Take Care Before Jumping Onto LaserBond Limited (ASX:LBL) Even Though It's 28% Cheaper

LaserBond Limited (ASX:LBL) shareholders that were waiting for something to happen have been dealt a blow with a 28% share price drop in the last month. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 42% in that time.

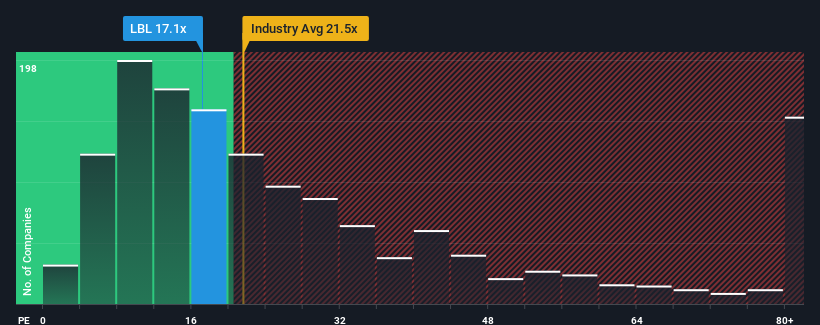

Even after such a large drop in price, it's still not a stretch to say that LaserBond's price-to-earnings (or "P/E") ratio of 17.1x right now seems quite "middle-of-the-road" compared to the market in Australia, where the median P/E ratio is around 19x. Although, it's not wise to simply ignore the P/E without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

LaserBond hasn't been tracking well recently as its declining earnings compare poorly to other companies, which have seen some growth on average. One possibility is that the P/E is moderate because investors think this poor earnings performance will turn around. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

See our latest analysis for LaserBond

Does Growth Match The P/E?

The only time you'd be comfortable seeing a P/E like LaserBond's is when the company's growth is tracking the market closely.

Retrospectively, the last year delivered a frustrating 38% decrease to the company's bottom line. This means it has also seen a slide in earnings over the longer-term as EPS is down 25% in total over the last three years. So unfortunately, we have to acknowledge that the company has not done a great job of growing earnings over that time.

Turning to the outlook, the next three years should generate growth of 42% each year as estimated by the lone analyst watching the company. Meanwhile, the rest of the market is forecast to only expand by 17% per year, which is noticeably less attractive.

With this information, we find it interesting that LaserBond is trading at a fairly similar P/E to the market. It may be that most investors aren't convinced the company can achieve future growth expectations.

The Bottom Line On LaserBond's P/E

LaserBond's plummeting stock price has brought its P/E right back to the rest of the market. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that LaserBond currently trades on a lower than expected P/E since its forecast growth is higher than the wider market. When we see a strong earnings outlook with faster-than-market growth, we assume potential risks are what might be placing pressure on the P/E ratio. It appears some are indeed anticipating earnings instability, because these conditions should normally provide a boost to the share price.

Don't forget that there may be other risks. For instance, we've identified 3 warning signs for LaserBond that you should be aware of.

You might be able to find a better investment than LaserBond. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:LBL

LaserBond

A surface engineering company, engages in the development and application of materials, technologies, and methodologies to enhance operating performance and wear life of capital-intensive machinery components in Australia.

Flawless balance sheet with reasonable growth potential and pays a dividend.

Market Insights

Community Narratives