- Australia

- /

- Aerospace & Defense

- /

- ASX:DRO

DroneShield Limited (ASX:DRO) Stocks Pounded By 29% But Not Lagging Industry On Growth Or Pricing

DroneShield Limited (ASX:DRO) shareholders that were waiting for something to happen have been dealt a blow with a 29% share price drop in the last month. The good news is that in the last year, the stock has shone bright like a diamond, gaining 243%.

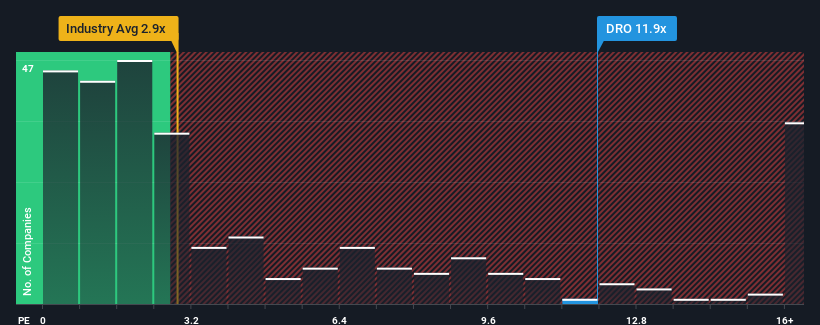

Even after such a large drop in price, when almost half of the companies in Australia's Aerospace & Defense industry have price-to-sales ratios (or "P/S") below 0.9x, you may still consider DroneShield as a stock not worth researching with its 11.9x P/S ratio. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for DroneShield

How DroneShield Has Been Performing

DroneShield certainly has been doing a good job lately as it's been growing revenue more than most other companies. It seems the market expects this form will continue into the future, hence the elevated P/S ratio. If not, then existing shareholders might be a little nervous about the viability of the share price.

Want the full picture on analyst estimates for the company? Then our free report on DroneShield will help you uncover what's on the horizon.How Is DroneShield's Revenue Growth Trending?

In order to justify its P/S ratio, DroneShield would need to produce outstanding growth that's well in excess of the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 173%. Spectacularly, three year revenue growth has ballooned by several orders of magnitude, thanks in part to the last 12 months of revenue growth. Accordingly, shareholders would have been over the moon with those medium-term rates of revenue growth.

Shifting to the future, estimates from the dual analysts covering the company suggest revenue should grow by 48% over the next year. Meanwhile, the rest of the industry is forecast to only expand by 18%, which is noticeably less attractive.

With this in mind, it's not hard to understand why DroneShield's P/S is high relative to its industry peers. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Bottom Line On DroneShield's P/S

A significant share price dive has done very little to deflate DroneShield's very lofty P/S. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

We've established that DroneShield maintains its high P/S on the strength of its forecasted revenue growth being higher than the the rest of the Aerospace & Defense industry, as expected. Right now shareholders are comfortable with the P/S as they are quite confident future revenues aren't under threat. It's hard to see the share price falling strongly in the near future under these circumstances.

You should always think about risks. Case in point, we've spotted 2 warning signs for DroneShield you should be aware of, and 1 of them makes us a bit uncomfortable.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:DRO

DroneShield

Engages in the development, commercialization, and sale of hardware and software technology for drone detection and security in Australia and the United States.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives