Why Silex Systems (ASX:SLX) Is Up 47.2% After Successful Commercial-Scale Laser Uranium Enrichment Test

Reviewed by Simply Wall St

- Global Laser Enrichment (GLE), the exclusive licensee of Silex Systems' uranium enrichment technology, recently completed large-scale demonstration testing in North Carolina, marking significant progress toward commercial deployment.

- This achievement positions GLE as the sole operator of third-generation, laser-based enrichment at commercial scale, a development that could reshape the future landscape of nuclear fuel production.

- We'll examine how successful large-scale demonstration testing strengthens Silex Systems' investment narrative and its potential impact on the nuclear fuel supply chain.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

What Is Silex Systems' Investment Narrative?

The big picture for Silex Systems rests on belief in the commercialisation of its unique uranium laser enrichment technology, especially with the recent breakthrough by Global Laser Enrichment in successfully completing large-scale demonstration testing in North Carolina. This achievement may act as a major near-term catalyst, as it potentially shifts Silex from years of capital-intensive development and recurring large losses (A$42.56 million net loss in 2025) toward a future where commercial licensing and manufacturing revenues become more tangible. The resulting optimism has been matched by steep share price gains over the past month, suggesting that investors are starting to price in a material change to the company’s risk profile. Still, the biggest risks remain: Silex is not expected to generate profits for several years, is highly dependent on further progress toward commercial deployment, and has frequently diluted shareholders through equity issuances. The news could mean the market will look more closely at near-term funding requirements and the pace of GLE’s path to commercialization, making these live issues for any new or current investor to watch. Yet, Silex’s funding needs and the timing of commercial revenues remain unresolved for now.

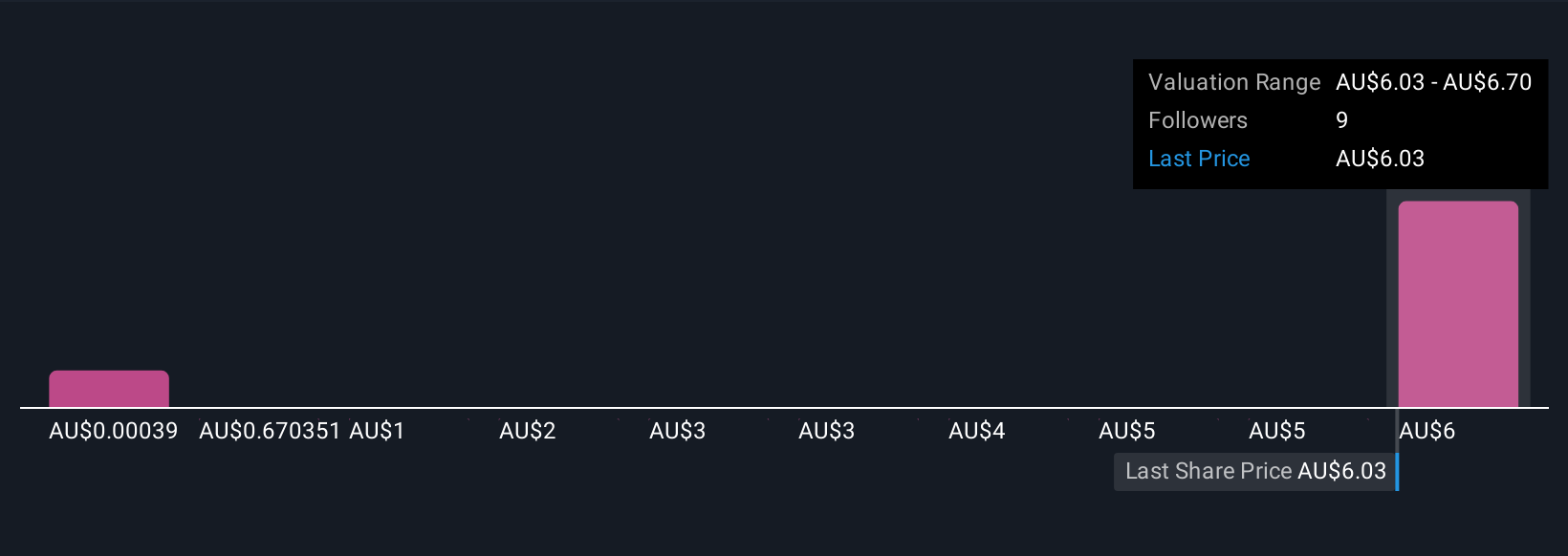

In light of our recent valuation report, it seems possible that Silex Systems is trading beyond its estimated value.Exploring Other Perspectives

Explore 3 other fair value estimates on Silex Systems - why the stock might be worth as much as 16% more than the current price!

Build Your Own Silex Systems Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Silex Systems research is our analysis highlighting 2 important warning signs that could impact your investment decision.

- Our free Silex Systems research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Silex Systems' overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The latest GPUs need a type of rare earth metal called Dysprosium and there are only 30 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:SLX

Silex Systems

A technology commercialization company, engages in the research and development, commercialization, and license of SILEX laser enrichment technology in Australia, the United States, and the United Kingdom.

Flawless balance sheet with limited growth.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)