- Australia

- /

- Aerospace & Defense

- /

- ASX:OEC

One Analyst Thinks Orbital Corporation Limited's (ASX:OEC) Revenues Are Under Threat

The analyst covering Orbital Corporation Limited (ASX:OEC) delivered a dose of negativity to shareholders today, by making a substantial revision to their statutory forecasts for this year. Revenue and earnings per share (EPS) forecasts were both revised downwards, with the analyst seeing grey clouds on the horizon.

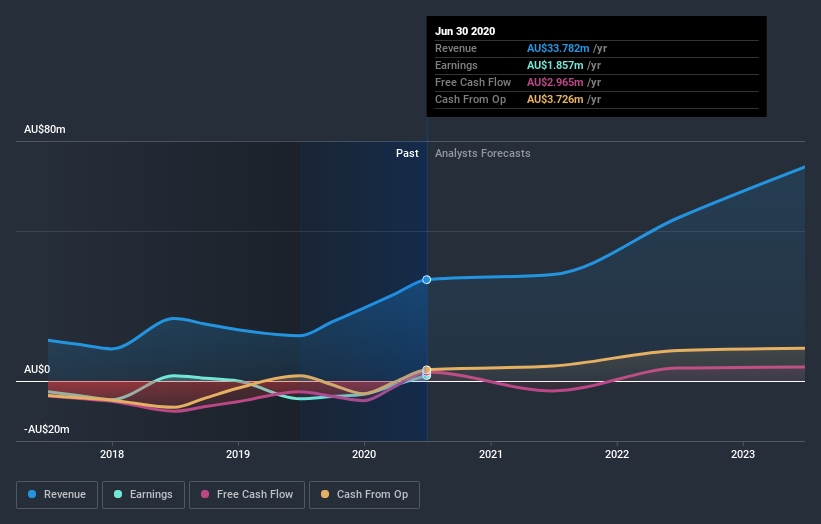

Following the downgrade, the latest consensus from Orbital's sole analyst is for revenues of AU$36m in 2021, which would reflect an okay 5.1% improvement in sales compared to the last 12 months. After this downgrade, the company is anticipated to report a loss of AU$0.02 in 2021, a sharp decline from a profit over the last year. Before this latest update, the analyst had been forecasting revenues of AU$48m and earnings per share (EPS) of AU$0.019 in 2021. So we can see that the consensus has become notably more bearish on Orbital's outlook with these numbers, making a pretty serious reduction to this year's revenue estimates. Furthermore, they expect the business to be loss-making this year, compared to their previous forecasts of a profit.

See our latest analysis for Orbital

These estimates are interesting, but it can be useful to paint some more broad strokes when seeing how forecasts compare, both to the Orbital's past performance and to peers in the same industry. It's pretty clear that there is an expectation that Orbital's revenue growth will slow down substantially, with revenues next year expected to grow 5.1%, compared to a historical growth rate of 21% over the past five years. By way of comparison, the other companies in this industry with analyst coverage are forecast to grow their revenue at 8.9% per year. So it's pretty clear that, while revenue growth is expected to slow down, the wider industry is also expected to grow faster than Orbital.

The Bottom Line

The biggest low-light for us was that the forecasts for Orbital dropped from profits to a loss this year. Unfortunately the analyst also downgraded their revenue estimates, and industry data suggests that Orbital's revenues are expected to grow slower than the wider market. After a cut like that, investors could be forgiven for thinking the analyst is a lot more bearish on Orbital, and a few readers might choose to steer clear of the stock.

Worse, Orbital is labouring under a substantial debt burden, which - if today's forecasts prove accurate - the forecast downgrade could potentially exacerbate. See why we're concerned about Orbital's balance sheet by visiting our risks dashboard for free on our platform here.

We also provide an overview of the Orbital Board and CEO remuneration and length of tenure at the company, and whether insiders have been buying the stock, here.

When trading Orbital or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About ASX:OEC

Orbital

Provides integrated propulsion systems and flight critical components for tactical unmanned aerial vehicles primarily in Australia and the United States.

Solid track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives