- Australia

- /

- Aerospace & Defense

- /

- ASX:OEC

Here's What We Learned About The CEO Pay At Orbital Corporation Limited (ASX:OEC)

Todd Alder has been the CEO of Orbital Corporation Limited (ASX:OEC) since 2017, and this article will examine the executive's compensation with respect to the overall performance of the company. This analysis will also assess whether Orbital pays its CEO appropriately, considering recent earnings growth and total shareholder returns.

View our latest analysis for Orbital

How Does Total Compensation For Todd Alder Compare With Other Companies In The Industry?

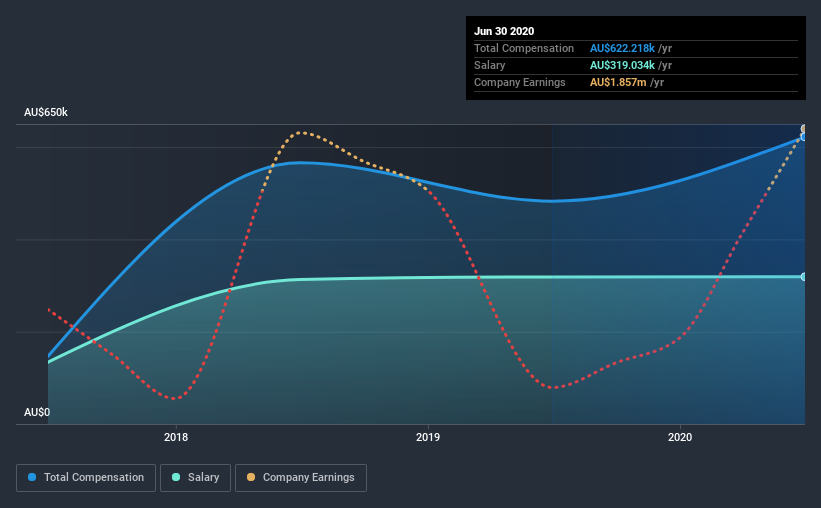

According to our data, Orbital Corporation Limited has a market capitalization of AU$92m, and paid its CEO total annual compensation worth AU$622k over the year to June 2020. Notably, that's an increase of 29% over the year before. Notably, the salary which is AU$319.0k, represents most of the total compensation being paid.

On comparing similar-sized companies in the industry with market capitalizations below AU$268m, we found that the median total CEO compensation was AU$635k. This suggests that Orbital remunerates its CEO largely in line with the industry average. What's more, Todd Alder holds AU$421k worth of shares in the company in their own name.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | AU$319k | AU$319k | 51% |

| Other | AU$303k | AU$164k | 49% |

| Total Compensation | AU$622k | AU$483k | 100% |

On an industry level, around 53% of total compensation represents salary and 47% is other remuneration. There isn't a significant difference between Orbital and the broader market, in terms of salary allocation in the overall compensation package. If salary is the major component in total compensation, it suggests that the CEO receives a higher fixed proportion of the total compensation, regardless of performance.

A Look at Orbital Corporation Limited's Growth Numbers

Orbital Corporation Limited has seen its earnings per share (EPS) increase by 22% a year over the past three years. Its revenue is up 123% over the last year.

Shareholders would be glad to know that the company has improved itself over the last few years. Most shareholders would be pleased to see strong revenue growth combined with EPS growth. This combo suggests a fast growing business. Looking ahead, you might want to check this free visual report on analyst forecasts for the company's future earnings..

Has Orbital Corporation Limited Been A Good Investment?

We think that the total shareholder return of 157%, over three years, would leave most Orbital Corporation Limited shareholders smiling. This strong performance might mean some shareholders don't mind if the CEO were to be paid more than is normal for a company of its size.

In Summary...

As we touched on above, Orbital Corporation Limited is currently paying a compensation that's close to the median pay for CEOs of companies belonging to the same industry and with similar market capitalizations. Few would be critical of the leadership, since returns have been juicy and EPS are moving in the right direction. Indeed, many might consider that Todd is compensated rather modestly, given the solid company performance! In fact, shareholders might even think the CEO deserves a raise as a reward due to the fantastic returns generated.

While CEO pay is an important factor to be aware of, there are other areas that investors should be mindful of as well. That's why we did some digging and identified 3 warning signs for Orbital that you should be aware of before investing.

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies that have HIGH return on equity and low debt.

If you’re looking to trade Orbital, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About ASX:OEC

Orbital

Provides integrated propulsion systems and flight critical components for tactical unmanned aerial vehicles primarily in Australia and the United States.

Solid track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives