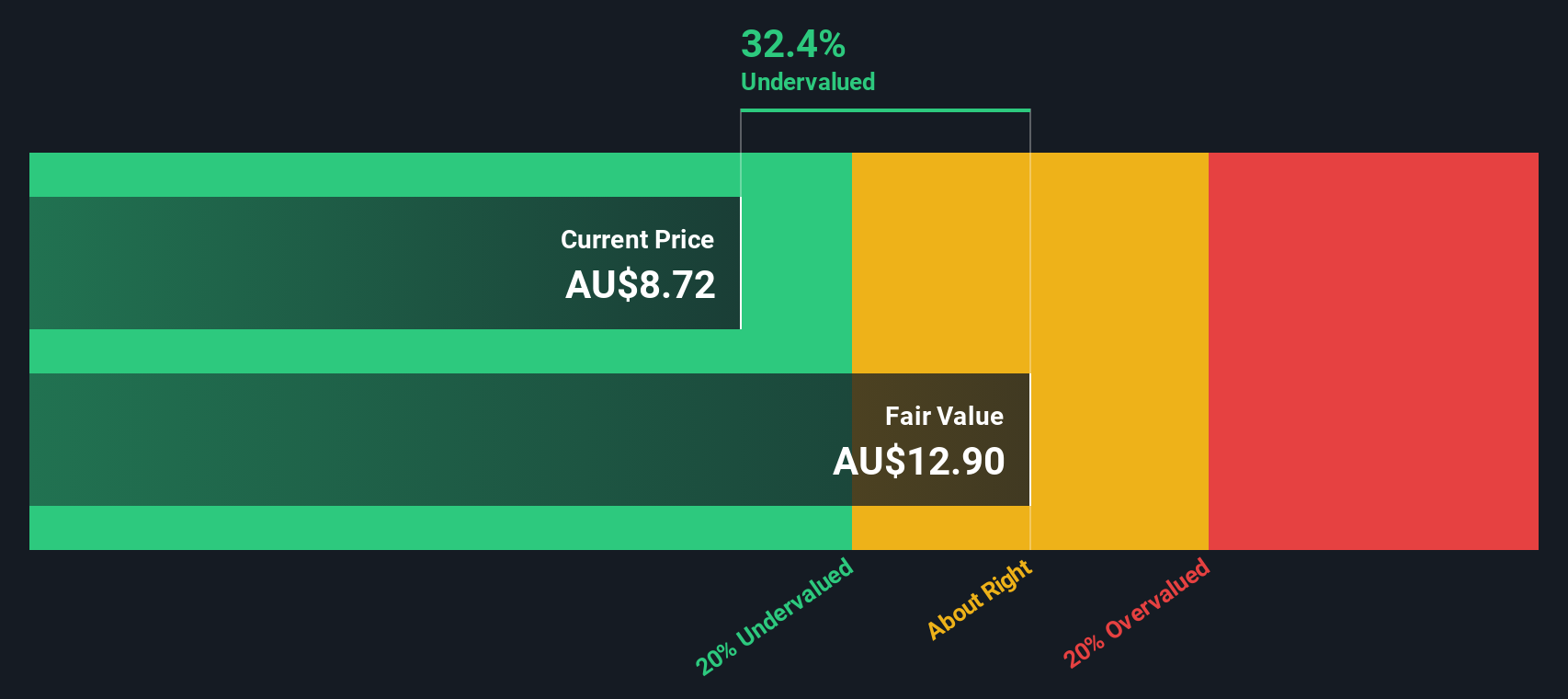

Mader Group, a dynamic player in Australia's small company sector, has recently been added to the S&P Global BMI Index as of September 2024. This inclusion reflects growing recognition and potential for increased investor interest. Despite relying solely on external borrowing, Mader's forecasted revenue growth of at least A$870 million for fiscal 2025 suggests robust operational momentum. Insider confidence is evident with recent share purchases, indicating belief in the company's future prospects. The firm also announced a dividend increase by 34% compared to the previous period, showcasing financial health and commitment to shareholder returns.

- Dive into the specifics of Mader Group here with our thorough valuation report.

Gain insights into Mader Group's historical performance by reviewing our past performance report.

Magellan Financial Group (ASX:MFG)

Simply Wall St Value Rating: ★★★★★☆

Overview: Magellan Financial Group is a financial services company specializing in investment management, with operations primarily focused on managing global equity and infrastructure strategies, and it has a market capitalization of A$5.64 billion.

Operations: Magellan Financial Group generates revenue primarily through Investment Management Services, contributing A$279.83 million, and Fund Investments at A$81.65 million. The company has experienced fluctuations in its gross profit margin, reaching 90.26% in September 2019 before declining to 80.78% by June 2024. Operating expenses have varied over time but include notable allocations for general and administrative costs and non-operating expenses impacting overall profitability.

PE: 7.7x

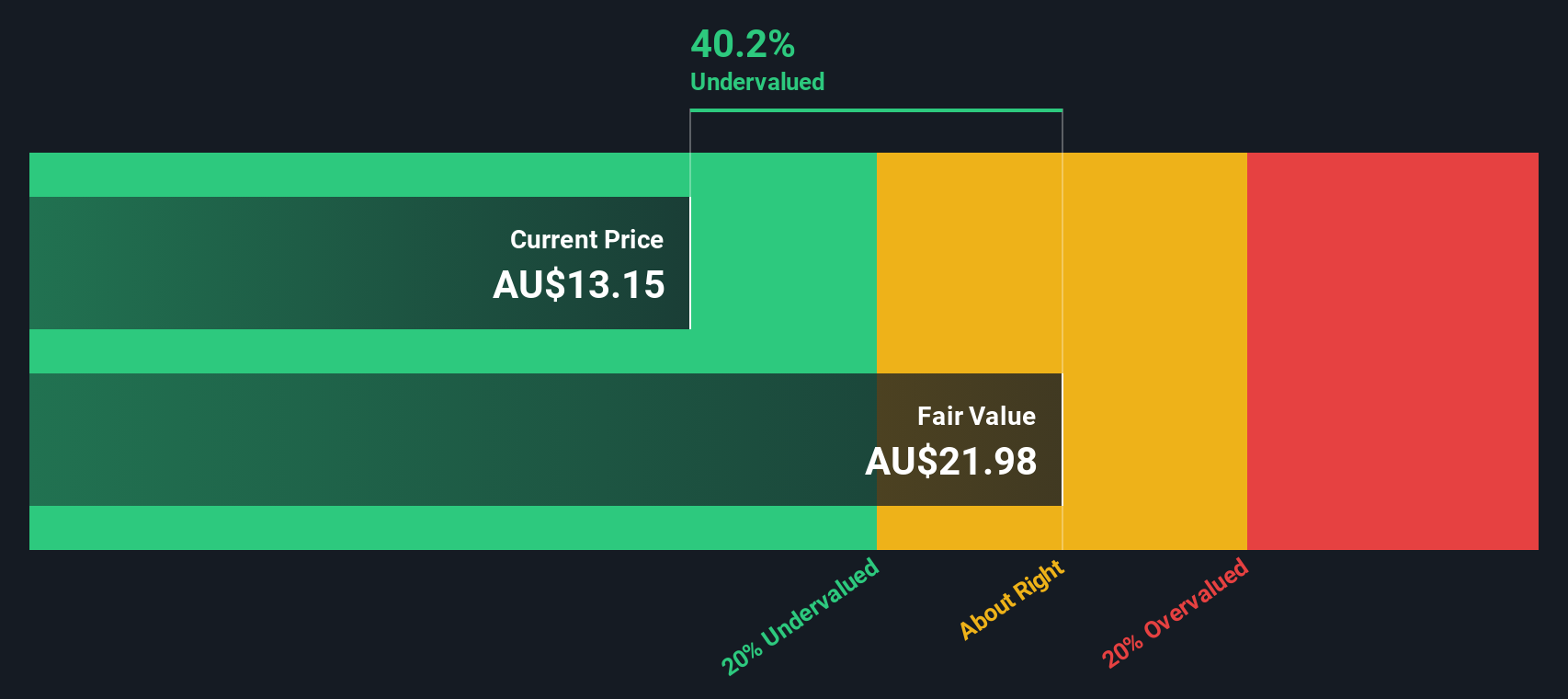

Magellan Financial Group, a smaller player in Australia, has caught attention with its strategic buyback activities. From July 2023 to June 2024, it repurchased 685,571 shares for A$5.19 million as part of a larger plan initiated in March 2022. Despite revenue dropping to A$378.63 million from A$431.65 million last year, net income rose to A$238.76 million from A$182.66 million due to high non-cash earnings quality and effective cost management strategies. However, future earnings are projected to decline by an average of 9.4% annually over the next three years due to reliance on external borrowing for funding instead of customer deposits and evolving market conditions that may impact growth prospects.

Turning Ideas Into Actions

- Access the full spectrum of 25 Undervalued ASX Small Caps With Insider Buying by clicking on this link.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:MAD

Mader Group

A contracting company, provides specialist technical services in the mining, energy, and industrial sectors in Australia and internationally.

Outstanding track record with flawless balance sheet.