The external fund manager backed by Berkshire Hathaway's Charlie Munger, Li Lu, makes no bones about it when he says 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. We can see that Austal Limited (ASX:ASB) does use debt in its business. But the more important question is: how much risk is that debt creating?

When Is Debt A Problem?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, plenty of companies use debt to fund growth, without any negative consequences. When we examine debt levels, we first consider both cash and debt levels, together.

Check out our latest analysis for Austal

How Much Debt Does Austal Carry?

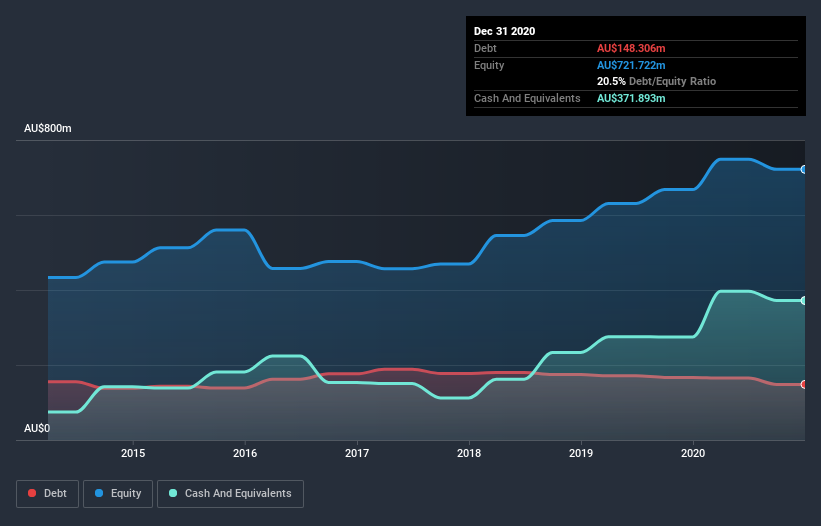

As you can see below, Austal had AU$148.3m of debt at December 2020, down from AU$167.0m a year prior. However, its balance sheet shows it holds AU$371.9m in cash, so it actually has AU$223.6m net cash.

How Strong Is Austal's Balance Sheet?

Zooming in on the latest balance sheet data, we can see that Austal had liabilities of AU$271.7m due within 12 months and liabilities of AU$293.1m due beyond that. Offsetting this, it had AU$371.9m in cash and AU$73.6m in receivables that were due within 12 months. So its liabilities outweigh the sum of its cash and (near-term) receivables by AU$119.3m.

Given Austal has a market capitalization of AU$895.1m, it's hard to believe these liabilities pose much threat. Having said that, it's clear that we should continue to monitor its balance sheet, lest it change for the worse. While it does have liabilities worth noting, Austal also has more cash than debt, so we're pretty confident it can manage its debt safely.

In addition to that, we're happy to report that Austal has boosted its EBIT by 40%, thus reducing the spectre of future debt repayments. There's no doubt that we learn most about debt from the balance sheet. But it is future earnings, more than anything, that will determine Austal's ability to maintain a healthy balance sheet going forward. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. Austal may have net cash on the balance sheet, but it is still interesting to look at how well the business converts its earnings before interest and tax (EBIT) to free cash flow, because that will influence both its need for, and its capacity to manage debt. Over the last three years, Austal actually produced more free cash flow than EBIT. That sort of strong cash conversion gets us as excited as the crowd when the beat drops at a Daft Punk concert.

Summing up

While Austal does have more liabilities than liquid assets, it also has net cash of AU$223.6m. And it impressed us with free cash flow of AU$187m, being 128% of its EBIT. So we don't think Austal's use of debt is risky. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately, every company can contain risks that exist outside of the balance sheet. Case in point: We've spotted 2 warning signs for Austal you should be aware of, and 1 of them is significant.

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

If you’re looking to trade Austal, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About ASX:ASB

Austal

Engages in the design, manufacture, and support of vessels for commercial and defense customers worldwide.

Excellent balance sheet with moderate growth potential.

Market Insights

Community Narratives