- Australia

- /

- Commercial Services

- /

- ASX:BXB

If You Like EPS Growth Then Check Out Brambles (ASX:BXB) Before It's Too Late

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it completely lacks a track record of revenue and profit. And in their study titled Who Falls Prey to the Wolf of Wall Street?' Leuz et. al. found that it is 'quite common' for investors to lose money by buying into 'pump and dump' schemes.

If, on the other hand, you like companies that have revenue, and even earn profits, then you may well be interested in Brambles (ASX:BXB). Now, I'm not saying that the stock is necessarily undervalued today; but I can't shake an appreciation for the profitability of the business itself. Conversely, a loss-making company is yet to prove itself with profit, and eventually the sweet milk of external capital may run sour.

See our latest analysis for Brambles

Brambles's Improving Profits

Even modest earnings per share growth (EPS) can create meaningful value, when it is sustained reliably from year to year. So it's no surprise that some investors are more inclined to invest in profitable businesses. It's good to see that Brambles's EPS have grown from US$0.33 to US$0.36 over twelve months. That's a 11% gain; respectable growth in the broader scheme of things.

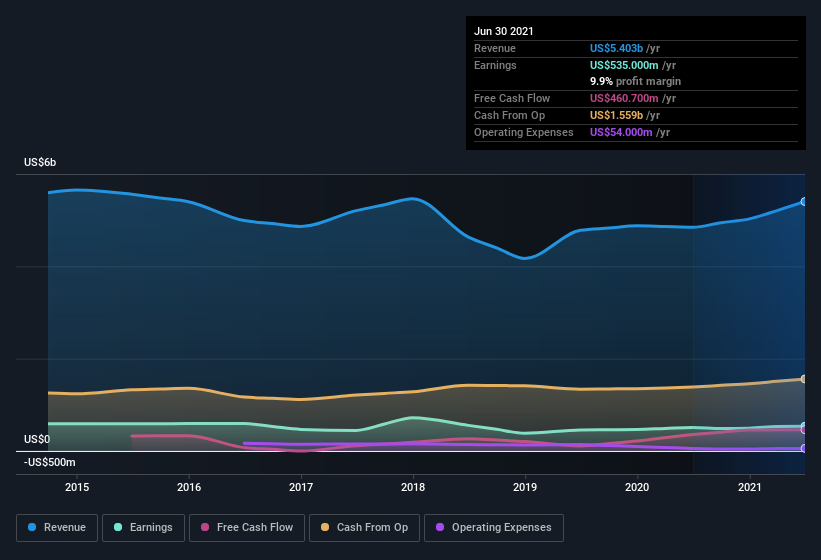

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. Not all of Brambles's revenue this year is revenue from operations, so keep in mind the revenue and margin numbers I've used might not be the best representation of the underlying business. Brambles maintained stable EBIT margins over the last year, all while growing revenue 11% to US$5.4b. That's a real positive.

In the chart below, you can see how the company has grown earnings, and revenue, over time. For finer detail, click on the image.

Of course the knack is to find stocks that have their best days in the future, not in the past. You could base your opinion on past performance, of course, but you may also want to check this interactive graph of professional analyst EPS forecasts for Brambles.

Are Brambles Insiders Aligned With All Shareholders?

Like that fresh smell in the air when the rains are coming, insider buying fills me with optimistic anticipation. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

Not only did Brambles insiders refrain from selling stock during the year, but they also spent US$267k buying it. That's nice to see, because it suggests insiders are optimistic. It is also worth noting that it was Independent Non-Executive Director Nora Scheinkestel who made the biggest single purchase, worth AU$119k, paying AU$10.92 per share.

Does Brambles Deserve A Spot On Your Watchlist?

One positive for Brambles is that it is growing EPS. That's nice to see. Not every business can grow its EPS, but Brambles certainly can. The cherry on top is the insider share purchases, which provide an extra impetus to keep and eye on this stock, at the very least. Even so, be aware that Brambles is showing 2 warning signs in our investment analysis , you should know about...

As a growth investor I do like to see insider buying. But Brambles isn't the only one. You can see a a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

When trading Brambles or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Brambles might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About ASX:BXB

Solid track record, good value and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)