- Australia

- /

- Metals and Mining

- /

- ASX:IPX

3 ASX Growth Stocks With Insider Ownership Up To 31%

Reviewed by Simply Wall St

The Australian market has shown resilience, with the ASX200 rising by 0.5% to 8,430 points, breaking a multi-day losing streak amid a stronger Aussie dollar and robust performances in the IT and Materials sectors. In this recovering landscape, growth companies with substantial insider ownership can be particularly appealing as they often signal confidence from those closest to the business's operations.

Top 10 Growth Companies With High Insider Ownership In Australia

| Name | Insider Ownership | Earnings Growth |

| Clinuvel Pharmaceuticals (ASX:CUV) | 10.4% | 26.2% |

| SKS Technologies Group (ASX:SKS) | 29.7% | 24.8% |

| Medallion Metals (ASX:MM8) | 13.8% | 67.5% |

| Acrux (ASX:ACR) | 14.6% | 91.8% |

| Newfield Resources (ASX:NWF) | 31.5% | 72.1% |

| AVA Risk Group (ASX:AVA) | 15.8% | 77.3% |

| Pointerra (ASX:3DP) | 23.8% | 126.4% |

| Plenti Group (ASX:PLT) | 12.7% | 120.1% |

| Brightstar Resources (ASX:BTR) | 16.2% | 86% |

| Findi (ASX:FND) | 35.8% | 110.7% |

Here's a peek at a few of the choices from the screener.

Duratec (ASX:DUR)

Simply Wall St Growth Rating: ★★★★☆☆

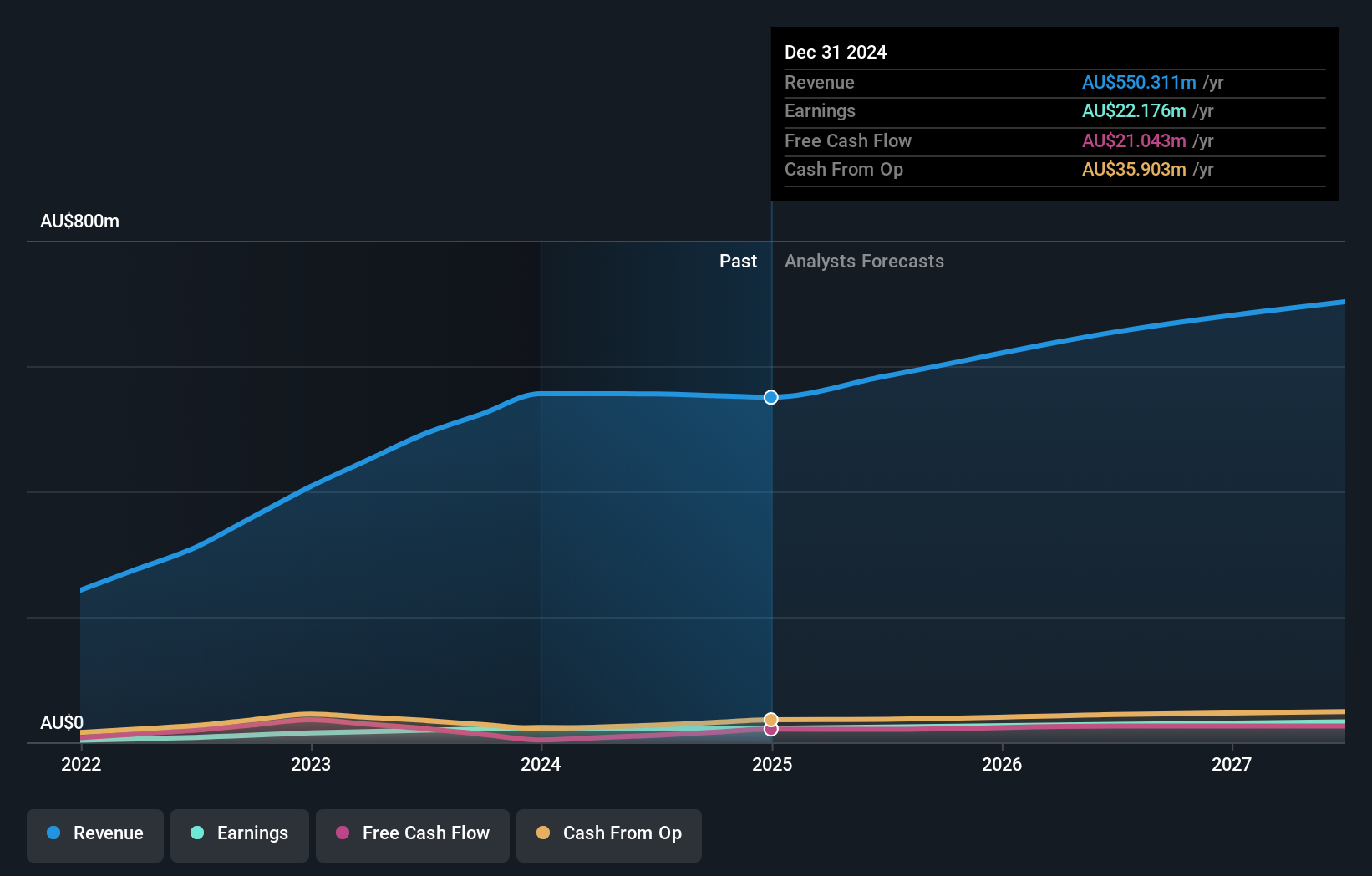

Overview: Duratec Limited, listed under the ticker ASX:DUR, provides assessment, protection, remediation, and refurbishment services for steel and concrete infrastructure in Australia with a market capitalization of A$404.53 million.

Operations: Duratec's revenue segments consist of Energy (A$46.64 million), Defence (A$220.16 million), Buildings & Facades (A$111.33 million), and Mining & Industrial (A$155.64 million).

Insider Ownership: 31.3%

Duratec is positioned as a growth company with high insider ownership, showing promising financial forecasts. Its earnings are expected to grow at 14.4% annually, outpacing the Australian market's 12.6%, while revenue is projected to increase by 8.4% per year. The company trades at nearly 30% below its estimated fair value, suggesting potential undervaluation. Recent guidance indicates expected revenue between A$600 million and A$640 million for the fiscal year ending June 2025, underscoring ongoing expansion efforts.

- Click here and access our complete growth analysis report to understand the dynamics of Duratec.

- The valuation report we've compiled suggests that Duratec's current price could be quite moderate.

IperionX (ASX:IPX)

Simply Wall St Growth Rating: ★★★★★★

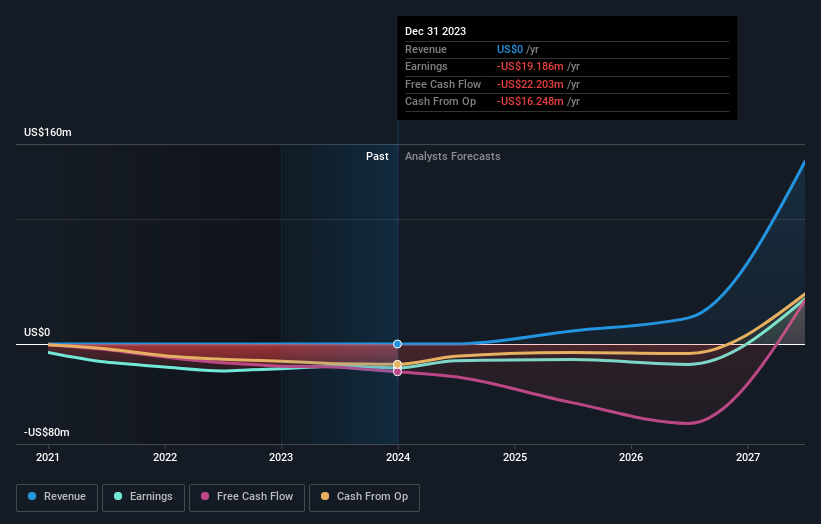

Overview: IperionX Limited is involved in the exploration and development of mineral properties in the United States, with a market capitalization of A$1.35 billion.

Operations: Revenue segments for IperionX Limited are currently not available.

Insider Ownership: 18.6%

IperionX showcases significant growth potential with high insider ownership. The company's revenue is forecast to grow at 64.1% annually, surpassing the Australian market's average. Earnings are expected to increase by 66.96% per year, and profitability is anticipated within three years, indicating robust expansion prospects. Trading at 91.7% below its estimated fair value suggests possible undervaluation, while recent insider buying reflects confidence in future performance despite past shareholder dilution concerns.

- Get an in-depth perspective on IperionX's performance by reading our analyst estimates report here.

- Our valuation report here indicates IperionX may be overvalued.

Regal Partners (ASX:RPL)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Regal Partners Limited is a privately owned hedge fund sponsor with a market capitalization of A$1.26 billion.

Operations: The company generates revenue of A$198.50 million from its investment management services segment.

Insider Ownership: 31.8%

Regal Partners demonstrates potential for growth with substantial insider ownership, despite recent shareholder dilution. Its revenue is projected to grow at 18% annually, outpacing the broader Australian market. Earnings are expected to rise significantly by 23.6% per year over the next three years. However, its dividend yield of 4.24% is not well covered by free cash flows, and recent delisting from OTC Equity may impact investor sentiment. The company remains engaged in strategic M&A discussions with Platinum Investment Management Limited.

- Dive into the specifics of Regal Partners here with our thorough growth forecast report.

- The analysis detailed in our Regal Partners valuation report hints at an deflated share price compared to its estimated value.

Seize The Opportunity

- Take a closer look at our Fast Growing ASX Companies With High Insider Ownership list of 90 companies by clicking here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:IPX

IperionX

Engages in exploration and development of its mineral properties in the United States.

Exceptional growth potential with excellent balance sheet.

Market Insights

Community Narratives