- Australia

- /

- Professional Services

- /

- ASX:APM

Three Leading Growth Companies In Australia With Insider Ownership Reaching 27%

Reviewed by Sasha Jovanovic

As the Australian market navigates through fluctuating bond yields and anticipates potential interest rate hikes, investors are closely monitoring various economic indicators and corporate activities. Amid these conditions, companies with high insider ownership can be particularly intriguing, as such ownership might align management's interests more closely with those of shareholders, potentially fostering greater resilience and long-term strategic focus during uncertain times.

Top 10 Growth Companies With High Insider Ownership In Australia

| Name | Insider Ownership | Growth Rating |

| Emerald Resources (ASX:EMR) | 17.7% | ★★★★★★ |

| Cettire (ASX:CTT) | 28.7% | ★★★★★★ |

| Hartshead Resources (ASX:HHR) | 13.9% | ★★★★★★ |

| Gratifii (ASX:GTI) | 15.6% | ★★★★★★ |

| Acrux (ASX:ACR) | 14.6% | ★★★★★★ |

| Latin Resources (ASX:LRS) | 13.1% | ★★★★★★ |

| Hillgrove Resources (ASX:HGO) | 10.4% | ★★★★★★ |

| Alpha HPA (ASX:A4N) | 28.3% | ★★★★★★ |

| WhiteHawk (ASX:WHK) | 14.5% | ★★★★★★ |

| Liontown Resources (ASX:LTR) | 16.4% | ★★★★★★ |

Let's dive into some prime choices out of from the screener.

APM Human Services International (ASX:APM)

Simply Wall St Growth Rating: ★★★★☆☆

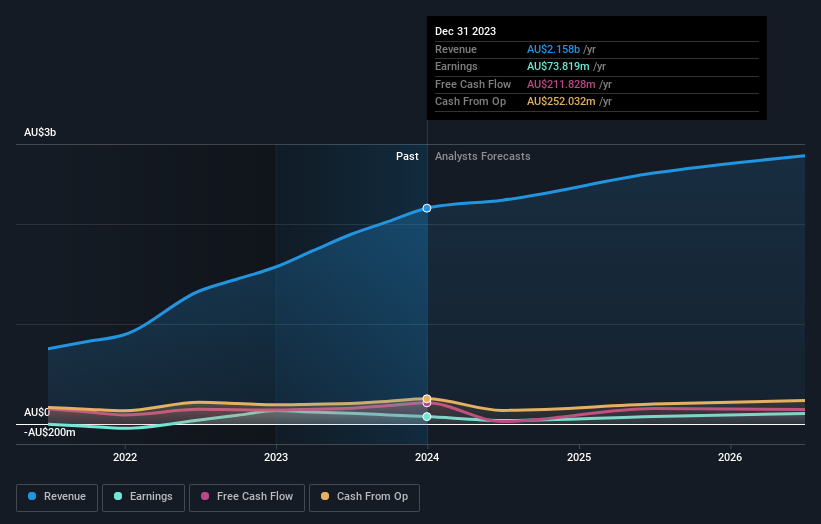

Overview: APM Human Services International Limited operates in providing human and health services both in Australia and globally, with a market capitalization of approximately A$1.11 billion.

Operations: APM Human Services International's revenue segments include A$850.01 million from Australia and New Zealand, A$910.37 million from North America, and A$396.49 million from other international markets such as Korea, Singapore, Germany, Switzerland, Spain, and the UK.

Insider Ownership: 27.3%

APM Human Services International, a growth-oriented company with significant insider ownership, is currently trading at A$63.6% below its estimated fair value. Despite challenges such as unstable dividends and insufficient earnings to cover interest payments, APM's financial outlook shows promise with expected significant annual profit growth (22.2% per year) over the next three years. However, its revenue growth projection is modest at 7.7% per year, slower than the desired 20% threshold for high-growth companies but still above the Australian market average of 4.7%. Recent M&A activities underscore a robust interest in APM's intrinsic value and strategic positioning, although these have not yet resulted in finalized transactions.

- Navigate through the intricacies of APM Human Services International with our comprehensive analyst estimates report here.

- Our comprehensive valuation report raises the possibility that APM Human Services International is priced lower than what may be justified by its financials.

Kelsian Group (ASX:KLS)

Simply Wall St Growth Rating: ★★★★☆☆

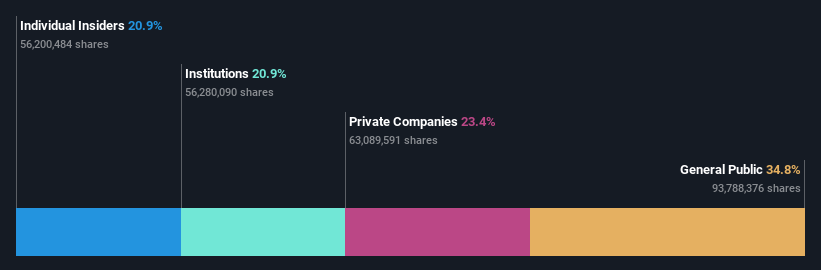

Overview: Kelsian Group Limited operates in land and marine transport and tourism sectors across Australia, the United States, Singapore, and the United Kingdom, with a market capitalization of approximately A$1.51 billion.

Operations: The company generates revenue through three primary segments: Australian Bus services contributing A$934.76 million, International Bus operations at A$448.87 million, and Marine and Tourism activities totaling A$337.90 million.

Insider Ownership: 20.9%

Kelsian Group, an Australian growth company with high insider ownership, reported a substantial increase in sales to A$982.71 million and net income to A$28.06 million for H1 2024. Despite this performance, the company's profit margins decreased from last year, and its dividend coverage remains weak. Analysts expect Kelsian's earnings to grow by 27.85% annually over the next three years, outpacing the market average significantly. Insider activities show more buying than selling recently, indicating confidence from those closest to the company.

- Dive into the specifics of Kelsian Group here with our thorough growth forecast report.

- The valuation report we've compiled suggests that Kelsian Group's current price could be quite moderate.

Mesoblast (ASX:MSB)

Simply Wall St Growth Rating: ★★★★★☆

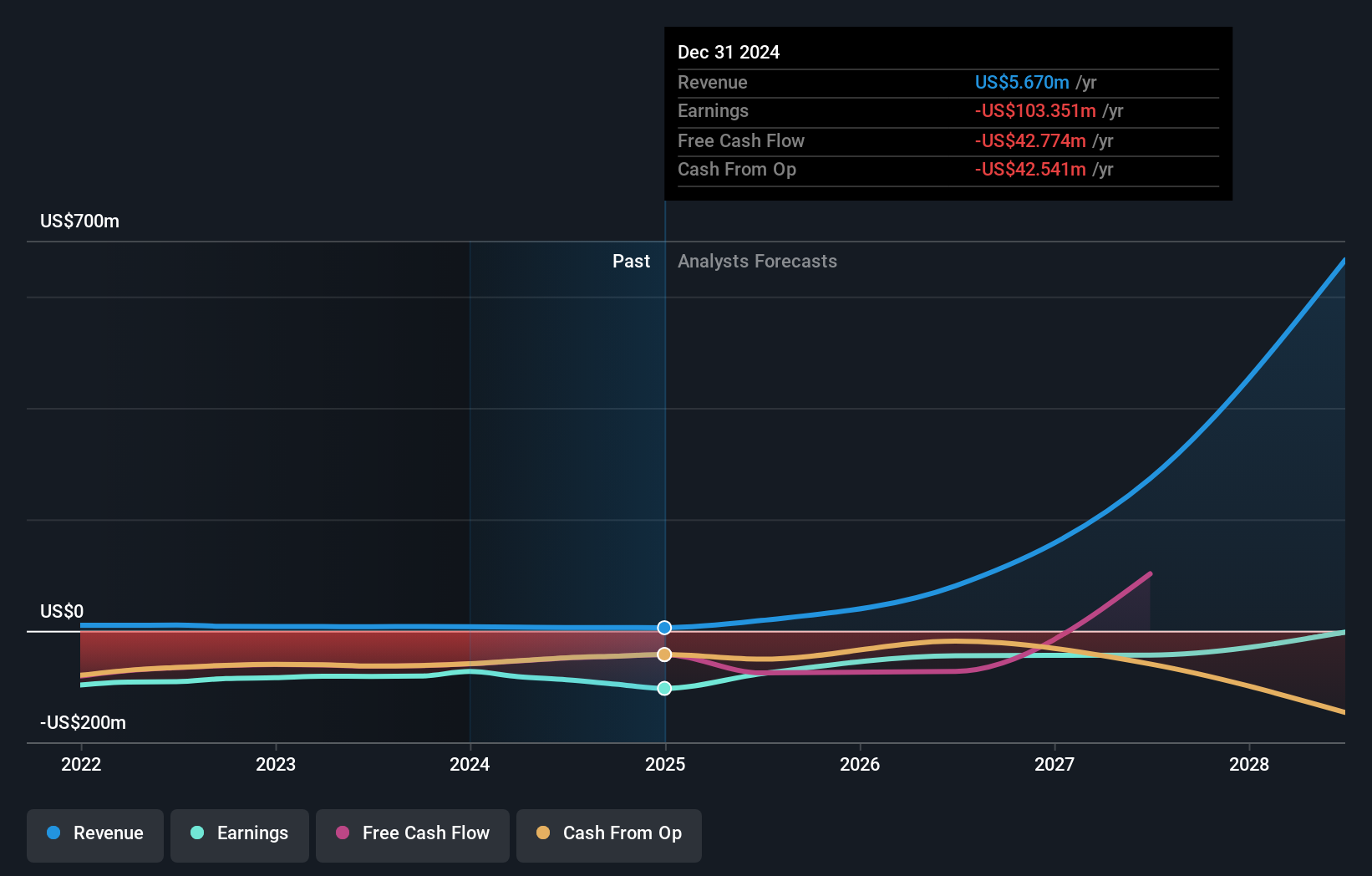

Overview: Mesoblast Limited, operating in Australia, the United States, Singapore, and Switzerland, focuses on developing regenerative medicine products with a market capitalization of approximately A$1.04 billion.

Operations: The company generates revenue primarily from its development of adult stem cell technology platform, totaling $7.47 million.

Insider Ownership: 21.2%

Mesoblast, a notable player in the biotechnology sector, has shown promising growth prospects with insider confidence demonstrated through recent substantial buying and no significant selling. Despite shareholder dilution last year, Mesoblast is on track to profitability within three years, underpinned by an expected annual revenue growth rate of 55.3%. However, its share price remains highly volatile. Recent FDA endorsements for its therapies could bolster future performance as it moves towards market expansion and product commercialization.

- Click here to discover the nuances of Mesoblast with our detailed analytical future growth report.

- Our valuation report unveils the possibility Mesoblast's shares may be trading at a discount.

Turning Ideas Into Actions

- Gain an insight into the universe of 92 Fast Growing Companies With High Insider Ownership by clicking here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:APM

Good value with mediocre balance sheet.

Market Insights

Community Narratives