- Australia

- /

- Construction

- /

- ASX:JLG

Johns Lyng Group Limited (ASX:JLG) insiders sold AU$29m worth of stock, a possible red flag that's yet to materialize

Despite a 4.1% gain in Johns Lyng Group Limited's (ASX:JLG) stock price this week, shareholders shouldn't let up. In spite of the relatively cheap prices, insiders made the decision to sell AU$29m worth of stock in the last 12 months. This could be a warning indicator of vulnerabilities in the future.

While we would never suggest that investors should base their decisions solely on what the directors of a company have been doing, we would consider it foolish to ignore insider transactions altogether.

See our latest analysis for Johns Lyng Group

Johns Lyng Group Insider Transactions Over The Last Year

The MD, CEO & Executive Director, Scott Didier, made the biggest insider sale in the last 12 months. That single transaction was for AU$16m worth of shares at a price of AU$6.00 each. That means that an insider was selling shares at slightly below the current price (AU$9.04). When an insider sells below the current price, it suggests that they considered that lower price to be fair. That makes us wonder what they think of the (higher) recent valuation. However, while insider selling is sometimes discouraging, it's only a weak signal. We note that the biggest single sale was only 4.8% of Scott Didier's holding. Scott Didier was the only individual insider to sell over the last year. Notably Scott Didier was also the biggest buyer, having purchased AU$12m worth of shares.

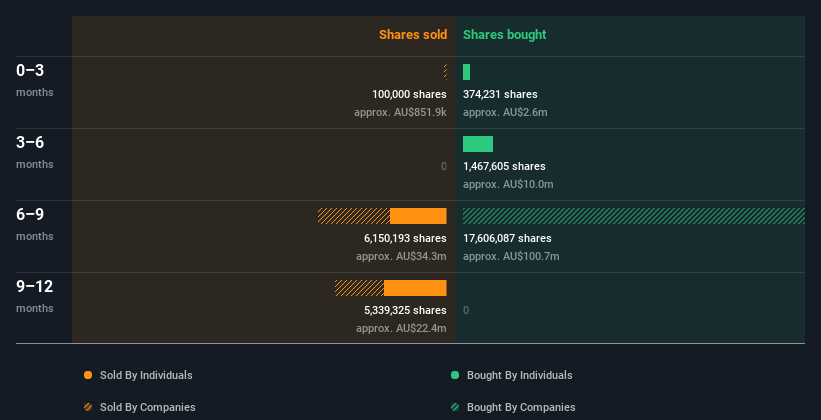

Happily, we note that in the last year insiders paid AU$12m for 1.82m shares. But they sold 5.70m shares for AU$29m. Scott Didier sold a total of 5.70m shares over the year at an average price of AU$5.16. You can see the insider transactions (by companies and individuals) over the last year depicted in the chart below. If you click on the chart, you can see all the individual transactions, including the share price, individual, and the date!

If you like to buy stocks that insiders are buying, rather than selling, then you might just love this free list of companies. (Hint: insiders have been buying them).

Johns Lyng Group Insiders Bought Stock Recently

Over the last quarter, Johns Lyng Group insiders have spent a meaningful amount on shares. In total, insiders bought AU$2.5m worth of shares in that time, and we didn't record any sales whatsoever. That shows some optimism about the company's future.

Does Johns Lyng Group Boast High Insider Ownership?

Looking at the total insider shareholdings in a company can help to inform your view of whether they are well aligned with common shareholders. Usually, the higher the insider ownership, the more likely it is that insiders will be incentivised to build the company for the long term. Johns Lyng Group insiders own about AU$752m worth of shares (which is 32% of the company). This kind of significant ownership by insiders does generally increase the chance that the company is run in the interest of all shareholders.

What Might The Insider Transactions At Johns Lyng Group Tell Us?

The recent insider purchases are heartening. On the other hand the transaction history, over the last year, isn't so positive. The high levels of insider ownership, and the recent buying by some insiders suggests they are well aligned and optimistic. In addition to knowing about insider transactions going on, it's beneficial to identify the risks facing Johns Lyng Group. To assist with this, we've discovered 1 warning sign that you should run your eye over to get a better picture of Johns Lyng Group.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of interesting companies, that have HIGH return on equity and low debt.

For the purposes of this article, insiders are those individuals who report their transactions to the relevant regulatory body. We currently account for open market transactions and private dispositions, but not derivative transactions.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:JLG

Johns Lyng Group

Provides integrated building services in Australia, New Zealand, and the United States.

Excellent balance sheet and good value.