- Australia

- /

- Aerospace & Defense

- /

- ASX:QHL

Here's Why We Think Quickstep Holdings (ASX:QHL) Is Well Worth Watching

Some have more dollars than sense, they say, so even companies that have no revenue, no profit, and a record of falling short, can easily find investors. Unfortunately, high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson.

So if you're like me, you might be more interested in profitable, growing companies, like Quickstep Holdings (ASX:QHL). Even if the shares are fully valued today, most capitalists would recognize its profits as the demonstration of steady value generation. While a well funded company may sustain losses for years, unless its owners have an endless appetite for subsidizing the customer, it will need to generate a profit eventually, or else breathe its last breath.

View our latest analysis for Quickstep Holdings

Quickstep Holdings's Improving Profits

Over the last three years, Quickstep Holdings has grown earnings per share (EPS) like young bamboo after rain; fast, and from a low base. So I don't think the percent growth rate is particularly meaningful. As a result, I'll zoom in on growth over the last year, instead. Like the last firework on New Year's Eve accelerating into the sky, Quickstep Holdings's EPS shot from AU$0.0016 to AU$0.0046, over the last year. You don't see 186% year-on-year growth like that, very often.

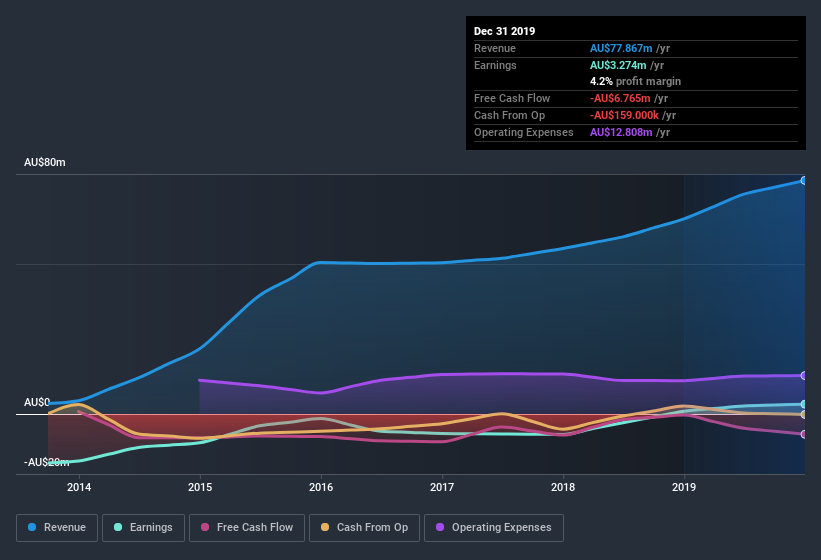

I like to see top-line growth as an indication that growth is sustainable, and I look for a high earnings before interest and taxation (EBIT) margin to point to a competitive moat (though some companies with low margins also have moats). Quickstep Holdings maintained stable EBIT margins over the last year, all while growing revenue 20% to AU$78m. That's a real positive.

The chart below shows how the company's bottom and top lines have progressed over time. Click on the chart to see the exact numbers.

Quickstep Holdings isn't a huge company, given its market capitalization of AU$61m. That makes it extra important to check on its balance sheet strength.

Are Quickstep Holdings Insiders Aligned With All Shareholders?

Like standing at the lookout, surveying the horizon at sunrise, insider buying, for some investors, sparks joy. Because oftentimes, the purchase of stock is a sign that the buyer views it as undervalued. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

Quickstep Holdings insiders both bought and sold shares over the last twelve months, but they did end up spending AU$22k more on stock than they received from selling it. When you weigh that up, it is a mild positive, indicating increased alignment between shareholders and management. It is also worth noting that it was CEO, MD & Director Mark Burgess who made the biggest single purchase, worth AU$143k, paying AU$0.09 per share.

Is Quickstep Holdings Worth Keeping An Eye On?

Quickstep Holdings's earnings per share growth have been levitating higher, like a mountain goat scaling the Alps. If you're like me, you'll find it hard to ignore that sort of explosive EPS growth. And in fact, it could well signal a fundamental shift in the business economics. If that's the case, you may regret neglecting to put Quickstep Holdings on your watchlist. However, before you get too excited we've discovered 4 warning signs for Quickstep Holdings (2 are a bit unpleasant!) that you should be aware of.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of Quickstep Holdings, you'll probably love this free list of growing companies that insiders are buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

If you decide to trade Quickstep Holdings, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Quickstep Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About ASX:QHL

Quickstep Holdings

Manufactures and sells advanced composites for the defense and commercial aerospace, automotive, and other industry sectors in Australia, the United Kingdom, and the United States.

Good value with mediocre balance sheet.

Market Insights

Community Narratives