- Australia

- /

- Aerospace & Defense

- /

- ASX:DRO

How Investors May Respond To DroneShield (ASX:DRO) Launching Advanced AI-Driven Counter-Drone Software

Reviewed by Sasha Jovanovic

- Earlier this month, DroneShield unveiled a major AI-driven software update designed to enhance detection accuracy, response speed, and integration with defense networks including those utilizing the SAPIENT protocol.

- This release introduces precise emitter-based drone disruption and supports the company's plan to drive substantial growth in software as a service revenue, directly addressing evolving counter-drone challenges across both defense and critical infrastructure sectors.

- We'll explore how DroneShield's new AI-powered detection and broader defense network interoperability could influence its long-term market opportunity.

We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

DroneShield Investment Narrative Recap

For shareholders, belief in DroneShield hinges on global demand for counter-drone solutions, underpinned by increased defense spending and rapid threat evolution. The recent AI-driven software release may reinforce the company’s push toward recurring SaaS revenue, a top short-term catalyst, though it does not immediately resolve risks tied to unpredictable, lumpy government contracts, which remain a central concern.

One of the most relevant developments linked to this AI update is DroneShield’s September 2025 agreement with Critical Infrastructure Technologies Ltd., aiming to supply C-UAS solutions for Ukraine’s Ministry of Defence. This further highlights the potential for software and platform enhancements to support new client wins and drive future contract opportunities.

However, given the company’s reliance on large government contracts, investors should also consider how sudden procurement delays or cancellations could impact...

Read the full narrative on DroneShield (it's free!)

DroneShield's narrative projects A$359.8 million in revenue and A$96.1 million in earnings by 2028. This requires 49.7% yearly revenue growth and an increase of A$90.5 million in earnings from A$5.6 million today.

Uncover how DroneShield's forecasts yield a A$3.65 fair value, a 39% downside to its current price.

Exploring Other Perspectives

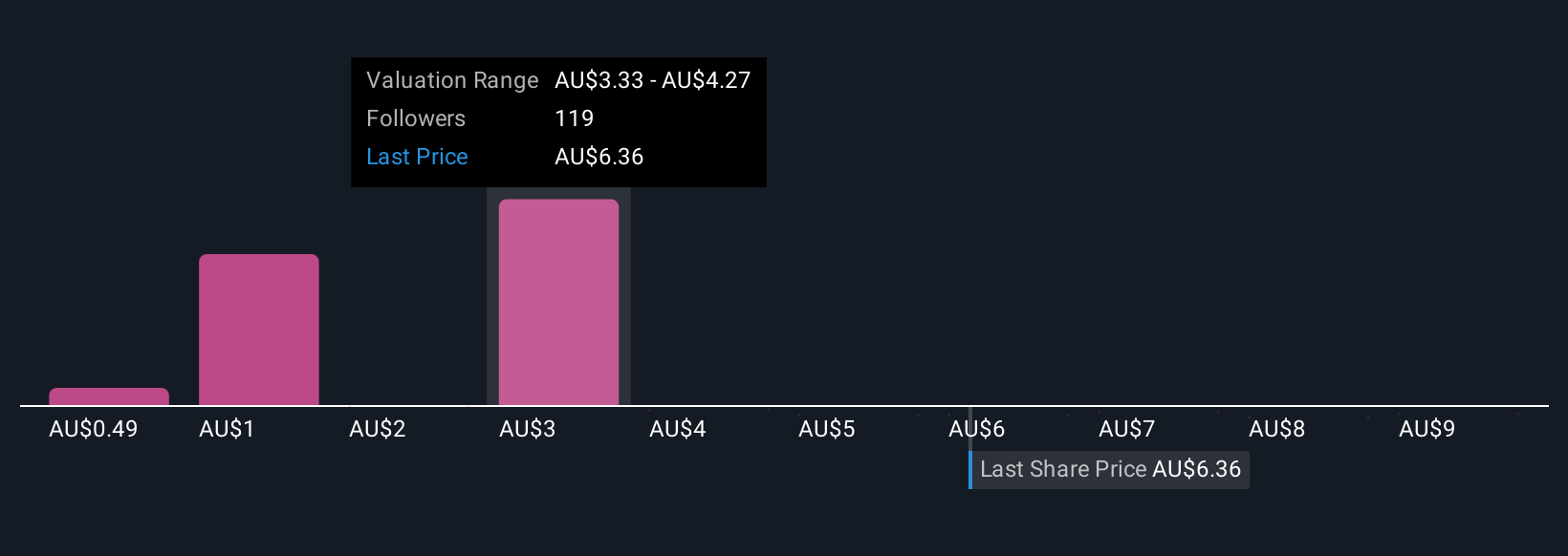

Simply Wall St Community members provided 47 fair value estimates for DroneShield ranging from A$0.49 to A$9.95 per share. While viewpoints are diverse, you should weigh these alongside ongoing risks like revenue volatility from large defense deals and consider how such factors might shape the company’s trajectory.

Explore 47 other fair value estimates on DroneShield - why the stock might be worth less than half the current price!

Build Your Own DroneShield Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your DroneShield research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

- Our free DroneShield research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate DroneShield's overall financial health at a glance.

Seeking Other Investments?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:DRO

DroneShield

Engages in the development, commercialization, and sale of hardware and software technology for drone detection and security in Australia and the United States.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives