- Australia

- /

- Electrical

- /

- ASX:LIS

Top ASX Penny Stocks To Watch In March 2025

Reviewed by Simply Wall St

The Australian market has been navigating a challenging landscape, with the ASX 200 futures pointing to a slight decline amid global trade tensions, particularly affecting sectors like alcohol. Despite these broader market uncertainties, investors often turn to penny stocks as an area of interest due to their potential for growth and affordability. While the term 'penny stocks' may seem outdated, they continue to offer opportunities for those seeking hidden value in smaller or newer companies with strong financial underpinnings.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Financial Health Rating |

| EZZ Life Science Holdings (ASX:EZZ) | A$1.61 | A$75.95M | ★★★★★★ |

| Bisalloy Steel Group (ASX:BIS) | A$3.08 | A$146.15M | ★★★★★★ |

| Regal Partners (ASX:RPL) | A$2.77 | A$929.05M | ★★★★★★ |

| GTN (ASX:GTN) | A$0.585 | A$114.88M | ★★★★★★ |

| IVE Group (ASX:IGL) | A$2.21 | A$342.3M | ★★★★★☆ |

| CTI Logistics (ASX:CLX) | A$1.62 | A$126.38M | ★★★★☆☆ |

| MotorCycle Holdings (ASX:MTO) | A$1.92 | A$141.71M | ★★★★★★ |

| West African Resources (ASX:WAF) | A$2.15 | A$2.45B | ★★★★★★ |

| Harvey Norman Holdings (ASX:HVN) | A$4.97 | A$6.19B | ★★★★★☆ |

| Accent Group (ASX:AX1) | A$1.765 | A$998.99M | ★★★★☆☆ |

Click here to see the full list of 1,004 stocks from our ASX Penny Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Bounty Oil & Gas (ASX:BUY)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Bounty Oil & Gas NL is involved in the exploration, development, production, and marketing of oil and gas projects in Australia, with a market cap of A$6.25 million.

Operations: The company's revenue is derived from Core Oil & Gas - Production Projects, generating A$1.61 million, and Secondary - Listed Securities, contributing A$0.02 million.

Market Cap: A$6.25M

Bounty Oil & Gas NL, with a market cap of A$6.25 million, is navigating the challenges typical of penny stocks. Despite generating A$1.61 million from its core oil and gas production projects, it remains unprofitable and lacks meaningful revenue streams, facing short-term liabilities that exceed its assets by A$1.1 million. However, it benefits from being debt-free and having a seasoned board with an average tenure of 19.3 years. The company has sufficient cash runway for over three years if free cash flow remains stable but faces increased weekly volatility in share price recently reaching 44%.

- Unlock comprehensive insights into our analysis of Bounty Oil & Gas stock in this financial health report.

- Learn about Bounty Oil & Gas' historical performance here.

Environmental Group (ASX:EGL)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: The Environmental Group Limited designs, applies, and services gas, vapor, and dust emission control systems as well as inlet and exhaust systems for gas turbines both in Australia and internationally, with a market cap of A$82.76 million.

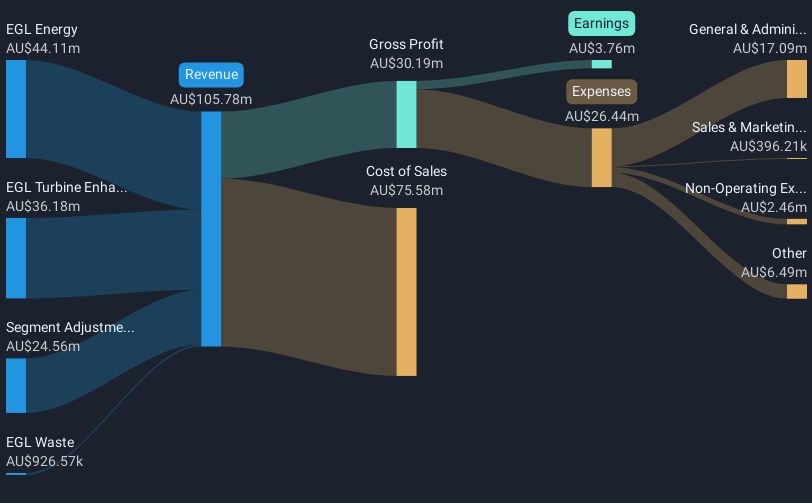

Operations: The company generates revenue through its segments in waste management (A$0.93 million), energy solutions (A$44.11 million), and turbine enhancement services (A$36.18 million).

Market Cap: A$82.76M

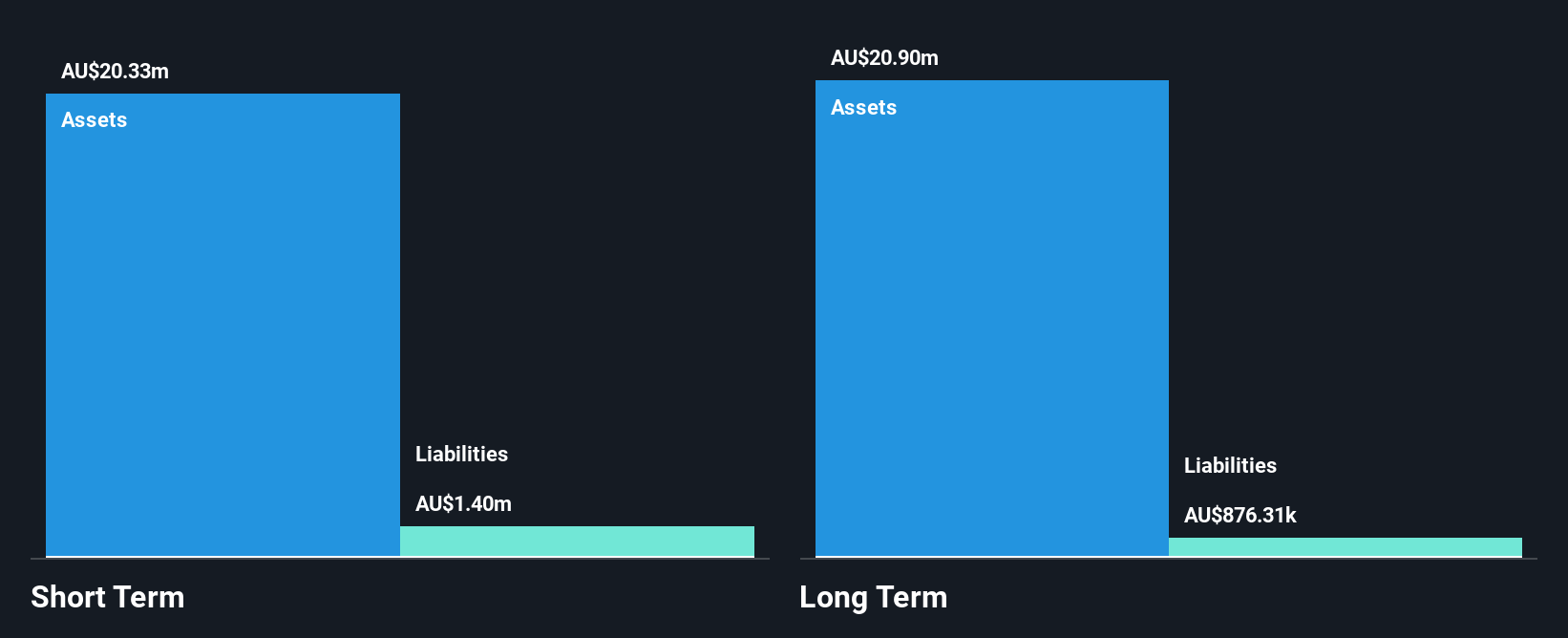

Environmental Group Limited, with a market cap of A$82.76 million, demonstrates the typical characteristics of penny stocks by balancing growth prospects and financial stability. The company reported A$54.23 million in sales for the half-year ending December 2024, showing revenue streams across waste management, energy solutions, and turbine services. Despite a slight decline in net income to A$1.44 million compared to last year, its debt levels are well-managed with operating cash flow significantly covering debt obligations. While earnings growth has decelerated recently compared to its five-year average, it still outpaces industry peers and remains undervalued relative to estimated fair value.

- Click here and access our complete financial health analysis report to understand the dynamics of Environmental Group.

- Explore Environmental Group's analyst forecasts in our growth report.

Li-S Energy (ASX:LIS)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Li-S Energy Limited is an Australian company focused on developing and commercializing lithium sulphur and metal batteries, with a market capitalization of A$73.16 million.

Operations: Li-S Energy Limited has not reported any revenue segments.

Market Cap: A$73.16M

Li-S Energy Limited, with a market cap of A$73.16 million, is pre-revenue and currently unprofitable, reporting a net loss of A$2.67 million for the half-year ending December 2024. The company has no debt and maintains a sufficient cash runway for more than a year based on current free cash flow trends. Recent board changes include the appointment of Rick Francis as non-executive director, bringing extensive experience in energy and infrastructure sectors. Despite its financial challenges, Li-S Energy's focus on lithium-sulphur battery technology positions it within an innovative niche in the energy sector.

- Dive into the specifics of Li-S Energy here with our thorough balance sheet health report.

- Examine Li-S Energy's past performance report to understand how it has performed in prior years.

Key Takeaways

- Embark on your investment journey to our 1,004 ASX Penny Stocks selection here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:LIS

Li-S Energy

Engages in the development and commercialization of lithium sulphur and metal batteries in Australia.

Flawless balance sheet low.

Market Insights

Community Narratives