- Australia

- /

- Metals and Mining

- /

- ASX:CAY

3 ASX Penny Stocks Under A$300M Market Cap

Reviewed by Simply Wall St

The Australian market has shown resilience, with the ASX200 closing up 0.69% at 8,126 points, driven by strong performances in the IT and Real Estate sectors. In such a fluctuating landscape, identifying stocks with solid fundamentals becomes crucial for investors seeking opportunities beyond traditional large-cap investments. Penny stocks may be an outdated term, but they still offer intriguing prospects for growth when backed by robust financials and strategic positioning in their respective industries.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Rewards & Risks |

| CTI Logistics (ASX:CLX) | A$1.695 | A$136.52M | ✅ 4 ⚠️ 2 View Analysis > |

| Accent Group (ASX:AX1) | A$1.855 | A$1.05B | ✅ 4 ⚠️ 2 View Analysis > |

| EZZ Life Science Holdings (ASX:EZZ) | A$1.415 | A$66.75M | ✅ 4 ⚠️ 2 View Analysis > |

| IVE Group (ASX:IGL) | A$2.64 | A$407.04M | ✅ 4 ⚠️ 2 View Analysis > |

| GTN (ASX:GTN) | A$0.62 | A$119.22M | ✅ 3 ⚠️ 2 View Analysis > |

| Bisalloy Steel Group (ASX:BIS) | A$3.38 | A$160.38M | ✅ 3 ⚠️ 1 View Analysis > |

| Regal Partners (ASX:RPL) | A$1.875 | A$630.31M | ✅ 4 ⚠️ 3 View Analysis > |

| Navigator Global Investments (ASX:NGI) | A$1.75 | A$857.64M | ✅ 5 ⚠️ 3 View Analysis > |

| Sugar Terminals (NSX:SUG) | A$1.10 | A$360M | ✅ 2 ⚠️ 2 View Analysis > |

| NRW Holdings (ASX:NWH) | A$2.71 | A$1.24B | ✅ 5 ⚠️ 1 View Analysis > |

Click here to see the full list of 988 stocks from our ASX Penny Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Canyon Resources (ASX:CAY)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Canyon Resources Limited, with a market cap of A$270.22 million, is involved in the exploration and development of mineral properties in West Africa through its subsidiaries.

Operations: Canyon Resources Limited does not currently report any revenue segments.

Market Cap: A$270.22M

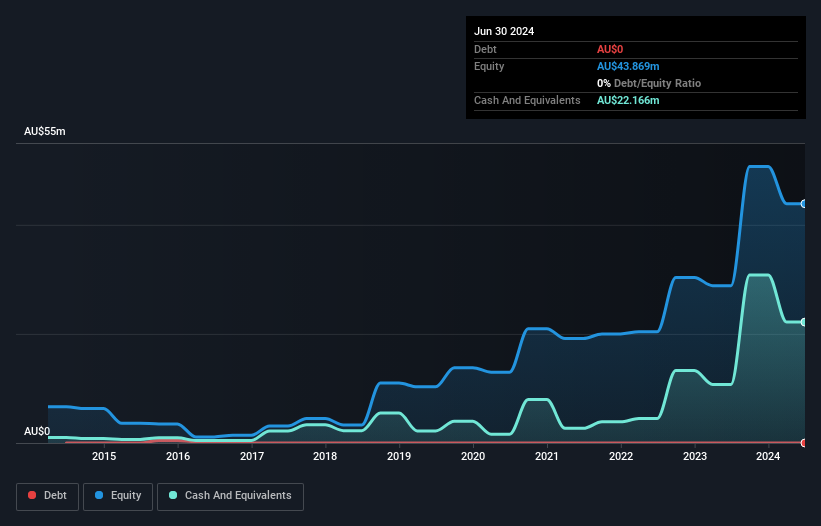

Canyon Resources Limited, with a market cap of A$270.22 million, remains a pre-revenue company focused on the development of its Minim Martap Bauxite Project in Cameroon. Recent inclusion in the S&P/ASX Emerging Companies and All Ordinaries Indexes highlights growing investor interest. The company's strategic focus is on completing the Definitive Feasibility Study by Q3 2025 to solidify project viability and secure funding for production commencement in 2026. Despite leadership changes and trading policy issues, Canyon's management aims to leverage high-quality bauxite reserves for long-term growth while navigating cash runway constraints effectively.

- Jump into the full analysis health report here for a deeper understanding of Canyon Resources.

- Understand Canyon Resources' track record by examining our performance history report.

SHAPE Australia (ASX:SHA)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: SHAPE Australia Corporation Limited operates in the construction, fitout, and refurbishment of commercial properties across Australia, with a market cap of A$264.77 million.

Operations: The company's revenue is primarily derived from its heavy construction segment, totaling A$902.63 million.

Market Cap: A$264.77M

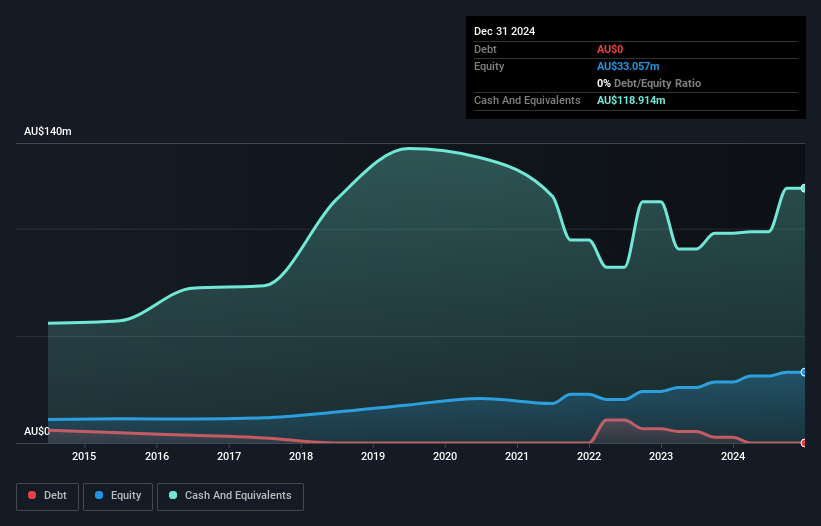

SHAPE Australia Corporation Limited, with a market cap of A$264.77 million, has shown robust financial health with no debt and short-term assets exceeding both short and long-term liabilities. Recent inclusion in the S&P/ASX Emerging Companies and All Ordinaries Indexes underscores its growing prominence. The company reported A$478.99 million in sales for H1 2025, reflecting solid earnings growth of 34.9% year-on-year, surpassing industry averages. Its Price-to-Earnings ratio is attractive compared to the broader Australian market. SHAPE's dividend track record remains unstable despite a recent increase, while its outstanding Return on Equity highlights operational efficiency amidst stable volatility levels.

- Take a closer look at SHAPE Australia's potential here in our financial health report.

- Explore SHAPE Australia's analyst forecasts in our growth report.

SKS Technologies Group (ASX:SKS)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: SKS Technologies Group Limited operates in Australia, focusing on the design, supply, and installation of audio visual, electrical, and communication products and services with a market cap of A$206.92 million.

Operations: The company generates revenue of A$198.59 million from its operations in the lighting and audio-visual markets.

Market Cap: A$206.92M

SKS Technologies Group Limited, with a market cap of A$206.92 million, has demonstrated significant earnings growth, reporting A$116.5 million in revenue for the half year ended December 31, 2024—more than doubling from the previous year. The company benefits from strong financial health with no debt and short-term assets exceeding liabilities. Its recent addition to the S&P/ASX All Ordinaries and Emerging Companies Indexes reflects increasing recognition in the market. SKS boasts an outstanding Return on Equity of 60.6% and maintains stable weekly volatility, trading below its estimated fair value while forecasting continued profit growth at 18.19% annually.

- Click here to discover the nuances of SKS Technologies Group with our detailed analytical financial health report.

- Gain insights into SKS Technologies Group's future direction by reviewing our growth report.

Key Takeaways

- Unlock our comprehensive list of 988 ASX Penny Stocks by clicking here.

- Contemplating Other Strategies? Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:CAY

Canyon Resources

Engages in the expedition and development of mineral properties in West Africa.

Adequate balance sheet slight.

Similar Companies

Market Insights

Community Narratives