The Australian market has recently seen the ASX200 reach new heights, closing up 0.45% at 8,444 points, with Health Care and Financials leading the charge despite mixed performances in other sectors. In such a dynamic market landscape, identifying promising investment opportunities requires careful consideration of financial health and growth potential. Penny stocks, often associated with smaller or newer companies, continue to offer intriguing possibilities for investors seeking value beyond the more prominent names; these stocks can present compelling opportunities when backed by strong fundamentals.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Financial Health Rating |

| Embark Early Education (ASX:EVO) | A$0.80 | A$144.95M | ★★★★☆☆ |

| LaserBond (ASX:LBL) | A$0.565 | A$66.23M | ★★★★★★ |

| SHAPE Australia (ASX:SHA) | A$2.79 | A$229.66M | ★★★★★★ |

| Helloworld Travel (ASX:HLO) | A$1.99 | A$327.26M | ★★★★★★ |

| Austin Engineering (ASX:ANG) | A$0.545 | A$325.58M | ★★★★★☆ |

| Navigator Global Investments (ASX:NGI) | A$1.685 | A$803.73M | ★★★★★☆ |

| Vita Life Sciences (ASX:VLS) | A$2.05 | A$116.77M | ★★★★★★ |

| Atlas Pearls (ASX:ATP) | A$0.16 | A$65.35M | ★★★★★★ |

| MaxiPARTS (ASX:MXI) | A$1.88 | A$103.99M | ★★★★★★ |

| Servcorp (ASX:SRV) | A$4.98 | A$490.37M | ★★★★☆☆ |

Click here to see the full list of 1,044 stocks from our ASX Penny Stocks screener.

We'll examine a selection from our screener results.

Accent Group (ASX:AX1)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Accent Group Limited operates in the retail, distribution, and franchise sectors for lifestyle footwear, apparel, and accessories across Australia and New Zealand with a market capitalization of A$1.35 billion.

Operations: The company's revenue is derived from its Retail segment, which generated A$1.27 billion, and its Wholesale segment, contributing A$463.20 million.

Market Cap: A$1.35B

Accent Group Limited, with a market cap of A$1.35 billion, operates in the retail sector and faces challenges typical of penny stocks. Despite trading at 51.6% below its estimated fair value, the company struggles with negative earnings growth over the past year and has a low return on equity of 14.2%. While its dividend yield is attractive at 5.44%, it isn't well covered by earnings, raising sustainability concerns. Recent board changes include appointing Dave Forsey as an independent non-executive director, potentially bringing valuable retail experience to navigate these challenges and support future growth strategies.

- Get an in-depth perspective on Accent Group's performance by reading our balance sheet health report here.

- Evaluate Accent Group's prospects by accessing our earnings growth report.

Imugene (ASX:IMU)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Imugene Limited is a clinical stage immuno-oncology company in Australia that develops immunotherapies to activate the immune system of cancer patients to treat and eradicate tumors, with a market cap of A$297.49 million.

Operations: The company's revenue segment is focused on the research, development, and commercialisation of health technologies, generating A$4.97 million.

Market Cap: A$297.49M

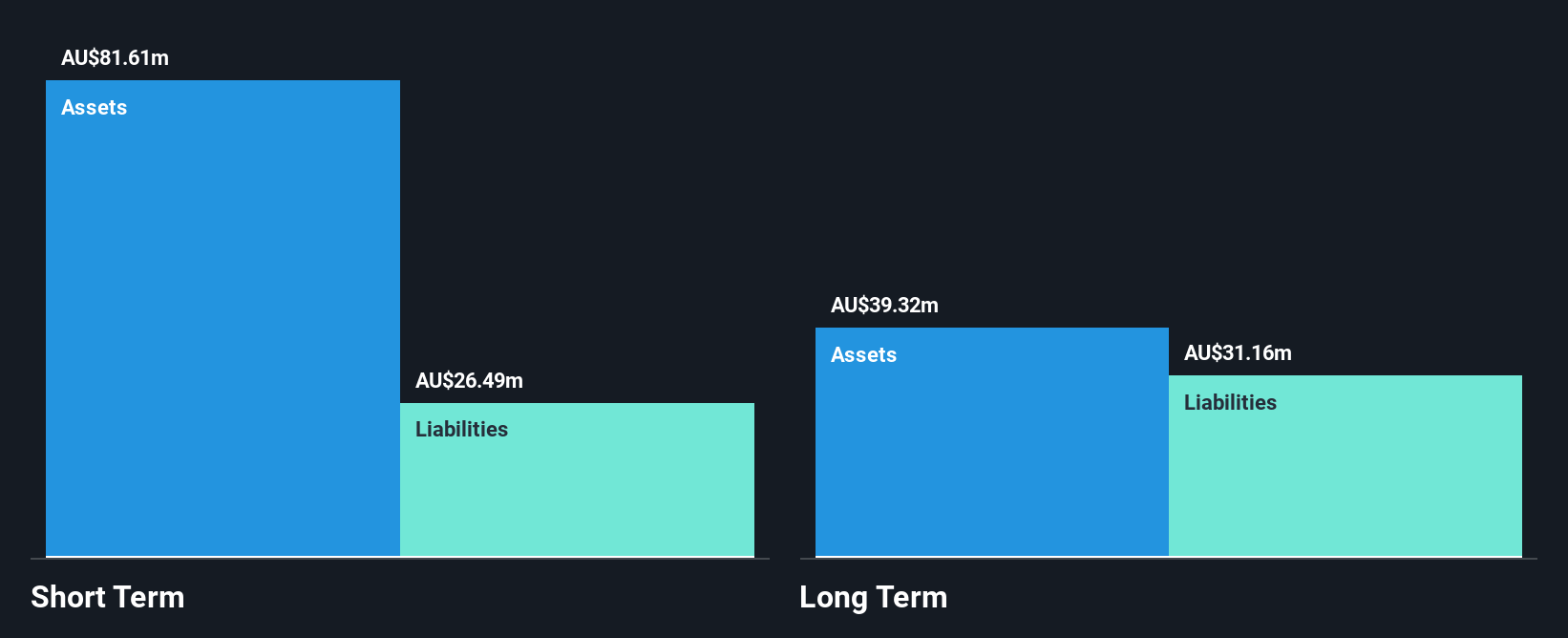

Imugene Limited, with a market cap of A$297.49 million, is navigating the complexities typical of penny stocks in the biotech sector. Despite promising Phase 1b trial results for its azer-cel therapy targeting relapsed/refractory diffuse large B cell lymphoma, Imugene remains pre-revenue with A$4.97 million in revenue focused on R&D activities. The company faces financial challenges, including increased losses and less than a year of cash runway. Recent board changes may impact strategic direction as it continues to pursue clinical advancements and potential regulatory approvals to establish itself further in the oncology field.

- Navigate through the intricacies of Imugene with our comprehensive balance sheet health report here.

- Assess Imugene's future earnings estimates with our detailed growth reports.

Ventia Services Group (ASX:VNT)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Ventia Services Group Limited operates as a provider of infrastructure services in Australia and New Zealand, with a market capitalization of A$3.92 billion.

Operations: The company's revenue is primarily derived from its Defence and Social Infrastructure segment at A$2.51 billion, followed by Telecommunications at A$1.50 billion, Infrastructure Services at A$1.30 billion, and Transport at A$657.6 million.

Market Cap: A$3.92B

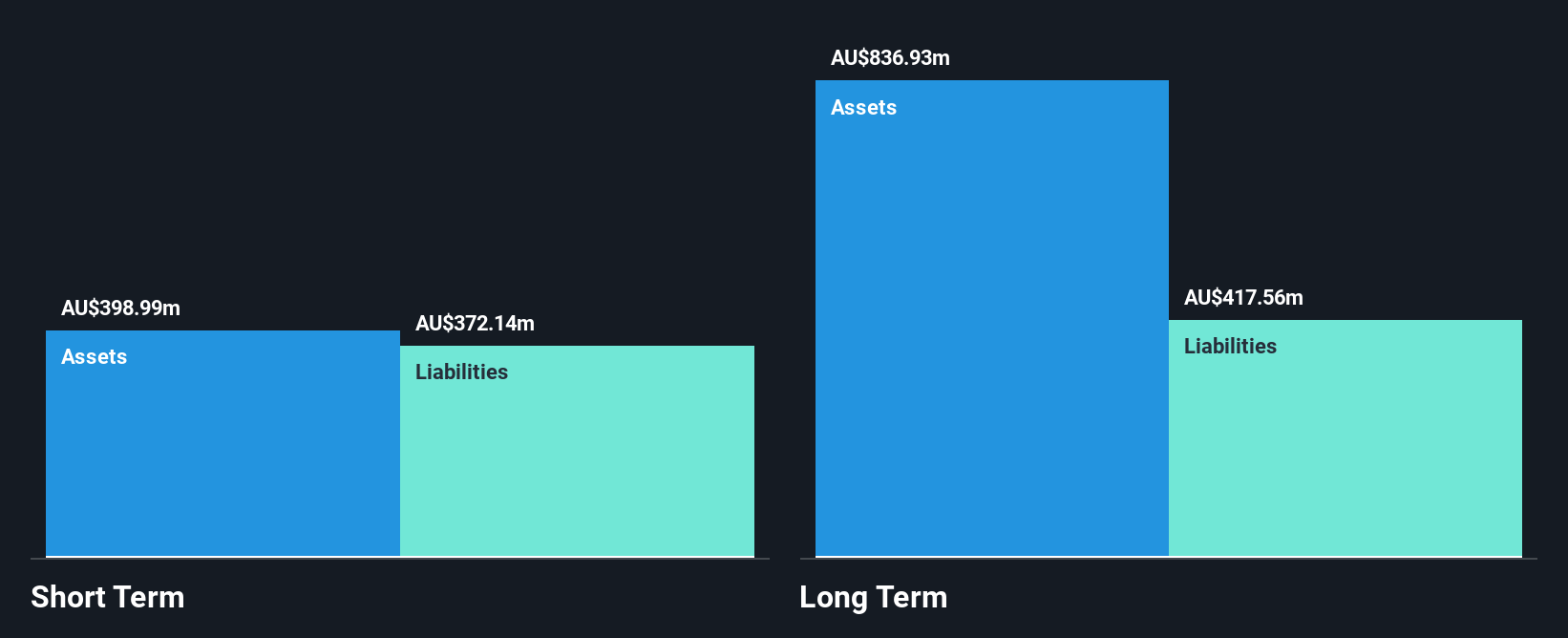

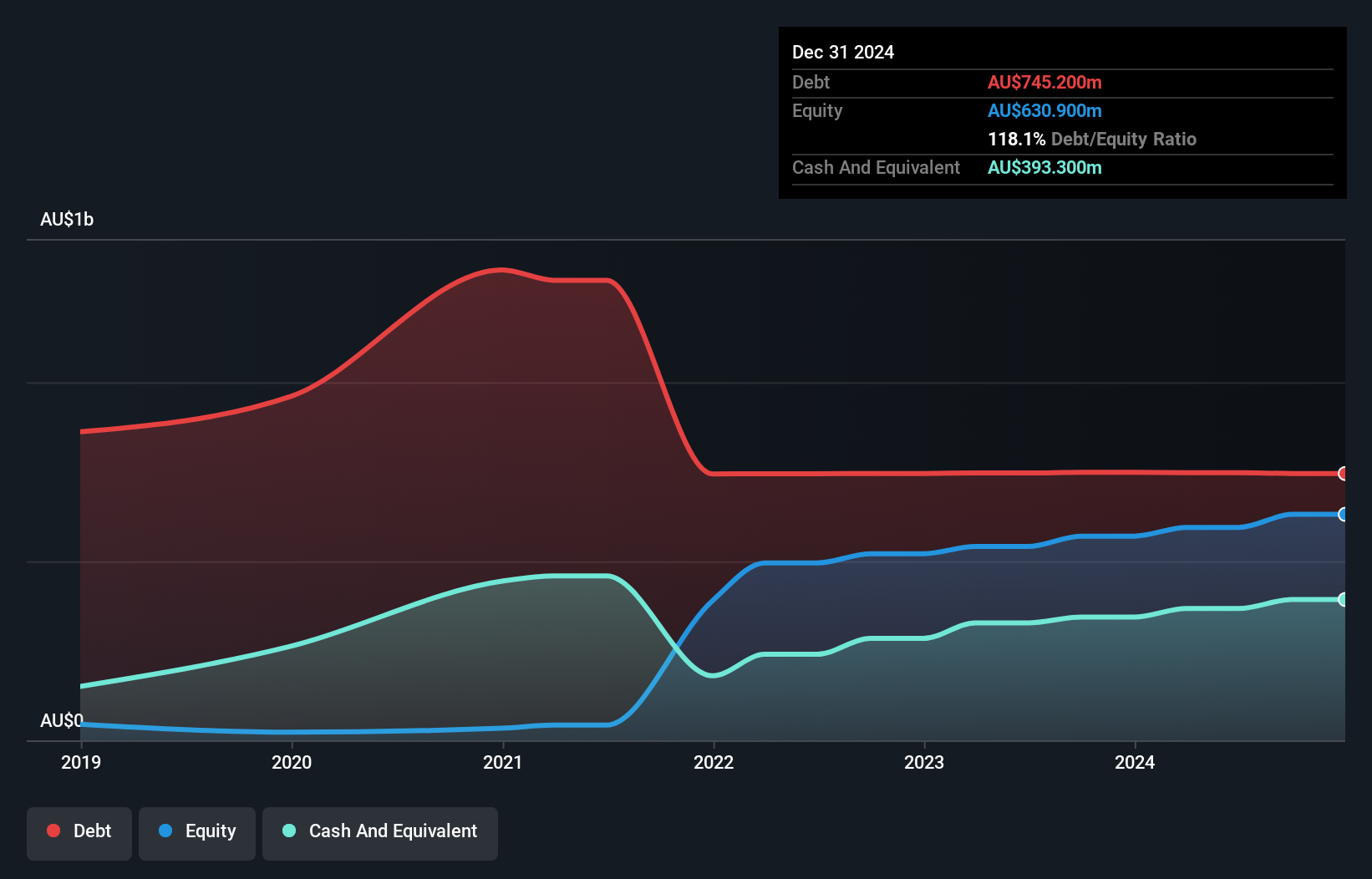

Ventia Services Group, with a market cap of A$3.92 billion, is navigating the infrastructure services sector with significant revenue streams across Defence and Social Infrastructure (A$2.51 billion) and Telecommunications (A$1.50 billion). Recent contract extensions, including a A$125 million deal with NSW Public Works and a A$150 million agreement with NBN Co, bolster its position in the market. Despite high debt levels impacting its return on equity metrics, Ventia's earnings have grown consistently over five years at 45% annually. Short-term assets comfortably cover liabilities, though management's inexperience may pose strategic challenges moving forward.

- Unlock comprehensive insights into our analysis of Ventia Services Group stock in this financial health report.

- Gain insights into Ventia Services Group's future direction by reviewing our growth report.

Key Takeaways

- Embark on your investment journey to our 1,044 ASX Penny Stocks selection here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:IMU

Imugene

A clinical stage immuno-oncology company, develops a range of immunotherapies to activate the immune system of cancer patients to treat and eradicate tumours in Australia.

Adequate balance sheet slight.