- Australia

- /

- Professional Services

- /

- ASX:IPH

IPH (ASX:IPH) Is Down 8.4% After Strong FY25 Results and Dividend Hike – What's Changed?

Reviewed by Simply Wall St

- In August 2025, IPH Limited reported strong full-year results, with revenue rising to A$710.3 million and net income reaching A$68.8 million, while the company also declared a final dividend of 19.5 cents per share, bringing the full-year dividend to 36.5 cents, both set for payment in September 2025.

- The growth in both earnings and dividends reflects improved performance across IPH’s operations and signals confidence in the company’s ongoing ability to generate shareholder returns.

- With the recent uplift in the final dividend and robust annual earnings, we'll explore how these developments may influence IPH’s investment narrative.

These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

IPH Investment Narrative Recap

To be an IPH shareholder today, you need to believe in the company's capacity to harness structural digitization and Asia-Pacific growth, while remaining cautious about its reliance on US patent flows. The recent earnings and dividend uptick provide support for near-term optimism, but do not fundamentally shift the company's most pressing short-term catalyst: further workflow normalization and growth in the Asian and Canadian markets. The main risk, continued US patent headwinds, remains material and should not be overlooked.

The latest full-year result, with revenue and net income both advancing, is closely tied to the company's decision to lift its final dividend to 19.5 cents per share. This reflects both improved operational performance and continuing confidence in cash generation, but also raises questions about earnings sustainability in light of sector-wide cost and margin pressures. Yet, beneath these headline gains, investors should stay alert to how much upcoming regional performance and cost savings will buffer against any prolonged weakness elsewhere.

On the other hand, there’s more investors should consider regarding the impact of declining US patent filings and its longer-term influence on...

Read the full narrative on IPH (it's free!)

IPH's outlook anticipates A$768.8 million in revenue and A$107.5 million in earnings by 2028. Achieving this would require annual revenue growth of 2.9% and an earnings increase of A$38.7 million from the current earnings of A$68.8 million.

Uncover how IPH's forecasts yield a A$5.86 fair value, a 34% upside to its current price.

Exploring Other Perspectives

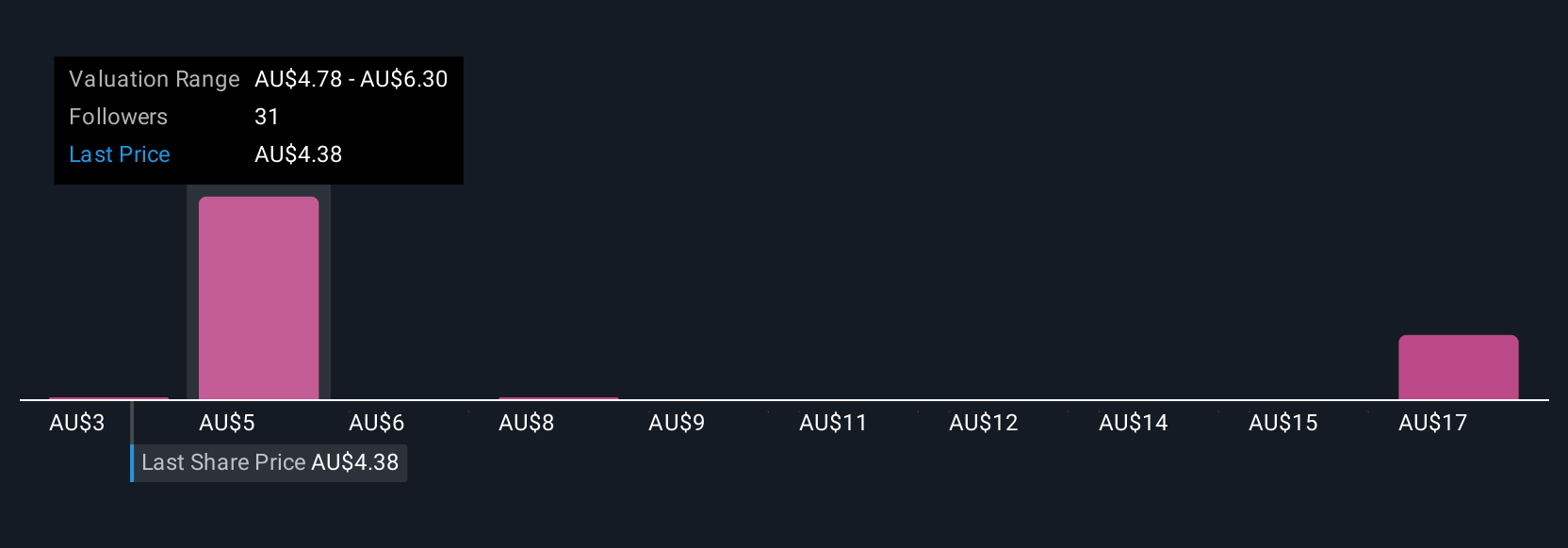

Simply Wall St Community members offered 6 fair value estimates for IPH stock, ranging from A$3.27 to A$18.36 per share. While opinions diverge significantly, many remain focused on IPH's exposure to US patent trends and how this could shape future returns.

Explore 6 other fair value estimates on IPH - why the stock might be worth over 4x more than the current price!

Build Your Own IPH Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your IPH research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free IPH research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate IPH's overall financial health at a glance.

Seeking Other Investments?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Find companies with promising cash flow potential yet trading below their fair value.

- This technology could replace computers: discover 23 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:IPH

Undervalued established dividend payer.

Market Insights

Community Narratives