- Australia

- /

- Metals and Mining

- /

- ASX:ARL

ASX Penny Stocks To Watch In December 2024

Reviewed by Simply Wall St

The Australian stock market has recently seen mixed performances, with the ASX200 closing down 0.56% and sectors like Materials and Real Estate facing declines, while Financials showed slight gains. In this context, investors might look to penny stocks as a potential avenue for growth, particularly those that demonstrate strong financial health despite their smaller size or newer status. Although the term 'penny stocks' may seem outdated, these investments can still offer unique opportunities for returns when backed by solid fundamentals.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Financial Health Rating |

| Embark Early Education (ASX:EVO) | A$0.755 | A$138.53M | ★★★★☆☆ |

| LaserBond (ASX:LBL) | A$0.55 | A$64.47M | ★★★★★★ |

| Austin Engineering (ASX:ANG) | A$0.51 | A$313.17M | ★★★★★☆ |

| SHAPE Australia (ASX:SHA) | A$2.84 | A$232.15M | ★★★★★★ |

| Helloworld Travel (ASX:HLO) | A$1.925 | A$315.05M | ★★★★★★ |

| MaxiPARTS (ASX:MXI) | A$1.75 | A$96.8M | ★★★★★★ |

| Navigator Global Investments (ASX:NGI) | A$1.61 | A$784.13M | ★★★★★☆ |

| SKS Technologies Group (ASX:SKS) | A$1.59 | A$215.17M | ★★★★★★ |

| Vita Life Sciences (ASX:VLS) | A$1.84 | A$103.2M | ★★★★★★ |

| Servcorp (ASX:SRV) | A$4.97 | A$479.51M | ★★★★☆☆ |

Click here to see the full list of 1,050 stocks from our ASX Penny Stocks screener.

Here's a peek at a few of the choices from the screener.

4DS Memory (ASX:4DS)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: 4DS Memory Limited is a semiconductor technology company based in Australia that specializes in providing non-volatile memory technology services, with a market cap of A$139.31 million.

Operations: The company generates revenue from its Computer Storage Devices segment, amounting to A$0.00805 million.

Market Cap: A$139.31M

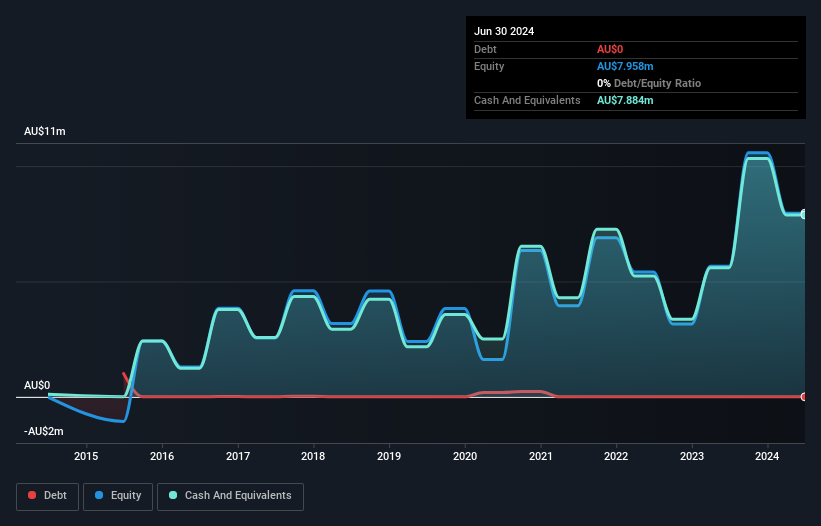

4DS Memory Limited, a semiconductor technology company, is pre-revenue with A$8K in earnings from its Computer Storage Devices segment. Despite being unprofitable, 4DS has managed to reduce its losses by 1.8% annually over the past five years and remains debt-free. The company's short-term assets of A$8M comfortably cover both short- and long-term liabilities. With an experienced board and management team, 4DS has a cash runway extending over a year based on current free cash flow trends. Recent corporate governance changes are set for discussion at the upcoming AGM on November 28, 2024.

- Jump into the full analysis health report here for a deeper understanding of 4DS Memory.

- Gain insights into 4DS Memory's historical outcomes by reviewing our past performance report.

Ardea Resources (ASX:ARL)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Ardea Resources Limited is an Australian company focused on battery minerals, with a market capitalization of A$61.90 million.

Operations: The company's revenue is primarily derived from its Mineral Exploration and Development segment, totaling A$0.32 million.

Market Cap: A$61.9M

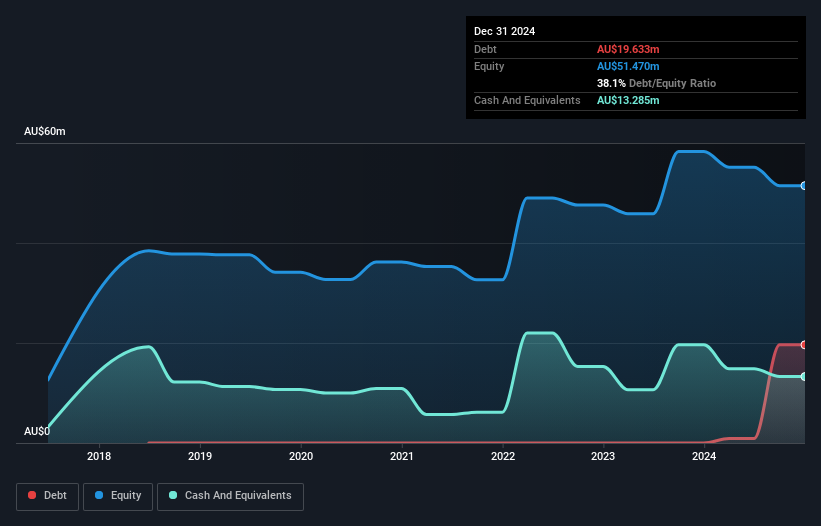

Ardea Resources, focused on battery minerals, is pre-revenue with A$0.32 million in earnings from mineral exploration. The company has a solid financial position, with short-term assets of A$16 million exceeding both short- and long-term liabilities. Despite being unprofitable and having increased losses by 31.8% annually over five years, Ardea's cash reserves surpass its total debt. However, the cash runway is under a year if current spending trends persist. Shareholders faced dilution last year as shares outstanding grew by 2.5%. The management team and board are experienced, averaging tenures of 5.7 and 4.4 years respectively.

- Navigate through the intricacies of Ardea Resources with our comprehensive balance sheet health report here.

- Understand Ardea Resources' track record by examining our performance history report.

Emeco Holdings (ASX:EHL)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Emeco Holdings Limited operates in Australia, offering surface and underground mining equipment rental along with complementary equipment and mining services, with a market cap of A$468.05 million.

Operations: The company's revenue is derived from three main segments: Rental (A$544.75 million), Workshops (A$282.41 million), and Pit N Portal (A$111.77 million).

Market Cap: A$468.05M

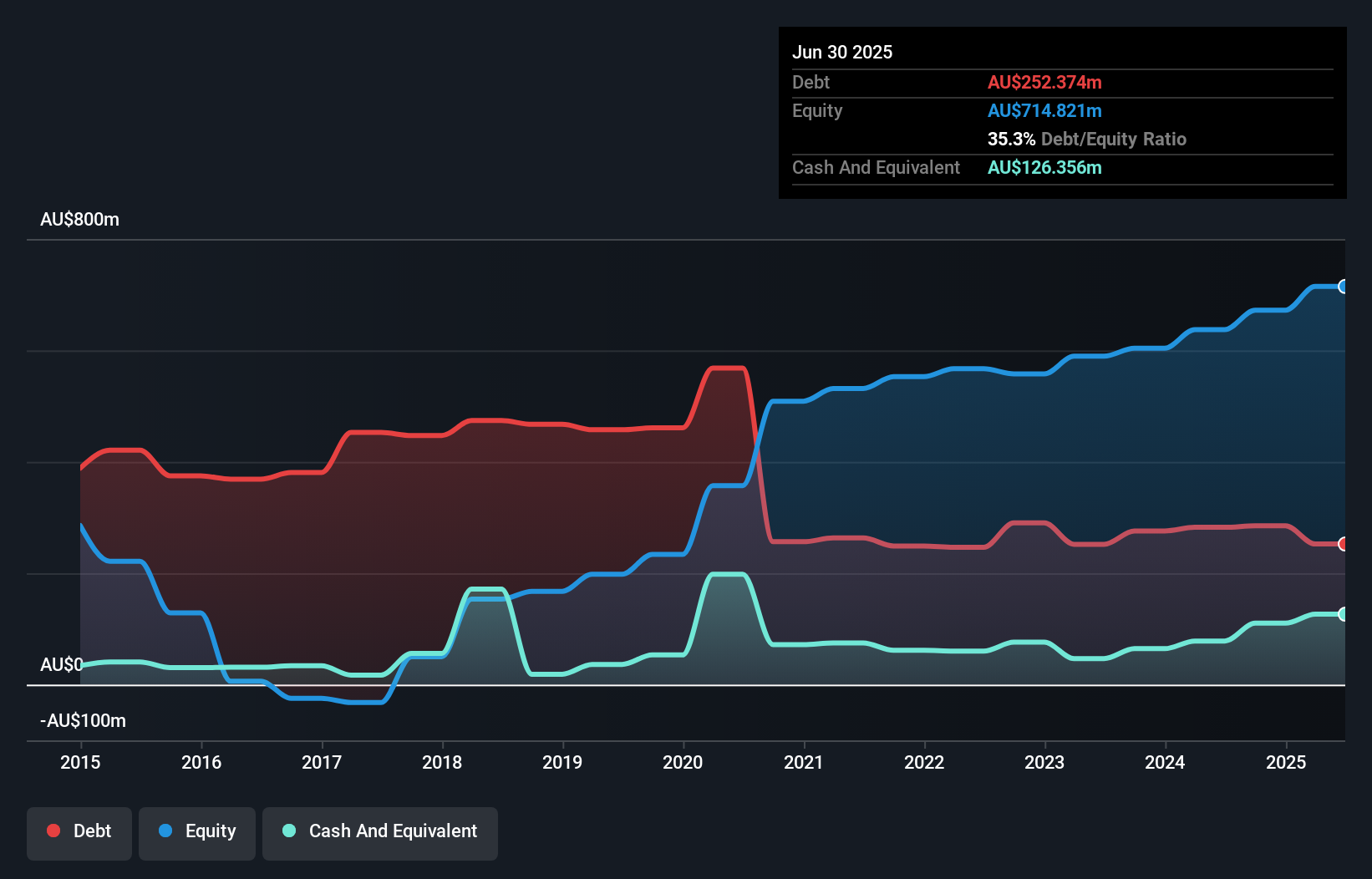

Emeco Holdings has shown significant earnings growth, with a 27.4% increase over the past year, surpassing its five-year average of 2.9% annually. The company's net debt to equity ratio is satisfactory at 32%, and its interest payments are well covered by EBIT at 4.7 times coverage. However, short-term assets of A$294 million do not cover long-term liabilities of A$341.7 million, indicating potential financial strain in the future. Recent board changes include appointing Ian Macliver as Chairman, bringing extensive mining sector experience which may enhance strategic direction amidst stable weekly volatility and no shareholder dilution last year.

- Dive into the specifics of Emeco Holdings here with our thorough balance sheet health report.

- Review our growth performance report to gain insights into Emeco Holdings' future.

Key Takeaways

- Explore the 1,050 names from our ASX Penny Stocks screener here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:ARL

Moderate with adequate balance sheet.