- Australia

- /

- Construction

- /

- ASX:SSM

ASX Penny Stocks Spotlight DroneShield And Two Other Promising Picks

Reviewed by Simply Wall St

As the Australian market experiences a green day, with the XJO bouncing back to 8,600 points amid Wall Street's recovery from last week's jitters, investors are keeping a close eye on sectors like materials and IT. For those interested in smaller or newer companies, penny stocks—despite their somewhat outdated label—remain a relevant investment area that can offer surprising value. By focusing on stocks with solid financial foundations and growth potential, investors may uncover opportunities that balance stability with the promise of future returns.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Rewards & Risks |

| Alfabs Australia (ASX:AAL) | A$0.43 | A$123.23M | ✅ 4 ⚠️ 3 View Analysis > |

| Dusk Group (ASX:DSK) | A$0.835 | A$51.99M | ✅ 4 ⚠️ 2 View Analysis > |

| IVE Group (ASX:IGL) | A$2.76 | A$424.18M | ✅ 4 ⚠️ 3 View Analysis > |

| MotorCycle Holdings (ASX:MTO) | A$3.68 | A$271.82M | ✅ 4 ⚠️ 2 View Analysis > |

| Veris (ASX:VRS) | A$0.068 | A$35.82M | ✅ 3 ⚠️ 2 View Analysis > |

| West African Resources (ASX:WAF) | A$3.04 | A$3.14B | ✅ 4 ⚠️ 2 View Analysis > |

| Service Stream (ASX:SSM) | A$2.24 | A$1.37B | ✅ 3 ⚠️ 2 View Analysis > |

| Fleetwood (ASX:FWD) | A$2.56 | A$237.01M | ✅ 3 ⚠️ 2 View Analysis > |

| MaxiPARTS (ASX:MXI) | A$2.34 | A$129.97M | ✅ 3 ⚠️ 2 View Analysis > |

| GWA Group (ASX:GWA) | A$2.46 | A$645.5M | ✅ 5 ⚠️ 1 View Analysis > |

Click here to see the full list of 412 stocks from our ASX Penny Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

DroneShield (ASX:DRO)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: DroneShield Limited develops, commercializes, and sells hardware and software technology for drone detection and security in Australia and the United States, with a market cap of A$1.97 billion.

Operations: The company's revenue is derived entirely from its Aerospace & Defense segment, amounting to A$107.17 million.

Market Cap: A$1.97B

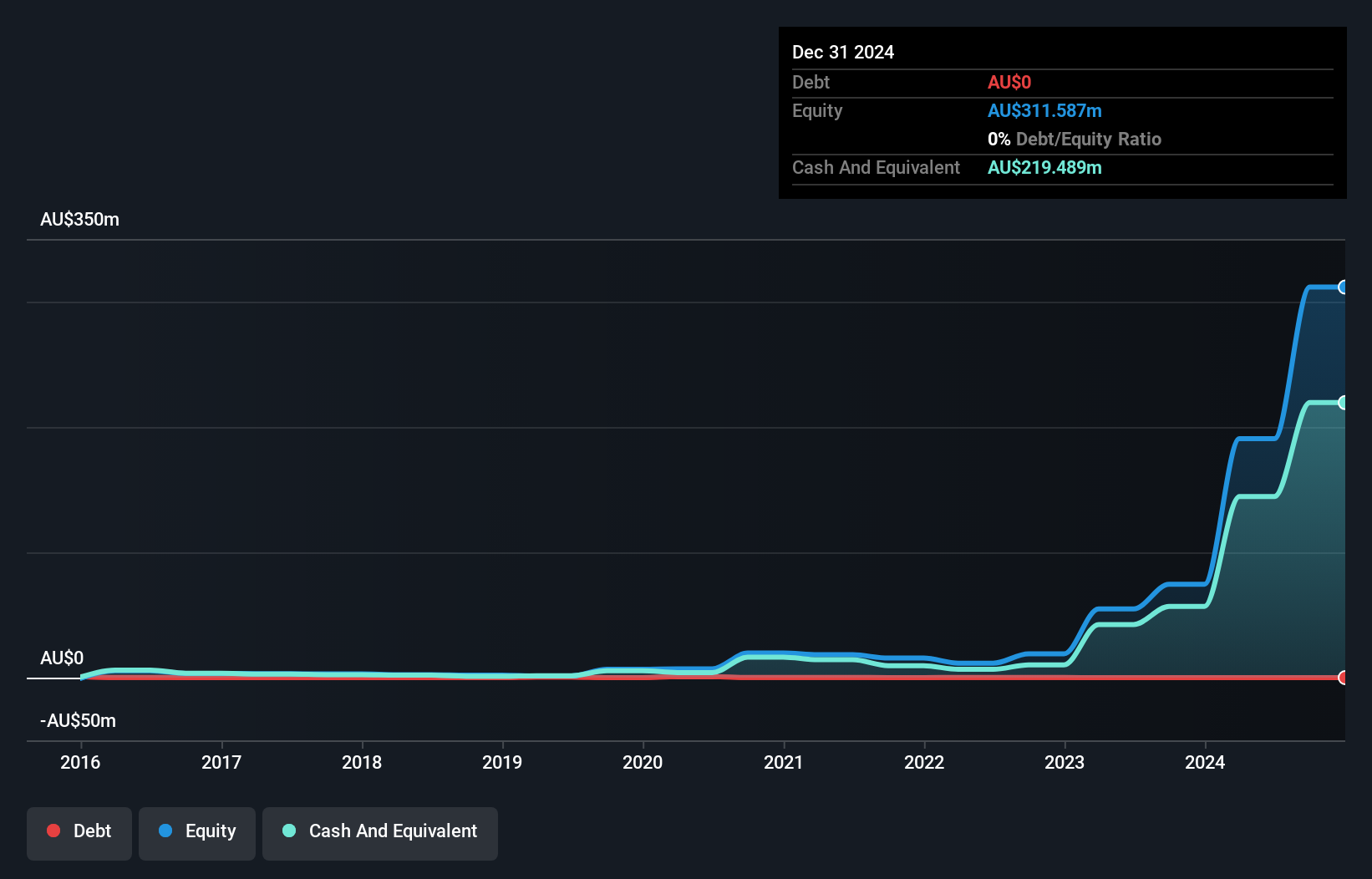

DroneShield Limited, with a market cap of A$1.97 billion, has shown significant revenue growth in its Aerospace & Defense segment, reporting A$107.17 million for the latest period. Despite this progress, earnings growth remains negative compared to industry averages, and profit margins have decreased from 11.3% to 5.2%. The company is debt-free and maintains strong short-term asset coverage over liabilities. Recent leadership changes include the resignation of its U.S. CEO and strategic appointments within its technology team, reflecting ongoing organizational maturation as it navigates volatile share prices and aims for technological advancement in defense markets.

- Click to explore a detailed breakdown of our findings in DroneShield's financial health report.

- Gain insights into DroneShield's future direction by reviewing our growth report.

Service Stream (ASX:SSM)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Service Stream Limited operates in Australia, focusing on the design, construction, operation, and maintenance of infrastructure networks within the telecommunications, utilities, and transport sectors; it has a market cap of A$1.37 billion.

Operations: The company generates revenue from three primary segments: Telecommunications (A$1.17 billion), Utilities (A$1.01 billion), and Transport (A$154.23 million).

Market Cap: A$1.37B

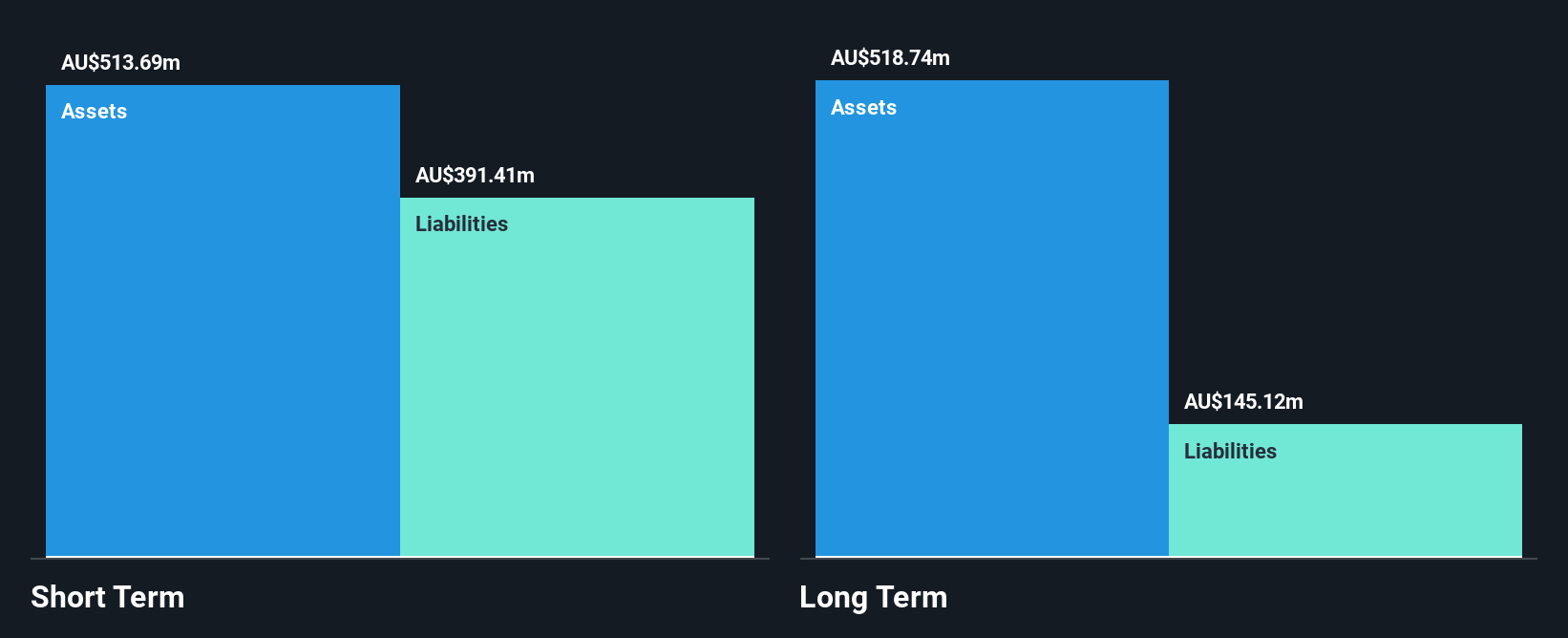

Service Stream Limited, with a market cap of A$1.37 billion, has demonstrated robust earnings growth of 83.2% over the past year, significantly outpacing the construction industry average. The company operates debt-free and maintains strong asset coverage over both short and long-term liabilities, highlighting financial stability. However, insider selling in recent months could raise concerns for potential investors. Despite trading below estimated fair value by 51.7%, its return on equity remains low at 11.5%. Upcoming events include an anticipated earnings release on November 27, which may provide further insights into its financial trajectory.

- Click here and access our complete financial health analysis report to understand the dynamics of Service Stream.

- Explore Service Stream's analyst forecasts in our growth report.

TPG Telecom (ASX:TPG)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: TPG Telecom Limited offers telecommunications services to a diverse range of customers including consumers, businesses, enterprises, government entities, and wholesale clients in Australia with a market cap of A$7.33 billion.

Operations: The company's revenue is derived from two main segments: Consumer, which generated A$4.53 billion, and Enterprise, Government and Wholesale, contributing A$1.11 billion.

Market Cap: A$7.33B

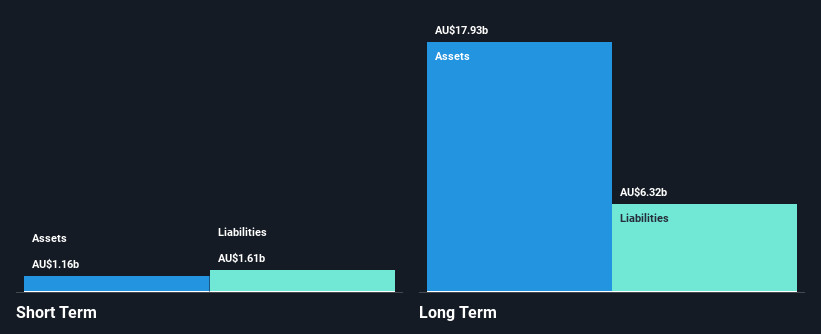

TPG Telecom Limited, with a market cap of A$7.33 billion, recently completed follow-on equity offerings totaling A$988 million, indicating active capital management strategies. Despite being unprofitable and having a negative return on equity, TPG's net debt to equity ratio is satisfactory at 37%, and it maintains sufficient cash runway for over three years due to positive free cash flow. The company's short-term assets of A$5.3 billion cover its short-term liabilities but fall short of long-term obligations. Trading at 75% below estimated fair value and with analyst consensus forecasting earnings growth of 49.42% annually, TPG presents potential investment interest amidst its financial restructuring efforts.

- Dive into the specifics of TPG Telecom here with our thorough balance sheet health report.

- Evaluate TPG Telecom's prospects by accessing our earnings growth report.

Key Takeaways

- Dive into all 412 of the ASX Penny Stocks we have identified here.

- Ready To Venture Into Other Investment Styles? We've found 14 US stocks that are forecast to pay a dividend yeild of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:SSM

Service Stream

Engages in the design, construction, operation, and maintenance of infrastructure networks across the telecommunications, utilities, and transport sectors in Australia.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success