- Australia

- /

- Construction

- /

- ASX:CVL

3 ASX Penny Stocks With Market Caps Larger Than A$500M

Reviewed by Simply Wall St

The Australian market recently experienced a boost following a policy reversal by Trump, which provided temporary relief on tariffs for China. In such fluctuating conditions, investors often seek opportunities in smaller or newer companies that can offer both affordability and potential growth. Despite the somewhat outdated term, penny stocks remain relevant as an investment area, with some demonstrating financial strength and stability that could appeal to those looking for hidden gems in the market.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Rewards & Risks |

| CTI Logistics (ASX:CLX) | A$1.78 | A$143.37M | ✅ 4 ⚠️ 2 View Analysis > |

| EZZ Life Science Holdings (ASX:EZZ) | A$1.46 | A$68.87M | ✅ 4 ⚠️ 2 View Analysis > |

| IVE Group (ASX:IGL) | A$2.67 | A$411.67M | ✅ 4 ⚠️ 2 View Analysis > |

| GTN (ASX:GTN) | A$0.62 | A$118.5M | ✅ 3 ⚠️ 2 View Analysis > |

| West African Resources (ASX:WAF) | A$2.27 | A$2.59B | ✅ 4 ⚠️ 1 View Analysis > |

| GR Engineering Services (ASX:GNG) | A$2.79 | A$466.92M | ✅ 2 ⚠️ 1 View Analysis > |

| Bisalloy Steel Group (ASX:BIS) | A$3.35 | A$158.96M | ✅ 3 ⚠️ 1 View Analysis > |

| Regal Partners (ASX:RPL) | A$2.43 | A$816.88M | ✅ 4 ⚠️ 4 View Analysis > |

| Navigator Global Investments (ASX:NGI) | A$1.67 | A$818.43M | ✅ 5 ⚠️ 3 View Analysis > |

| NRW Holdings (ASX:NWH) | A$2.90 | A$1.33B | ✅ 5 ⚠️ 1 View Analysis > |

Click here to see the full list of 994 stocks from our ASX Penny Stocks screener.

We'll examine a selection from our screener results.

Clarity Pharmaceuticals (ASX:CU6)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Clarity Pharmaceuticals Ltd is a clinical stage radiopharmaceutical company focused on the research and development of radiopharmaceutical products in Australia and the United States, with a market cap of A$822.66 million.

Operations: Clarity Pharmaceuticals generates revenue through its radiopharmaceutical development segment, amounting to A$10.78 million.

Market Cap: A$822.66M

Clarity Pharmaceuticals, with a market cap of A$822.66 million, is navigating the penny stock landscape with its focus on radiopharmaceuticals. Despite being unprofitable and experiencing increased losses over the past five years, Clarity's strategic moves are noteworthy. The company has secured a commercial-scale supply agreement for copper-64 with Nusano, enhancing its capacity for large-scale production in the US market. Additionally, Clarity's SECuRE trial is advancing to Phase II following promising results in prostate cancer treatment. With sufficient cash runway and no debt burden, Clarity positions itself strategically within this niche sector despite high volatility challenges.

- Navigate through the intricacies of Clarity Pharmaceuticals with our comprehensive balance sheet health report here.

- Learn about Clarity Pharmaceuticals' future growth trajectory here.

Civmec (ASX:CVL)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Civmec Limited is an investment holding company that offers construction and engineering services across the energy, resources, infrastructure, marine, and defense sectors in Australia, with a market cap of A$503.44 million.

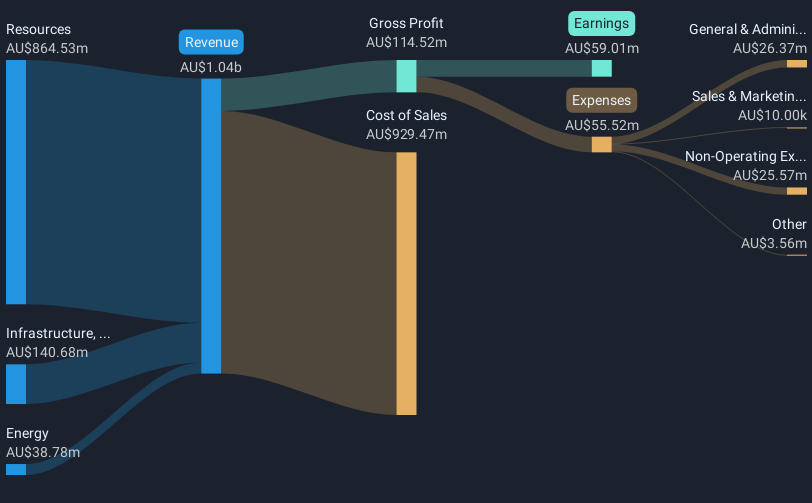

Operations: The company generates revenue from several segments, including A$38.78 million from Energy, A$864.53 million from Resources, and A$140.68 million from Infrastructure, Marine & Defence.

Market Cap: A$503.44M

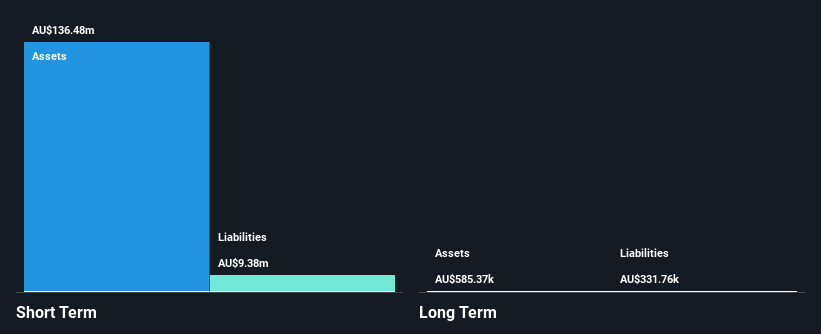

Civmec Limited, with a market cap of A$503.44 million, is actively expanding its footprint in the construction and engineering sectors through significant contract awards and extensions valued at approximately A$285 million. The company's recent projects, including the Port Waratah shiploader project and Eneabba rare earths refinery works, underscore its robust order book and client confidence. Despite facing challenges such as lower net profit margins compared to last year and negative earnings growth over the past year, Civmec maintains financial stability with satisfactory debt levels and strong asset coverage for liabilities. Its dividend yield remains attractive but is not well covered by free cash flows.

- Unlock comprehensive insights into our analysis of Civmec stock in this financial health report.

- Examine Civmec's earnings growth report to understand how analysts expect it to perform.

Stanmore Resources (ASX:SMR)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Stanmore Resources Limited is involved in the exploration, development, production, and sale of metallurgical coal in Australia, with a market cap of A$1.78 billion.

Operations: The company generates revenue from its Metals & Mining segment, specifically through coal, amounting to $2.40 billion.

Market Cap: A$1.78B

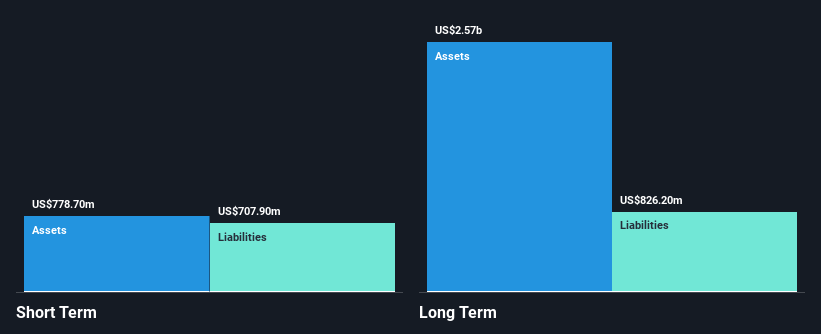

Stanmore Resources, with a market cap of A$1.78 billion, has seen its revenue decline to US$2.50 billion for 2024 from the previous year. Despite this, it maintains stable debt levels with a net debt to equity ratio of 1% and adequate interest coverage at 3.5 times EBIT. Short-term assets exceed liabilities, though long-term liabilities remain uncovered by short-term assets. The company's profit margins have decreased significantly from last year, and earnings are projected to decline further over the next three years. Its dividend yield is high but not supported by free cash flows, indicating potential sustainability concerns.

- Jump into the full analysis health report here for a deeper understanding of Stanmore Resources.

- Evaluate Stanmore Resources' prospects by accessing our earnings growth report.

Taking Advantage

- Get an in-depth perspective on all 994 ASX Penny Stocks by using our screener here.

- Contemplating Other Strategies? AI is about to change healthcare. These 23 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Civmec, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:CVL

Civmec

An investment holding company, provides construction and engineering services to the energy, resources, infrastructure, marine, and defense sectors in Australia.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives