- Australia

- /

- Commercial Services

- /

- ASX:DOW

Downer EDI (ASX:DOW): Valuation Insights Following Progress on Share Buy-Back Initiative

Reviewed by Kshitija Bhandaru

Downer EDI (ASX:DOW) has reported further progress in its ongoing on-market share buy-back program. This approach highlights management’s ongoing efforts to optimise capital structure and return value to shareholders, which provides confidence for investors.

See our latest analysis for Downer EDI.

Downer EDI’s share price has climbed over 41% so far this year, with a 1-year total shareholder return of nearly 41% and longer-term gains continuing to impress. The recent momentum, supported by active capital management and ongoing contract wins, suggests that investor confidence in the company’s growth story remains strong.

If Downer’s rally has you thinking about what else might be on the move, this could be the right moment to broaden your search and discover fast growing stocks with high insider ownership

But with shares already up sharply and recent analyst targets close to the current price, is there still a buying opportunity here? Or has the market already fully factored in Downer EDI’s expected future growth?

Most Popular Narrative: 3.4% Overvalued

Downer EDI’s last close at A$7.52 now sits above the most popular narrative’s fair value of A$7.28, painting a picture of a share price running ahead of consensus expectations.

The company identified four key tailwinds supporting its strategy: transitional energy, government outsourcing, defense capability uplift, and building local industry capability. These align with its strengths in energy and electrical capabilities, defense services, and local manufacturing capability. These factors are expected to drive revenue growth over the coming years.

What bold assumptions could be fueling these ambitious revenue and margin projections? The narrative hints at a transformation plan leveraging sector tailwinds, but the true catalysts behind this premium valuation remain just beneath the surface. Want to uncover which numbers set this apart? Explore beyond the headlines and see the full foundation of the narrative’s price target.

Result: Fair Value of $7.28 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, execution risks tied to Downer's ongoing transformation and potential policy shifts in key government contracts could quickly change the current growth outlook.

Find out about the key risks to this Downer EDI narrative.

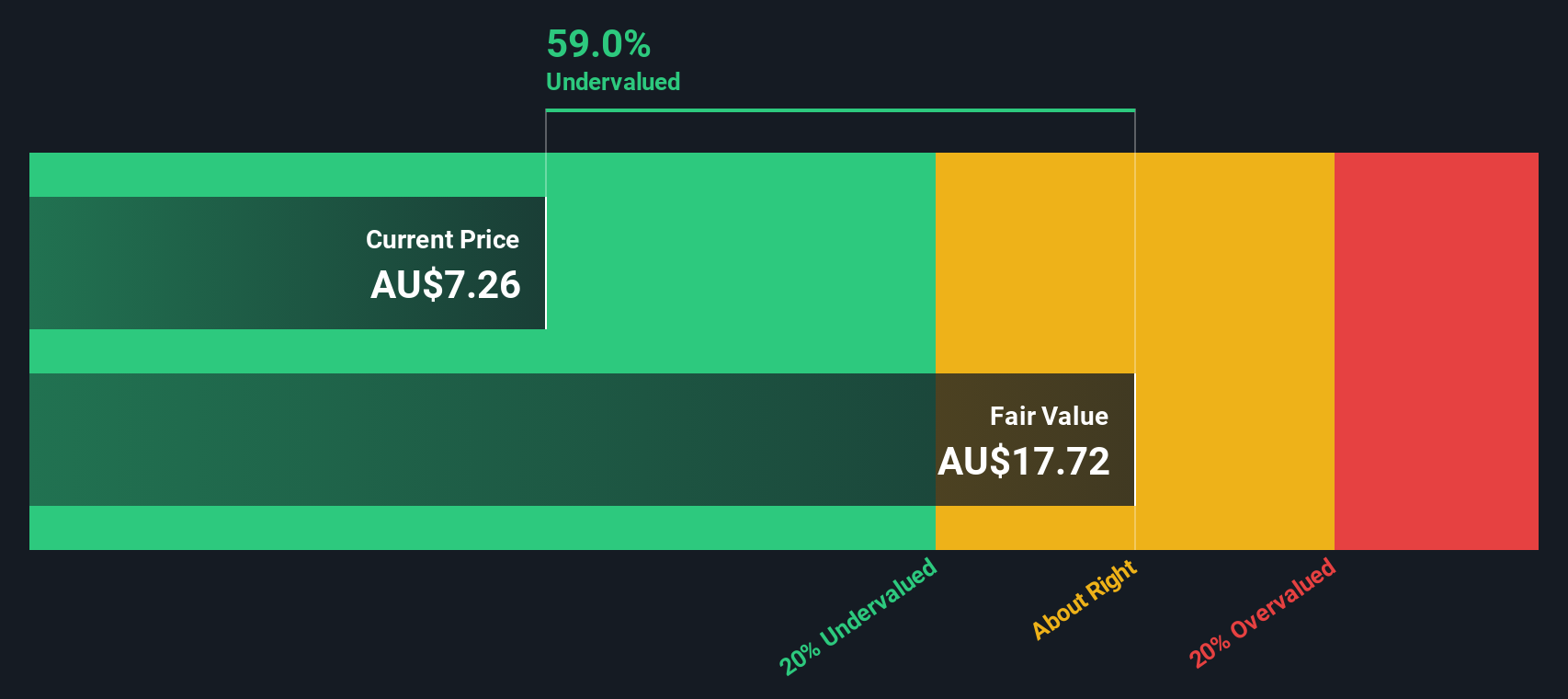

Another View: Our SWS DCF Model Suggests Major Upside

While the current share price appears overvalued by popular narrative and consensus targets, our SWS DCF model paints a much more optimistic picture. According to this approach, Downer EDI is trading at a significant 57% discount to fair value, which suggests untapped long-term potential. Can this much difference between models really be justified?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Downer EDI for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Downer EDI Narrative

If you prefer your own analysis or want to shape the story differently, you can craft your own narrative using the data in just a few minutes with Do it your way.

A great starting point for your Downer EDI research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Unlock new opportunities beyond Downer EDI by using the Simply Wall Street Screener. Act now to uncover unique markets and investment potential before others catch on.

- Capture rising income opportunities and jump into these 18 dividend stocks with yields > 3% delivering yields above 3% in today’s market.

- Spot high-potential technology innovators transforming our world when you review these 25 AI penny stocks making waves in artificial intelligence.

- Supercharge your portfolio by targeting these 881 undervalued stocks based on cash flows with strong fundamentals and attractive valuations that are still under the radar.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:DOW

Downer EDI

Operates as an integrated facilities management services provider in Australia, New Zealand, and internationally.

Excellent balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives