- Australia

- /

- Aerospace & Defense

- /

- ASX:DRO

After Leaping 42% DroneShield Limited (ASX:DRO) Shares Are Not Flying Under The Radar

Despite an already strong run, DroneShield Limited (ASX:DRO) shares have been powering on, with a gain of 42% in the last thirty days. The last month tops off a massive increase of 116% in the last year.

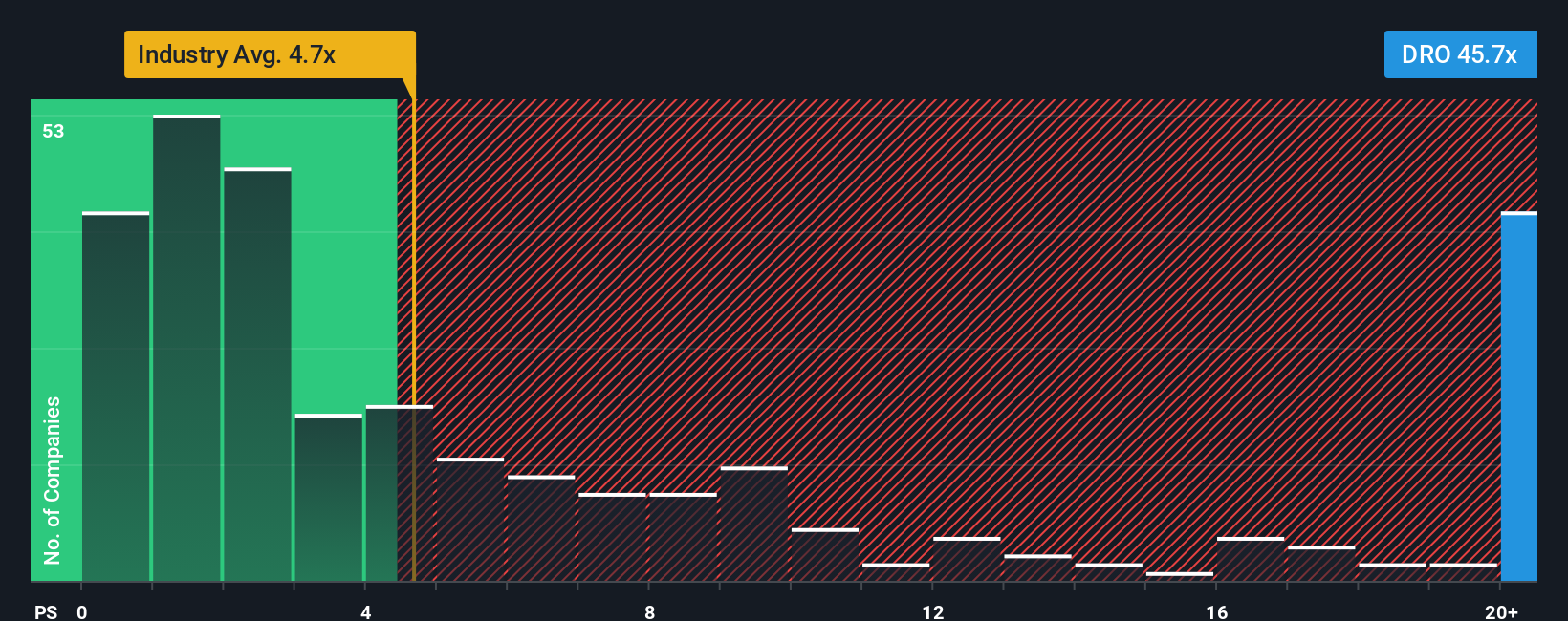

Since its price has surged higher, given around half the companies in Australia's Aerospace & Defense industry have price-to-sales ratios (or "P/S") below 2.9x, you may consider DroneShield as a stock to avoid entirely with its 45.7x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

Check out our latest analysis for DroneShield

How Has DroneShield Performed Recently?

There hasn't been much to differentiate DroneShield's and the industry's revenue growth lately. Perhaps the market is expecting future revenue performance to improve, justifying the currently elevated P/S. However, if this isn't the case, investors might get caught out paying too much for the stock.

Keen to find out how analysts think DroneShield's future stacks up against the industry? In that case, our free report is a great place to start.Is There Enough Revenue Growth Forecasted For DroneShield?

The only time you'd be truly comfortable seeing a P/S as steep as DroneShield's is when the company's growth is on track to outshine the industry decidedly.

Taking a look back first, we see that the company managed to grow revenues by a handy 7.0% last year. Spectacularly, three year revenue growth has ballooned by several orders of magnitude, even though the last 12 months were fairly tame in comparison. Accordingly, shareholders would have been over the moon with those medium-term rates of revenue growth.

Turning to the outlook, the next three years should generate growth of 72% each year as estimated by the dual analysts watching the company. That's shaping up to be materially higher than the 12% per year growth forecast for the broader industry.

With this information, we can see why DroneShield is trading at such a high P/S compared to the industry. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

What We Can Learn From DroneShield's P/S?

DroneShield's P/S has grown nicely over the last month thanks to a handy boost in the share price. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Our look into DroneShield shows that its P/S ratio remains high on the merit of its strong future revenues. Right now shareholders are comfortable with the P/S as they are quite confident future revenues aren't under threat. Unless the analysts have really missed the mark, these strong revenue forecasts should keep the share price buoyant.

There are also other vital risk factors to consider before investing and we've discovered 1 warning sign for DroneShield that you should be aware of.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:DRO

DroneShield

Engages in the development, commercialization, and sale of hardware and software technology for drone detection and security in Australia and the United States.

High growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives