- Australia

- /

- Metals and Mining

- /

- ASX:IRD

3 ASX Penny Stocks With Market Caps Over A$30M

Reviewed by Simply Wall St

As the ASX 200 points to a 0.89% decline at open, driven by trade concerns from the U.S., investors are keeping a close eye on market movements and economic indicators. In such fluctuating conditions, identifying stocks with strong fundamentals becomes crucial for those seeking stability and potential growth. Penny stocks, though often associated with higher risk due to their smaller size and less-established nature, can still present valuable opportunities when backed by robust financial health.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Rewards & Risks |

| Lindsay Australia (ASX:LAU) | A$0.705 | A$223.61M | ✅ 4 ⚠️ 2 View Analysis > |

| CTI Logistics (ASX:CLX) | A$1.80 | A$144.98M | ✅ 4 ⚠️ 2 View Analysis > |

| Accent Group (ASX:AX1) | A$1.91 | A$1.15B | ✅ 4 ⚠️ 2 View Analysis > |

| EZZ Life Science Holdings (ASX:EZZ) | A$1.615 | A$76.18M | ✅ 4 ⚠️ 2 View Analysis > |

| IVE Group (ASX:IGL) | A$2.59 | A$399.33M | ✅ 4 ⚠️ 2 View Analysis > |

| GTN (ASX:GTN) | A$0.60 | A$114.64M | ✅ 3 ⚠️ 2 View Analysis > |

| Bisalloy Steel Group (ASX:BIS) | A$3.50 | A$166.08M | ✅ 3 ⚠️ 1 View Analysis > |

| Regal Partners (ASX:RPL) | A$2.15 | A$722.75M | ✅ 4 ⚠️ 4 View Analysis > |

| Navigator Global Investments (ASX:NGI) | A$1.70 | A$833.14M | ✅ 5 ⚠️ 3 View Analysis > |

| Tasmea (ASX:TEA) | A$2.88 | A$669.09M | ✅ 4 ⚠️ 2 View Analysis > |

Click here to see the full list of 999 stocks from our ASX Penny Stocks screener.

Let's explore several standout options from the results in the screener.

Betmakers Technology Group (ASX:BET)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Betmakers Technology Group Ltd develops and provides software, data, and analytics products for the B2B wagering market across various regions including Australia, New Zealand, the United States, the United Kingdom, Europe, and internationally with a market cap of A$106.73 million.

Operations: The company's revenue is derived from two main segments: Global Tote, which generates A$50.51 million, and Global Betting Services, contributing A$34.73 million.

Market Cap: A$106.73M

Betmakers Technology Group Ltd, with a market cap of A$106.73 million, faces challenges as a penny stock due to its unprofitability and increasing losses over the past five years. Despite generating revenue from Global Tote (A$50.51 million) and Global Betting Services (A$34.73 million), recent earnings showed a decline in sales to A$41.39 million for the half-year ending December 2024, alongside a net loss of A$17.15 million. Positively, Betmakers has sufficient cash runway exceeding one year and short-term assets surpassing both short- and long-term liabilities, suggesting some financial stability amidst volatility concerns.

- Click here to discover the nuances of Betmakers Technology Group with our detailed analytical financial health report.

- Examine Betmakers Technology Group's earnings growth report to understand how analysts expect it to perform.

Iron Road (ASX:IRD)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Iron Road Limited is engaged in the exploration and evaluation of iron ore properties in Australia, with a market cap of A$36.46 million.

Operations: Iron Road's revenue is derived entirely from its Metals & Mining - Iron & Steel segment, amounting to A$8.42 million.

Market Cap: A$36.46M

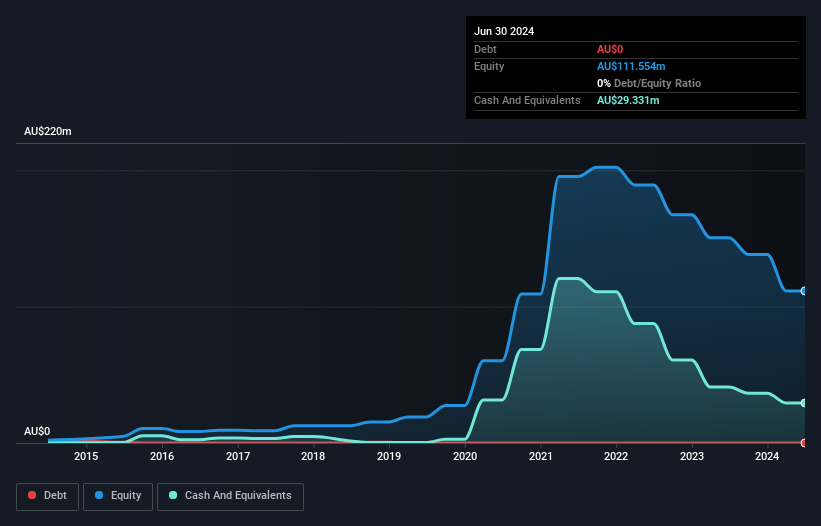

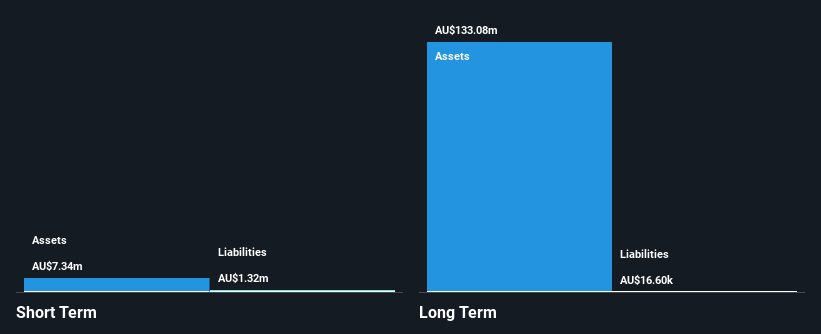

Iron Road Limited, with a market cap of A$36.46 million, has transitioned to profitability recently, marking a significant shift in its financial trajectory. The company’s short-term assets of A$7.3 million comfortably cover both its short-term liabilities (A$1.3 million) and long-term liabilities (A$16.6K), highlighting strong liquidity management despite being pre-revenue in the Metals & Mining sector with revenue at A$8.42 million annually from iron ore exploration and evaluation activities. Iron Road's debt-free status further underscores its fiscal prudence, while seasoned leadership supports strategic stability amidst the inherent volatility typical of penny stocks in this industry.

- Take a closer look at Iron Road's potential here in our financial health report.

- Examine Iron Road's past performance report to understand how it has performed in prior years.

Johns Lyng Group (ASX:JLG)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Johns Lyng Group Limited offers integrated building services across Australia, New Zealand, and the United States with a market cap of A$676.64 million.

Operations: The company's revenue is primarily derived from Insurance Building and Restoration Services at A$1.05 billion, supplemented by Commercial Building Services contributing A$85.12 million, and Commercial Construction adding A$11.90 million.

Market Cap: A$676.64M

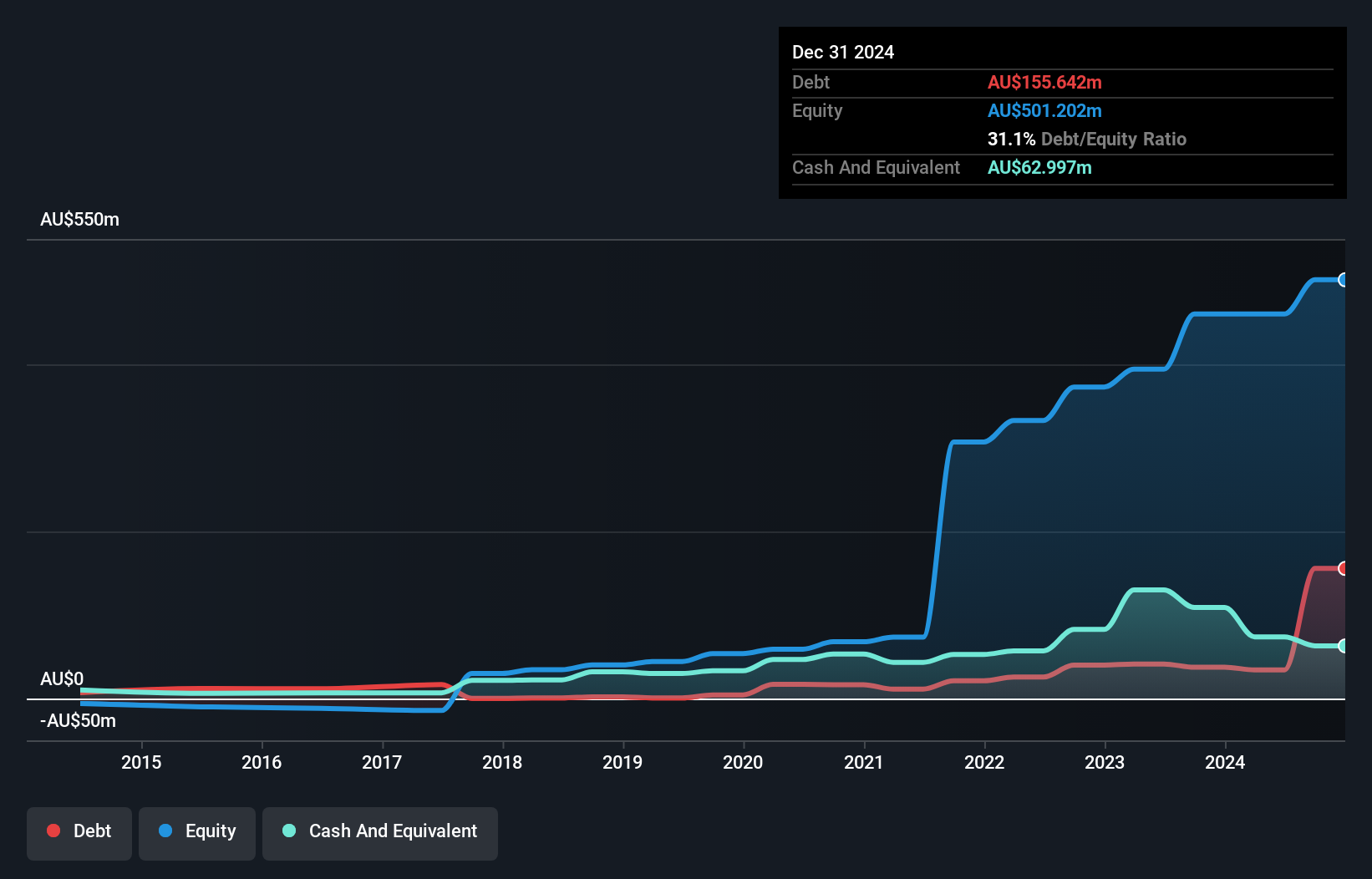

Johns Lyng Group, with a market cap of A$676.64 million, derives substantial revenue from its Insurance Building and Restoration Services at A$1.05 billion. Despite recent challenges like dropping from the S&P/ASX 200 Index and lowered earnings guidance for 2025, the company's short-term assets exceed both its short-term (A$263.5M) and long-term liabilities (A$195.7M), indicating solid liquidity management. However, negative earnings growth over the past year contrasts with significant profit growth over five years at 26.3% annually. The board's experienced tenure supports governance stability amid these fluctuations typical of penny stocks' volatility in Australia.

- Navigate through the intricacies of Johns Lyng Group with our comprehensive balance sheet health report here.

- Gain insights into Johns Lyng Group's future direction by reviewing our growth report.

Key Takeaways

- Gain an insight into the universe of 999 ASX Penny Stocks by clicking here.

- Searching for a Fresh Perspective? Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:IRD

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives