- Australia

- /

- Commercial Services

- /

- ASX:MAD

3 ASX Stocks That Could Be Trading Up To 42.3% Below Intrinsic Value Estimates

Reviewed by Simply Wall St

Amidst a mixed performance in global markets and a slight dip anticipated for Australian shares, investors are keeping an eye on the ASX as it navigates through economic uncertainties. In such conditions, identifying undervalued stocks can be crucial, as they may offer potential upside when trading below intrinsic value estimates.

Top 10 Undervalued Stocks Based On Cash Flows In Australia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Acrow (ASX:ACF) | A$1.07 | A$2.01 | 46.7% |

| Domino's Pizza Enterprises (ASX:DMP) | A$26.73 | A$51.87 | 48.5% |

| Nido Education (ASX:NDO) | A$0.82 | A$1.59 | 48.3% |

| Champion Iron (ASX:CIA) | A$5.20 | A$9.21 | 43.6% |

| Kinatico (ASX:KYP) | A$0.175 | A$0.34 | 49.1% |

| Lotus Resources (ASX:LOT) | A$0.20 | A$0.39 | 48.7% |

| SciDev (ASX:SDV) | A$0.425 | A$0.82 | 47.9% |

| Charter Hall Group (ASX:CHC) | A$16.90 | A$31.98 | 47.2% |

| South32 (ASX:S32) | A$3.53 | A$6.42 | 45% |

| ReadyTech Holdings (ASX:RDY) | A$2.61 | A$5.11 | 48.9% |

We're going to check out a few of the best picks from our screener tool.

Adriatic Metals (ASX:ADT)

Overview: Adriatic Metals PLC, through its subsidiaries, focuses on the exploration and development of precious and base metals, with a market cap of A$1.54 billion.

Operations: Adriatic Metals PLC generates revenue primarily through its activities in the exploration and development of precious and base metals.

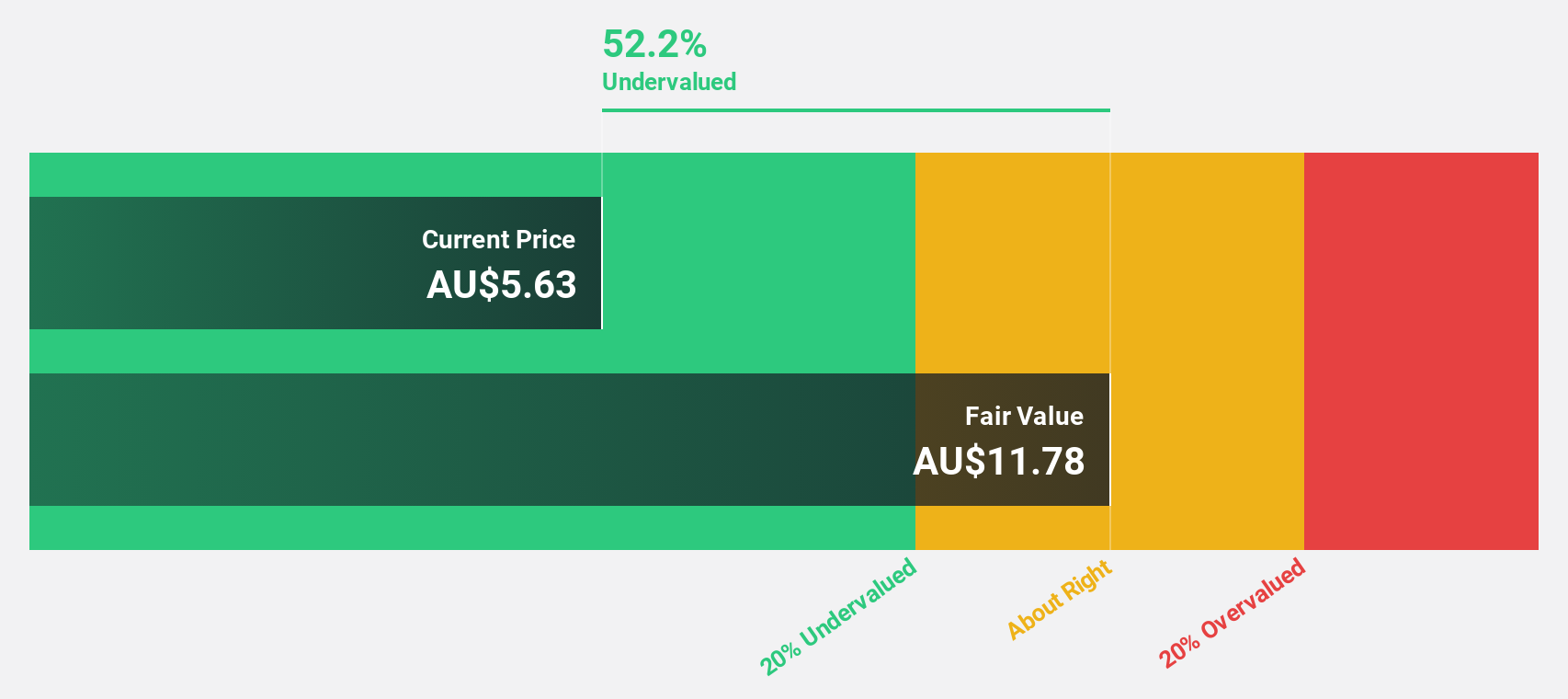

Estimated Discount To Fair Value: 42.3%

Adriatic Metals is trading at A$4.47, significantly below its estimated fair value of A$7.75, suggesting it may be undervalued based on cash flows. The company is expected to become profitable within three years with revenue growth forecasted at 43.1% annually, outpacing the Australian market's average. Recent equity offerings raised approximately A$80 million, potentially supporting future growth initiatives and enhancing cash flow prospects despite current low revenue levels of US$243K.

- Insights from our recent growth report point to a promising forecast for Adriatic Metals' business outlook.

- Click to explore a detailed breakdown of our findings in Adriatic Metals' balance sheet health report.

Mader Group (ASX:MAD)

Overview: Mader Group Limited is a contracting company that offers specialist technical services in the mining, energy, and industrial sectors both in Australia and internationally, with a market capitalization of A$1.20 billion.

Operations: The company generates revenue primarily through its Staffing & Outsourcing Services segment, which accounts for A$811.54 million.

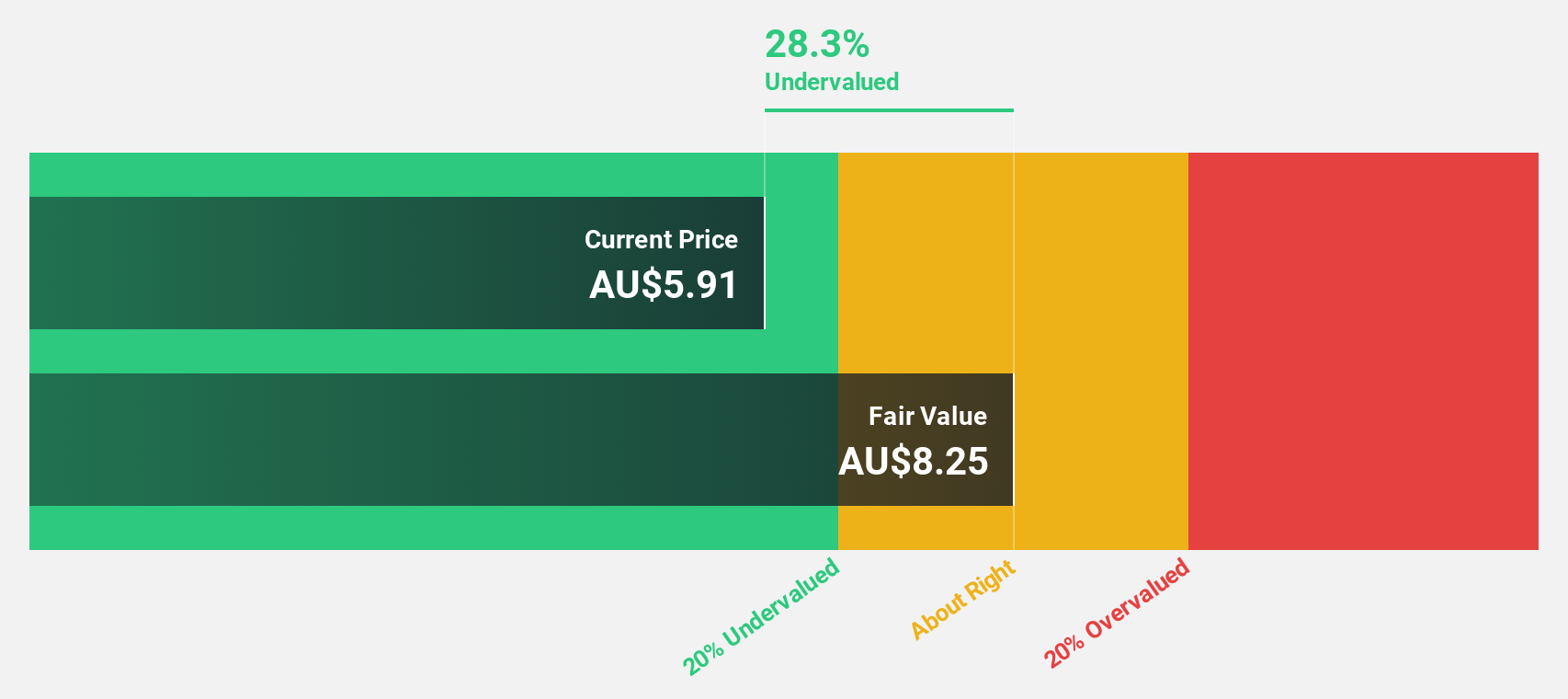

Estimated Discount To Fair Value: 25.1%

Mader Group, trading at A$5.92, is valued below its estimated fair value of A$7.90, highlighting potential undervaluation based on cash flows. The company reaffirmed its fiscal year 2025 guidance with expected revenue of at least A$870 million and NPAT of at least A$57 million. Recent earnings showed sales growth to A$411.5 million for the half-year ended December 31, 2024, with net income rising to A$26.01 million from the previous year’s figures.

- Our growth report here indicates Mader Group may be poised for an improving outlook.

- Get an in-depth perspective on Mader Group's balance sheet by reading our health report here.

Technology One (ASX:TNE)

Overview: Technology One Limited develops, markets, sells, implements, and supports integrated enterprise business software solutions both in Australia and internationally with a market cap of A$9.31 billion.

Operations: The company's revenue is derived from three primary segments: Software (A$347.35 million), Corporate (A$87.02 million), and Consulting (A$72.17 million).

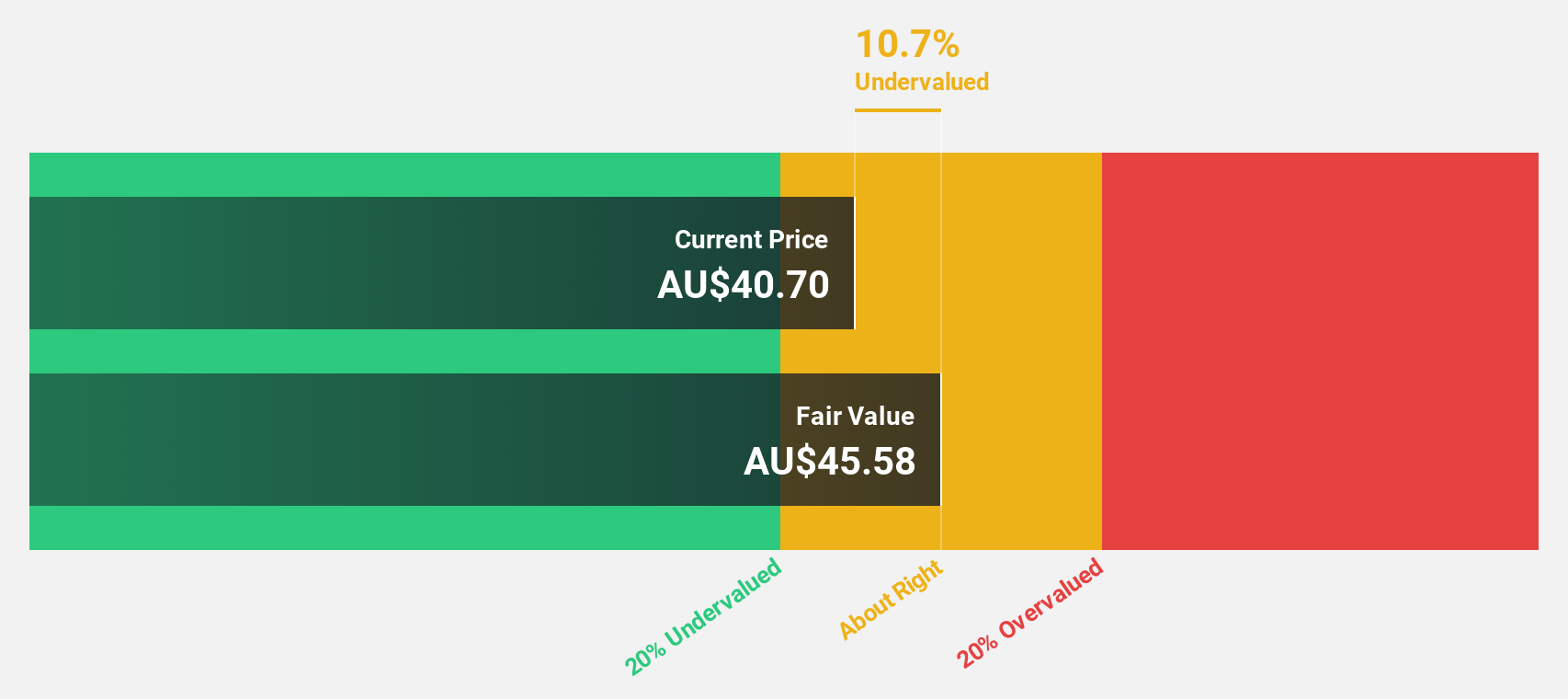

Estimated Discount To Fair Value: 29.8%

Technology One, trading at A$28.46, is priced below its fair value estimate of A$40.52, suggesting undervaluation based on cash flows. The company forecasts earnings growth of 16.1% annually, outpacing the Australian market's 12.2%. However, significant insider selling has occurred recently. Revenue is expected to grow by 12.4% per year. Recent changes include a constitutional amendment and the retirement of long-serving director Richard Anstey after Technology One's AGM in February 2025.

- Our earnings growth report unveils the potential for significant increases in Technology One's future results.

- Click here and access our complete balance sheet health report to understand the dynamics of Technology One.

Where To Now?

- Click here to access our complete index of 39 Undervalued ASX Stocks Based On Cash Flows.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:MAD

Mader Group

A contracting company, provides specialist technical services in the mining, energy, and industrial sectors in Australia and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives