- Australia

- /

- Metals and Mining

- /

- ASX:ERM

3 Promising ASX Penny Stocks With Under A$400M Market Cap

Reviewed by Simply Wall St

As the ASX200 experiences a slight dip of 0.35% and materials lag behind other sectors, investors are keenly observing market movements, especially with the festive season approaching. Despite the term "penny stocks" being somewhat outdated, these lower-priced shares can still offer intriguing opportunities for growth, particularly in smaller or emerging companies. By focusing on those with strong financial health and potential for long-term growth, investors may uncover valuable prospects within this niche segment of the market.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Financial Health Rating |

| Embark Early Education (ASX:EVO) | A$0.755 | A$138.53M | ★★★★☆☆ |

| LaserBond (ASX:LBL) | A$0.55 | A$64.47M | ★★★★★★ |

| Austin Engineering (ASX:ANG) | A$0.505 | A$313.17M | ★★★★★☆ |

| SHAPE Australia (ASX:SHA) | A$2.80 | A$232.15M | ★★★★★★ |

| Helloworld Travel (ASX:HLO) | A$1.935 | A$315.05M | ★★★★★★ |

| MaxiPARTS (ASX:MXI) | A$1.75 | A$96.8M | ★★★★★★ |

| Navigator Global Investments (ASX:NGI) | A$1.60 | A$784.13M | ★★★★★☆ |

| SKS Technologies Group (ASX:SKS) | A$1.59 | A$215.17M | ★★★★★★ |

| Vita Life Sciences (ASX:VLS) | A$1.84 | A$103.2M | ★★★★★★ |

| Servcorp (ASX:SRV) | A$4.86 | A$479.51M | ★★★★☆☆ |

Click here to see the full list of 1,050 stocks from our ASX Penny Stocks screener.

Let's uncover some gems from our specialized screener.

Alchemy Resources (ASX:ALY)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Alchemy Resources Limited is an Australian company focused on the discovery, exploration, and development of mineral properties with a market cap of A$9.42 million.

Operations: The company generates revenue of A$0.0082 million from its mineral exploration and prospecting activities.

Market Cap: A$9.42M

Alchemy Resources, with a market cap of A$9.42 million, is pre-revenue and unprofitable but has reduced its losses significantly over the past five years. It benefits from a seasoned board with an average tenure of 13.1 years and maintains no debt, enhancing financial stability despite auditor concerns about its ability to continue as a going concern. The company has sufficient cash runway for more than three years if current cash flow trends persist. However, its share price remains highly volatile, which is common among penny stocks in the mining sector.

- Dive into the specifics of Alchemy Resources here with our thorough balance sheet health report.

- Evaluate Alchemy Resources' historical performance by accessing our past performance report.

Emmerson Resources (ASX:ERM)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Emmerson Resources Limited, along with its subsidiaries, focuses on the exploration and evaluation of mineral properties, with a market capitalization of A$33.23 million.

Operations: The company's revenue is primarily derived from its mineral exploration segment, amounting to A$0.14 million.

Market Cap: A$33.23M

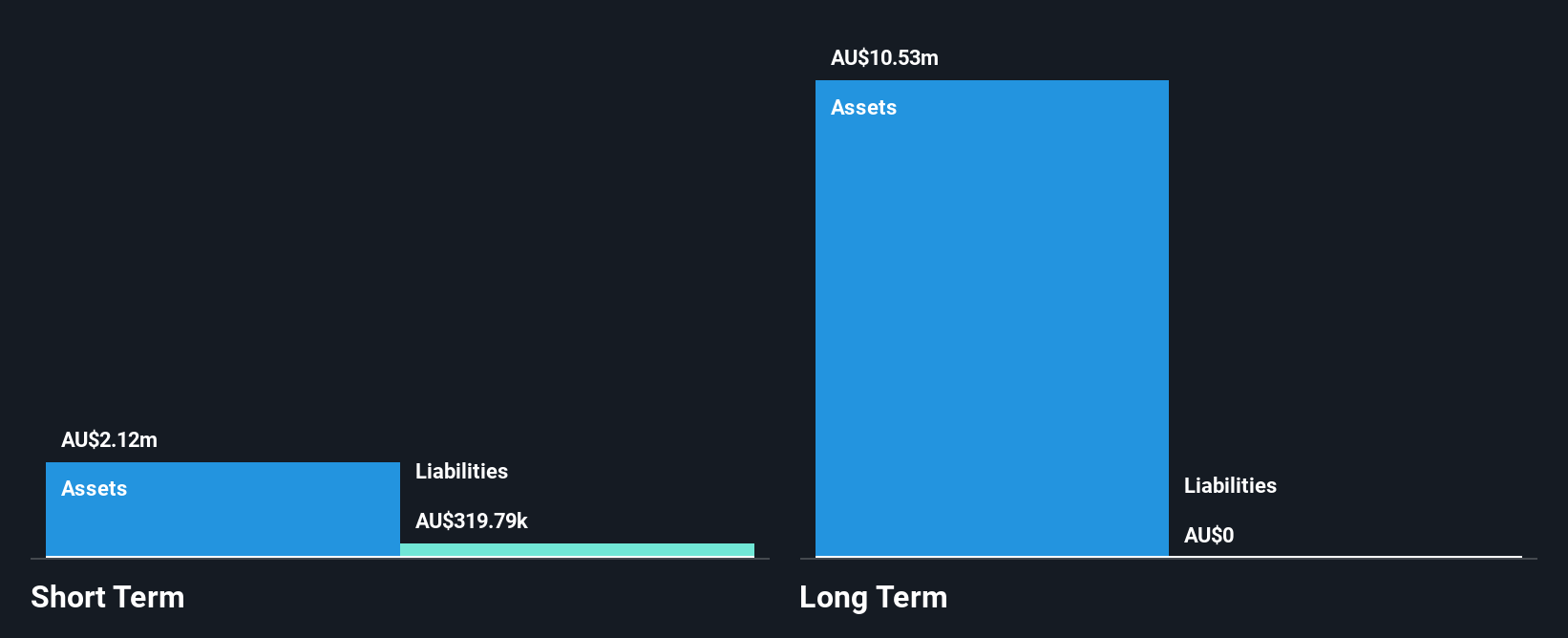

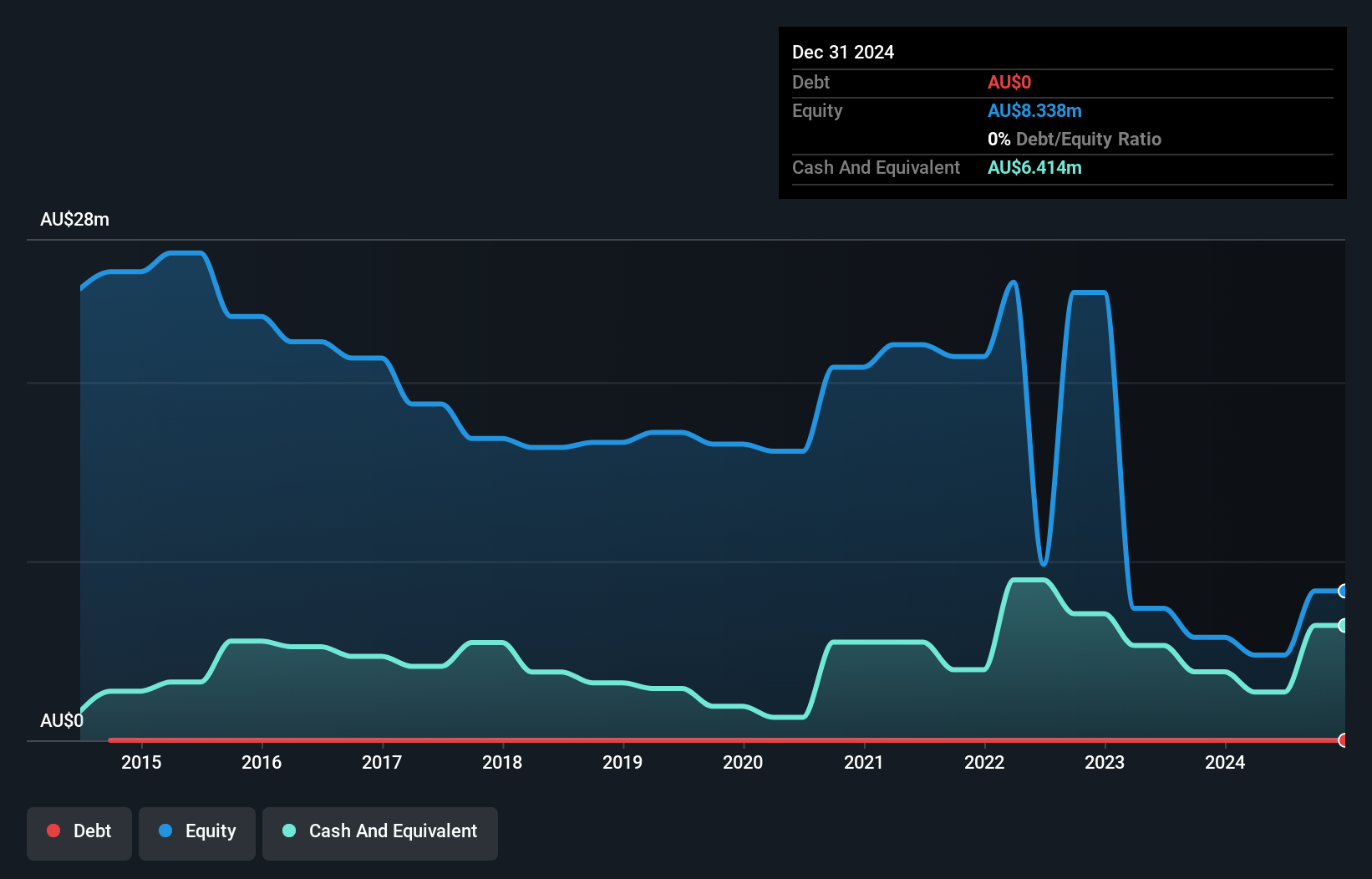

Emmerson Resources, with a market cap of A$33.23 million, is pre-revenue and unprofitable, facing challenges as losses have increased by 22.7% annually over the past five years. The company benefits from a seasoned management team and board, enhancing governance stability. Emmerson remains debt-free with short-term assets covering liabilities comfortably. Recent developments include a A$5 million equity offering to bolster its cash runway beyond current estimates of 11 months based on free cash flow trends. However, the resignation of its auditor could raise concerns about financial oversight amidst stable weekly volatility in its share price.

- Click to explore a detailed breakdown of our findings in Emmerson Resources' financial health report.

- Examine Emmerson Resources' past performance report to understand how it has performed in prior years.

Sugar Terminals (NSX:SUG)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Sugar Terminals Limited offers storage and handling solutions for bulk sugar and other commodities in Australia, with a market cap of A$388.80 million.

Operations: The company generates revenue of A$115.38 million from the sugar industry segment.

Market Cap: A$388.8M

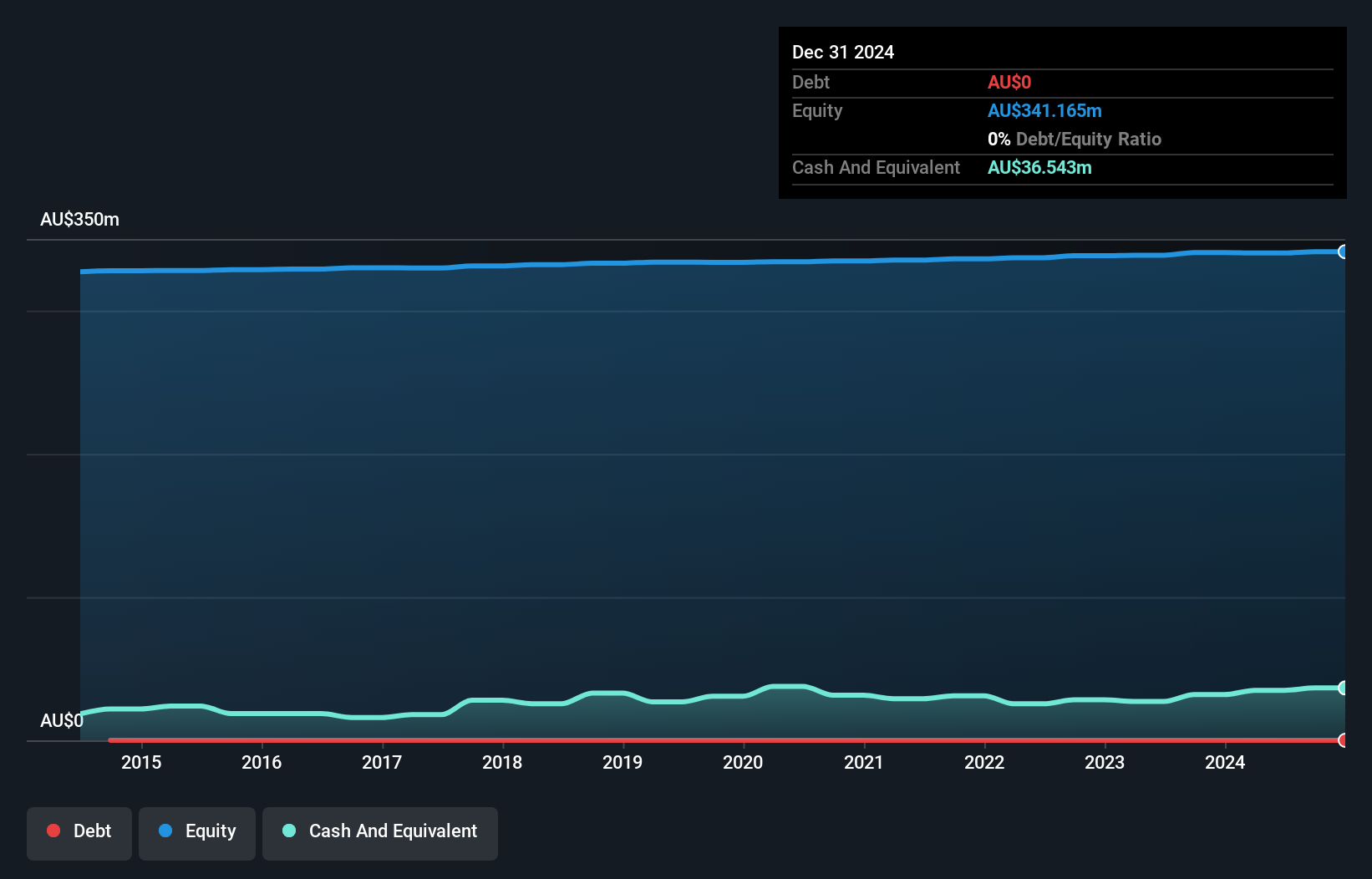

Sugar Terminals Limited, with a market cap of A$388.80 million, is financially stable with no debt and earnings growth of 11.4% over the past year, surpassing its five-year average. The company maintains high-quality earnings and has a strong balance sheet, with short-term assets exceeding both short- and long-term liabilities. Despite trading at a significant discount to estimated fair value, its return on equity remains low at 9.5%. Recent board changes include the retirement of two directors after years of service, which could impact governance dynamics moving forward but also reflects adherence to corporate governance practices.

- Click here and access our complete financial health analysis report to understand the dynamics of Sugar Terminals.

- Explore historical data to track Sugar Terminals' performance over time in our past results report.

Key Takeaways

- Investigate our full lineup of 1,050 ASX Penny Stocks right here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Emmerson Resources might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:ERM

Emmerson Resources

Engages in the exploration and evaluation of mineral properties.

Flawless balance sheet slight.

Market Insights

Community Narratives