- Australia

- /

- Construction

- /

- ASX:SHA

3 ASX Stocks That May Be Trading Up To 49.1% Below Intrinsic Value Estimates

Reviewed by Simply Wall St

The Australian stock market has faced challenges this year, with the ASX200 underperforming compared to a basket of its peers despite some sectors like materials and real estate showing resilience. In such an environment, identifying undervalued stocks can be crucial for investors seeking potential opportunities, as these stocks may offer value relative to their intrinsic worth amidst broader market fluctuations.

Top 10 Undervalued Stocks Based On Cash Flows In Australia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Smart Parking (ASX:SPZ) | A$1.33 | A$2.26 | 41.3% |

| Ramelius Resources (ASX:RMS) | A$3.81 | A$7.17 | 46.8% |

| NRW Holdings (ASX:NWH) | A$5.04 | A$8.91 | 43.4% |

| Lynas Rare Earths (ASX:LYC) | A$12.66 | A$22.15 | 42.8% |

| LGI (ASX:LGI) | A$3.95 | A$7.77 | 49.2% |

| Guzman y Gomez (ASX:GYG) | A$21.60 | A$39.08 | 44.7% |

| Cromwell Property Group (ASX:CMW) | A$0.47 | A$0.86 | 45.6% |

| CleanSpace Holdings (ASX:CSX) | A$0.63 | A$1.11 | 43.1% |

| Bellevue Gold (ASX:BGL) | A$1.435 | A$2.82 | 49.1% |

| Airtasker (ASX:ART) | A$0.33 | A$0.63 | 48% |

Let's dive into some prime choices out of the screener.

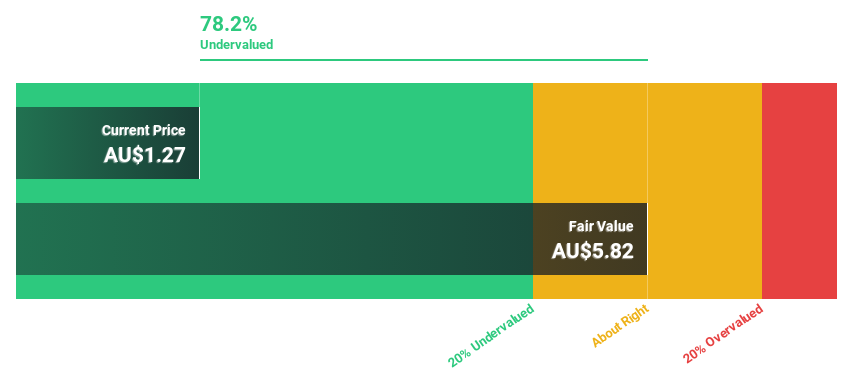

Bellevue Gold (ASX:BGL)

Overview: Bellevue Gold Limited is an Australian company involved in the exploration, development, mining, and processing of gold properties, with a market cap of A$2.12 billion.

Operations: The company's revenue segment is primarily focused on the exploration and evaluation of minerals and mine development, generating A$394.97 million.

Estimated Discount To Fair Value: 49.1%

Bellevue Gold is trading at A$1.44, significantly undervalued compared to its estimated fair value of A$2.82, and below fair value by over 20%. The company's revenue is forecast to grow at 17% annually, outpacing the broader Australian market. Bellevue Gold aims for increased ore grades with resumed development in Deacon North, a key high-grade area, supporting future profitability expected within three years despite past shareholder dilution.

- The growth report we've compiled suggests that Bellevue Gold's future prospects could be on the up.

- Unlock comprehensive insights into our analysis of Bellevue Gold stock in this financial health report.

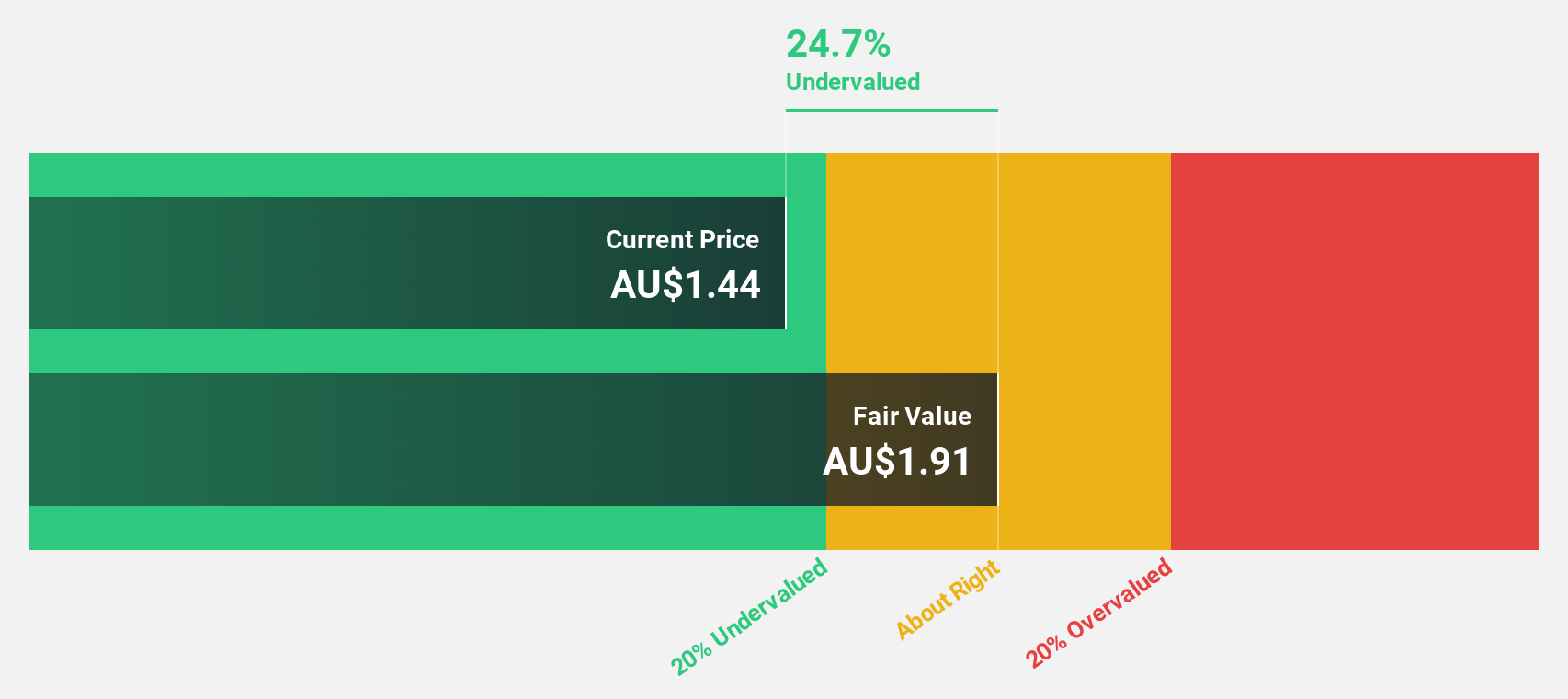

Duratec (ASX:DUR)

Overview: Duratec Limited, with a market cap of A$475.73 million, provides assessment, protection, remediation, and refurbishment services for steel and concrete infrastructure assets in Australia.

Operations: The company's revenue segments include Energy (A$82.51 million), Defence (A$181.36 million), Buildings & Facades (A$111.87 million), and Mining & Industrial (A$136.65 million).

Estimated Discount To Fair Value: 13.8%

Duratec, trading at A$1.85, is undervalued compared to its fair value estimate of A$2.14 and trades 13.8% below this estimate. Earnings are projected to grow at 13.09% annually, surpassing the Australian market average of 12%. Recent strategic initiatives include seeking acquisitions and investments to enhance diversification and growth, supported by strong funding. Duratec's revenue growth forecast of 7.7% annually outpaces the broader market's expected rate of 5.9%.

- Upon reviewing our latest growth report, Duratec's projected financial performance appears quite optimistic.

- Get an in-depth perspective on Duratec's balance sheet by reading our health report here.

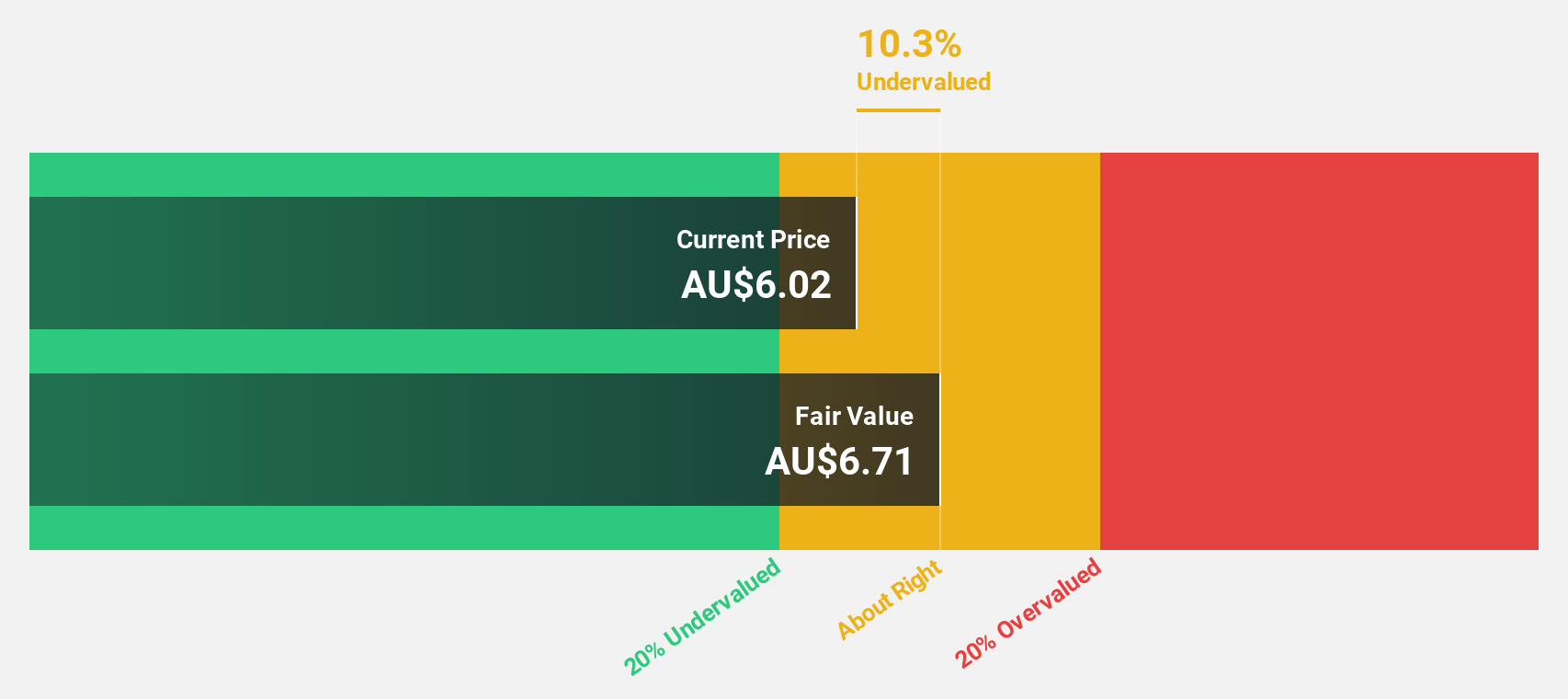

SHAPE Australia (ASX:SHA)

Overview: SHAPE Australia Corporation Limited operates in the construction, fitout, and refurbishment of commercial properties across Australia with a market cap of A$485.83 million.

Operations: The company generates revenue of A$956.87 million from its heavy construction segment.

Estimated Discount To Fair Value: 28.8%

SHAPE Australia is trading at A$5.9, significantly below its estimated fair value of A$8.28, suggesting it is undervalued based on cash flows. The company's earnings grew by 31.9% last year and are forecast to increase by 15.4% annually, outpacing the Australian market's growth rate of 12%. Although revenue growth is slower at 9.9%, it still exceeds the market average of 5.9%. Recent M&A discussions could impact future valuations positively or negatively depending on outcomes.

- Insights from our recent growth report point to a promising forecast for SHAPE Australia's business outlook.

- Delve into the full analysis health report here for a deeper understanding of SHAPE Australia.

Key Takeaways

- Gain an insight into the universe of 33 Undervalued ASX Stocks Based On Cash Flows by clicking here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:SHA

SHAPE Australia

Engages in the construction, fitout, and refurbishment of commercial properties in Australia.

Outstanding track record with flawless balance sheet.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

Deep Value Multi Bagger Opportunity

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Trending Discussion