- Australia

- /

- Aerospace & Defense

- /

- ASX:PTB

Is PTB Group Limited's (ASX:PTB) Recent Performancer Underpinned By Weak Financials?

Group (ASX:PTB) has had a rough month with its share price down 8.8%. We decided to study the company's financials to determine if the downtrend will continue as the long-term performance of a company usually dictates market outcomes. In this article, we decided to focus on Group's ROE.

ROE or return on equity is a useful tool to assess how effectively a company can generate returns on the investment it received from its shareholders. Put another way, it reveals the company's success at turning shareholder investments into profits.

Check out our latest analysis for Group

How Is ROE Calculated?

The formula for return on equity is:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for Group is:

4.7% = AU$4.0m ÷ AU$86m (Based on the trailing twelve months to June 2020).

The 'return' is the profit over the last twelve months. That means that for every A$1 worth of shareholders' equity, the company generated A$0.05 in profit.

What Is The Relationship Between ROE And Earnings Growth?

Thus far, we have learned that ROE measures how efficiently a company is generating its profits. Based on how much of its profits the company chooses to reinvest or "retain", we are then able to evaluate a company's future ability to generate profits. Generally speaking, other things being equal, firms with a high return on equity and profit retention, have a higher growth rate than firms that don’t share these attributes.

Group's Earnings Growth And 4.7% ROE

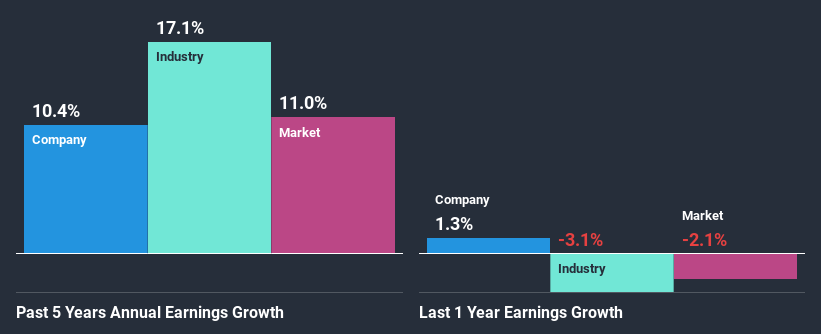

On the face of it, Group's ROE is not much to talk about. Next, when compared to the average industry ROE of 10%, the company's ROE leaves us feeling even less enthusiastic. However, the moderate 10% net income growth seen by Group over the past five years is definitely a positive. So, there might be other aspects that are positively influencing the company's earnings growth. Such as - high earnings retention or an efficient management in place.

Next, on comparing with the industry net income growth, we found that Group's reported growth was lower than the industry growth of 17% in the same period, which is not something we like to see.

The basis for attaching value to a company is, to a great extent, tied to its earnings growth. It’s important for an investor to know whether the market has priced in the company's expected earnings growth (or decline). By doing so, they will have an idea if the stock is headed into clear blue waters or if swampy waters await. If you're wondering about Group's's valuation, check out this gauge of its price-to-earnings ratio, as compared to its industry.

Is Group Using Its Retained Earnings Effectively?

The high three-year median payout ratio of 97% (or a retention ratio of 2.8%) for Group suggests that the company's growth wasn't really hampered despite it returning most of its income to its shareholders.

Besides, Group has been paying dividends over a period of eight years. This shows that the company is committed to sharing profits with its shareholders. Our latest analyst data shows that the future payout ratio of the company is expected to drop to 40% over the next three years. As a result, the expected drop in Group's payout ratio explains the anticipated rise in the company's future ROE to 8.7%, over the same period.

Conclusion

On the whole, Group's performance is quite a big let-down. While no doubt its earnings growth is pretty respectable, its ROE and earnings retention is quite poor. So while the company has managed to grow its earnings in spite of this, we are unconvinced if this growth could extend, specially during troubled times. Having said that, looking at the current analyst estimates, we found that the company's earnings are expected to gain momentum. Are these analysts expectations based on the broad expectations for the industry, or on the company's fundamentals? Click here to be taken to our analyst's forecasts page for the company.

If you’re looking to trade Group, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About ASX:PTB

PTB Group

PTB Group Limited, together with its subsidiaries, engages in the aviation business in Australia, Papua New Guinea, New Zealand, the Pacific Islands, North and South America, Asia, Africa, and Europe.

Flawless balance sheet and good value.

Market Insights

Community Narratives