Getting In Cheap On Reliance Worldwide Corporation Limited (ASX:RWC) Might Be Difficult

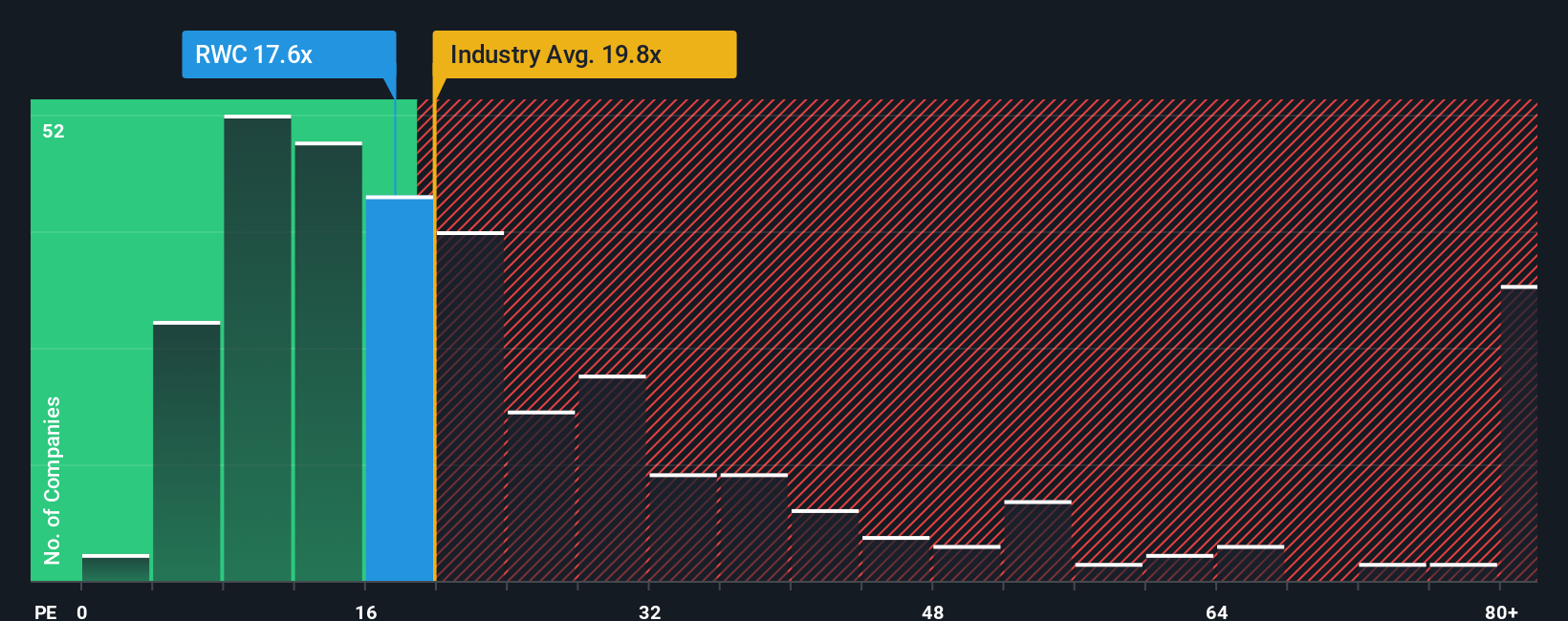

There wouldn't be many who think Reliance Worldwide Corporation Limited's (ASX:RWC) price-to-earnings (or "P/E") ratio of 17.6x is worth a mention when the median P/E in Australia is similar at about 19x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/E.

Reliance Worldwide could be doing better as it's been growing earnings less than most other companies lately. It might be that many expect the uninspiring earnings performance to strengthen positively, which has kept the P/E from falling. If not, then existing shareholders may be a little nervous about the viability of the share price.

See our latest analysis for Reliance Worldwide

How Is Reliance Worldwide's Growth Trending?

In order to justify its P/E ratio, Reliance Worldwide would need to produce growth that's similar to the market.

Retrospectively, the last year delivered virtually the same number to the company's bottom line as the year before. This isn't what shareholders were looking for as it means they've been left with a 7.5% decline in EPS over the last three years in total. Therefore, it's fair to say the earnings growth recently has been undesirable for the company.

Shifting to the future, estimates from the analysts covering the company suggest earnings should grow by 14% per year over the next three years. With the market predicted to deliver 15% growth each year, the company is positioned for a comparable earnings result.

With this information, we can see why Reliance Worldwide is trading at a fairly similar P/E to the market. It seems most investors are expecting to see average future growth and are only willing to pay a moderate amount for the stock.

What We Can Learn From Reliance Worldwide's P/E?

We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

As we suspected, our examination of Reliance Worldwide's analyst forecasts revealed that its market-matching earnings outlook is contributing to its current P/E. At this stage investors feel the potential for an improvement or deterioration in earnings isn't great enough to justify a high or low P/E ratio. It's hard to see the share price moving strongly in either direction in the near future under these circumstances.

Many other vital risk factors can be found on the company's balance sheet. Our free balance sheet analysis for Reliance Worldwide with six simple checks will allow you to discover any risks that could be an issue.

If these risks are making you reconsider your opinion on Reliance Worldwide, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:RWC

Reliance Worldwide

Engages in the design, manufacture, and supply of water flow, control, and monitoring products and solutions for plumbing and heating industries.

Good value with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives