- Australia

- /

- Construction

- /

- ASX:SND

This Analyst Just Made An Incredible Upgrade To Their Saunders International Limited (ASX:SND) Earnings Forecasts

Celebrations may be in order for Saunders International Limited (ASX:SND) shareholders, with the covering analyst delivering a significant upgrade to their statutory estimates for the company. The analyst greatly increased their revenue estimates, suggesting a stark improvement in business fundamentals.

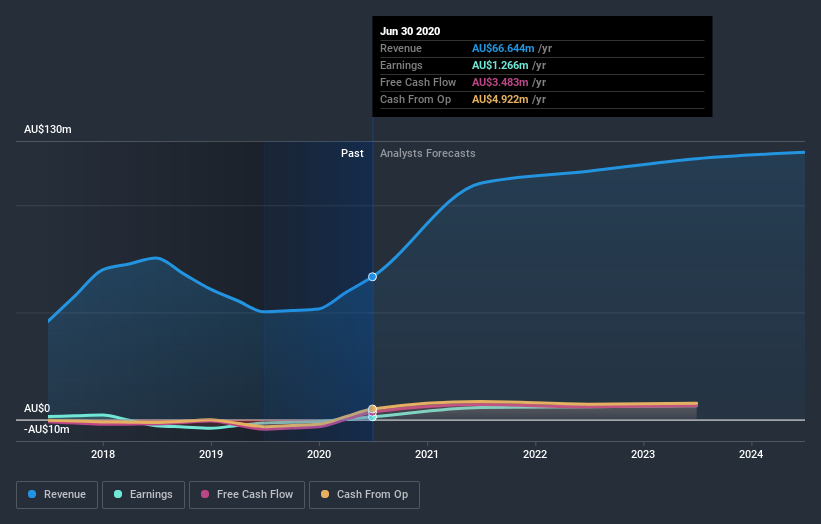

Following the upgrade, the current consensus from Saunders International's sole analyst is for revenues of AU$110m in 2021 which - if met - would reflect a sizeable 66% increase on its sales over the past 12 months. Per-share earnings are expected to bounce 347% to AU$0.055. Before this latest update, the analyst had been forecasting revenues of AU$100m and earnings per share (EPS) of AU$0.03 in 2021. There has definitely been an improvement in perception recently, with the analyst substantially increasing both their earnings and revenue estimates.

View our latest analysis for Saunders International

With these upgrades, we're not surprised to see that the analyst has lifted their price target 55% to AU$0.85 per share.

One way to get more context on these forecasts is to look at how they compare to both past performance, and how other companies in the same industry are performing. It's clear from the latest estimates that Saunders International's rate of growth is expected to accelerate meaningfully, with the forecast 66% annualised revenue growth to the end of 2021 noticeably faster than its historical growth of 8.8% p.a. over the past five years. By contrast, our data suggests that other companies (with analyst coverage) in a similar industry are forecast to grow their revenue at 12% per year. It seems obvious that, while the growth outlook is brighter than the recent past, the analyst also expect Saunders International to grow faster than the wider industry.

The Bottom Line

The most important thing to take away from this upgrade is that the analyst upgraded their earnings per share estimates for this year, expecting improving business conditions. They also upgraded their revenue estimates for this year, and sales are expected to grow faster than the wider market. With a serious upgrade to expectations and a rising price target, it might be time to take another look at Saunders International.

Still, the long-term prospects of the business are much more relevant than next year's earnings. At least one analyst has provided forecasts out to 2024, which can be seen for free on our platform here.

Of course, seeing company management invest large sums of money in a stock can be just as useful as knowing whether analysts are upgrading their estimates. So you may also wish to search this free list of stocks that insiders are buying.

If you’re looking to trade Saunders International, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About ASX:SND

Saunders International

Provides design, construction, fabrication, shutdown, maintenance, and industrial automation services to organizations of steel storage tanks and concrete bridges in Australia and the Pacific Region.

Adequate balance sheet slight.

Market Insights

Community Narratives