- Australia

- /

- Construction

- /

- ASX:DUR

ASX Growth Companies With Significant Insider Ownership October 2024

Reviewed by Simply Wall St

The Australian market has shown resilience, with the ASX200 rising 0.34% to 8,234 points, driven by gains in big banks and miners, while IT leads as the best performing sector. In this environment of positive momentum and sectoral shifts, growth companies with significant insider ownership can offer unique insights into potential long-term value creation.

Top 10 Growth Companies With High Insider Ownership In Australia

| Name | Insider Ownership | Earnings Growth |

| Clinuvel Pharmaceuticals (ASX:CUV) | 10.4% | 27.4% |

| Genmin (ASX:GEN) | 12.3% | 117.7% |

| AVA Risk Group (ASX:AVA) | 15.7% | 118.8% |

| Catalyst Metals (ASX:CYL) | 14.8% | 33.1% |

| Hillgrove Resources (ASX:HGO) | 10.4% | 66.7% |

| Acrux (ASX:ACR) | 17.4% | 91.6% |

| Findi (ASX:FND) | 35.8% | 64.8% |

| Pointerra (ASX:3DP) | 20.1% | 126.4% |

| Adveritas (ASX:AV1) | 21.2% | 144.2% |

| Plenti Group (ASX:PLT) | 12.8% | 107.6% |

Let's explore several standout options from the results in the screener.

Chrysos (ASX:C79)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Chrysos Corporation Limited develops and supplies mining technology, with a market cap of A$617.57 million.

Operations: The company generates revenue of A$45.36 million from its mining services segment.

Insider Ownership: 17.7%

Earnings Growth Forecast: 48.3% p.a.

Chrysos Corporation is experiencing robust growth, with revenue forecast to increase by 28.3% annually, outpacing the Australian market's 5.5%. Despite recent shareholder dilution and a low projected return on equity of 6.2%, the company plans to achieve profitability within three years, surpassing average market growth expectations. Chrysos reaffirmed its fiscal year 2025 revenue guidance of A$60 million to A$70 million, following a significant sales increase from A$26.82 million to A$45.36 million in the past year.

- Click here and access our complete growth analysis report to understand the dynamics of Chrysos.

- Our expertly prepared valuation report Chrysos implies its share price may be too high.

Duratec (ASX:DUR)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Duratec Limited, with a market cap of A$414.61 million, provides assessment, protection, remediation, and refurbishment services for steel and concrete infrastructure assets in Australia.

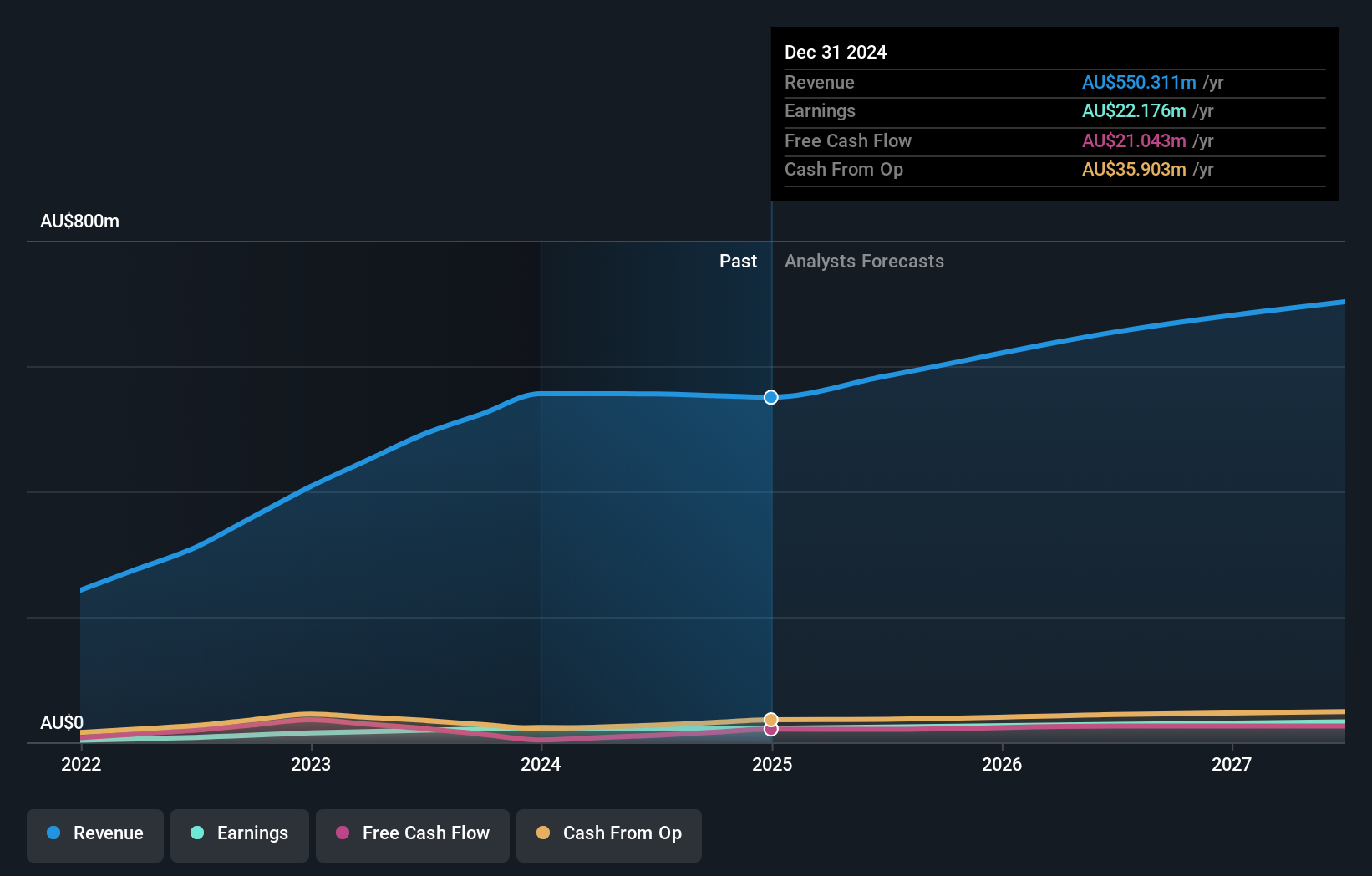

Operations: The company's revenue segments include Energy (A$46.64 million), Defence (A$220.16 million), Buildings & Facades (A$111.33 million), and Mining & Industrial (A$155.64 million).

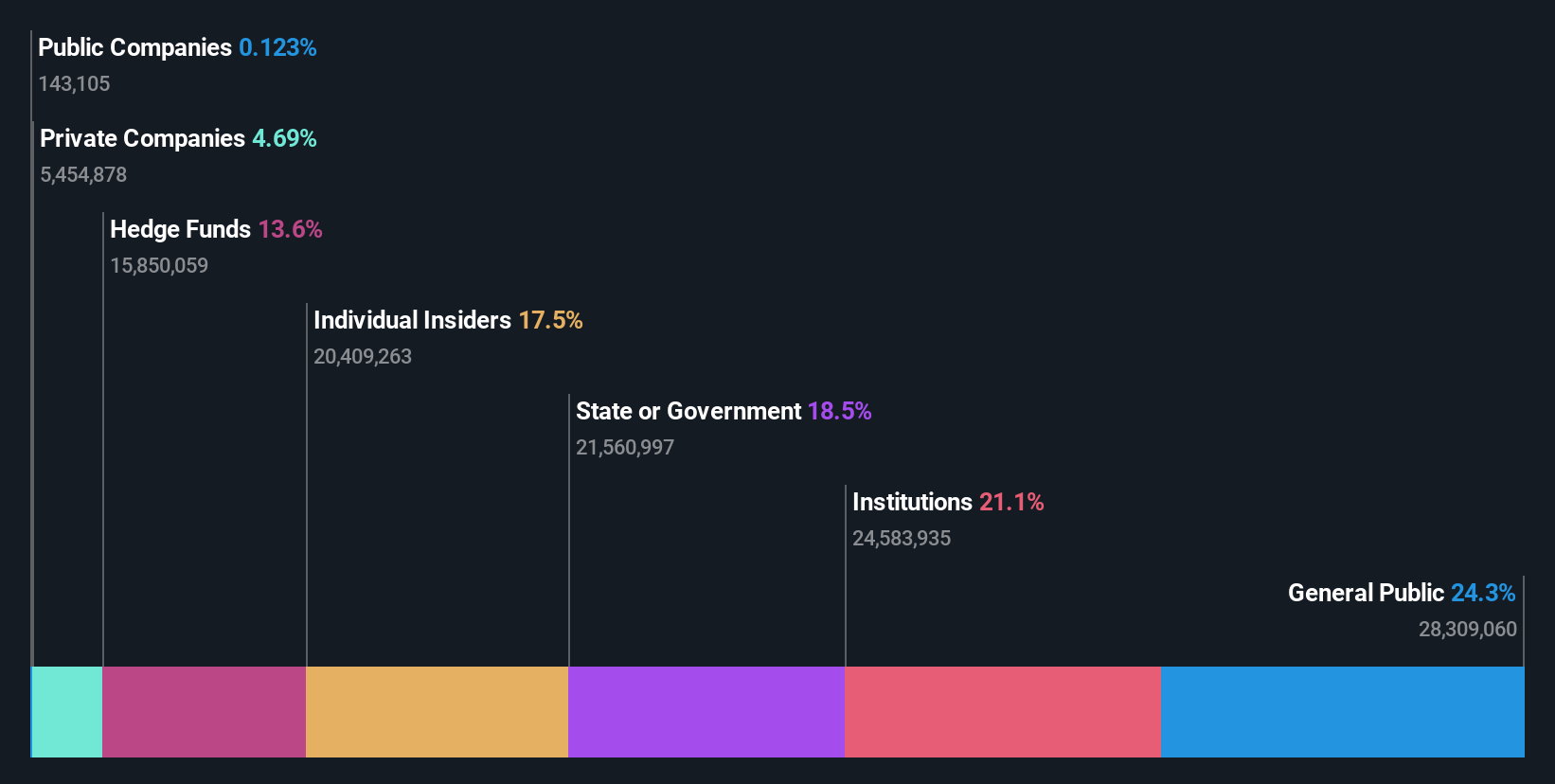

Insider Ownership: 31.3%

Earnings Growth Forecast: 13.6% p.a.

Duratec shows potential with its earnings projected to grow 13.57% annually, surpassing the Australian market average of 12.2%. Despite a slower revenue growth forecast of 7.7%, it remains above the market's 5.5%. The company trades at a notable discount to its estimated fair value and was recently added to the S&P Global BMI Index, highlighting its growing prominence. Recent results show sales rising from A$491.8 million to A$555.79 million year-over-year, indicating solid performance momentum.

- Click to explore a detailed breakdown of our findings in Duratec's earnings growth report.

- According our valuation report, there's an indication that Duratec's share price might be on the cheaper side.

Guzman y Gomez (ASX:GYG)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Guzman y Gomez Limited owns, operates, and franchises quick service restaurants in Australia, Singapore, Japan, and the United States with a market cap of A$3.94 billion.

Operations: The company generates revenue of A$364.99 million from its quick service restaurant operations across Australia, Singapore, Japan, and the United States.

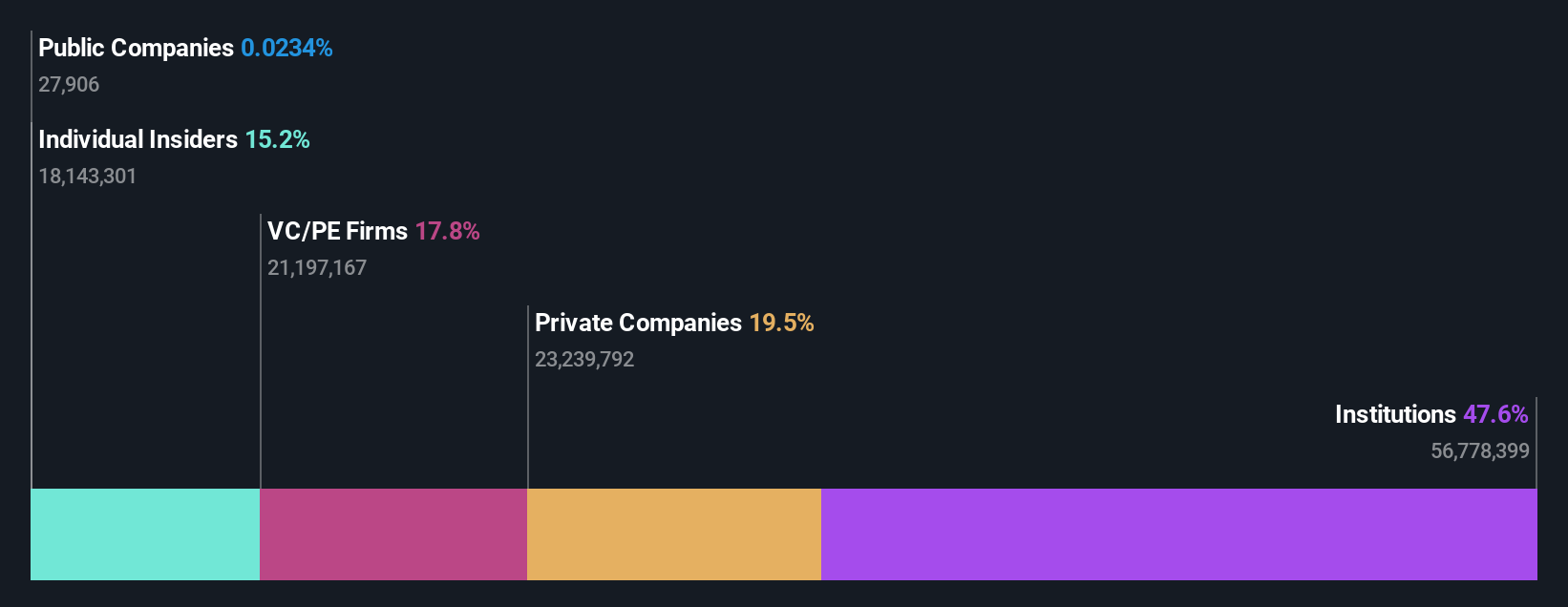

Insider Ownership: 13%

Earnings Growth Forecast: 46.7% p.a.

Guzman y Gomez is experiencing rapid growth, with revenue increasing by A$83.17 million to A$342.21 million in the past year, despite a net loss of A$13.75 million. The company is forecasted to achieve profitability within three years, with earnings expected to grow at 46.69% annually and revenue at 17.8%, outpacing the Australian market's average growth rate of 5.5%. Its recent inclusion in multiple S&P/ASX indices underscores its rising significance in the market landscape.

- Take a closer look at Guzman y Gomez's potential here in our earnings growth report.

- According our valuation report, there's an indication that Guzman y Gomez's share price might be on the expensive side.

Make It Happen

- Click here to access our complete index of 97 Fast Growing ASX Companies With High Insider Ownership.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:DUR

Duratec

Engages in the provision of assessment, protection, remediation, and refurbishment services to a range of assets, primarily steel and concrete infrastructure in Australia.

Flawless balance sheet with reasonable growth potential.

Market Insights

Community Narratives