- Australia

- /

- Oil and Gas

- /

- ASX:COI

ASX Penny Stocks To Watch In January 2025

Reviewed by Simply Wall St

The Australian market recently saw the ASX200 reach a record high, buoyed by easing concerns over tariffs on China and strong performances in sectors like IT, Materials, and Real Estate. In such a positive climate, investors might be inclined to explore opportunities beyond the well-known names. Penny stocks, though an outdated term, still represent smaller or newer companies that can offer valuable prospects when backed by solid financials.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Financial Health Rating |

| Embark Early Education (ASX:EVO) | A$0.78 | A$142.2M | ★★★★☆☆ |

| LaserBond (ASX:LBL) | A$0.57 | A$67.4M | ★★★★★★ |

| EZZ Life Science Holdings (ASX:EZZ) | A$2.16 | A$91.99M | ★★★★★★ |

| SHAPE Australia (ASX:SHA) | A$2.96 | A$247.9M | ★★★★★★ |

| Austin Engineering (ASX:ANG) | A$0.50 | A$319.37M | ★★★★★☆ |

| MaxiPARTS (ASX:MXI) | A$1.92 | A$105.1M | ★★★★★★ |

| GTN (ASX:GTN) | A$0.55 | A$106.04M | ★★★★★★ |

| Helloworld Travel (ASX:HLO) | A$2.01 | A$327.26M | ★★★★★★ |

| Servcorp (ASX:SRV) | A$5.10 | A$485.51M | ★★★★☆☆ |

| IVE Group (ASX:IGL) | A$2.23 | A$337.66M | ★★★★☆☆ |

Click here to see the full list of 1,029 stocks from our ASX Penny Stocks screener.

Here's a peek at a few of the choices from the screener.

Austin Engineering (ASX:ANG)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Austin Engineering Limited, with a market cap of A$319.37 million, operates in the industrial and resources sectors by manufacturing, repairing, overhauling, and supplying mining attachment products along with related services.

Operations: The company's revenue is derived from three geographical segments: Asia-Pacific with A$166.14 million, North America contributing A$95.53 million, and South America generating A$51.58 million.

Market Cap: A$319.37M

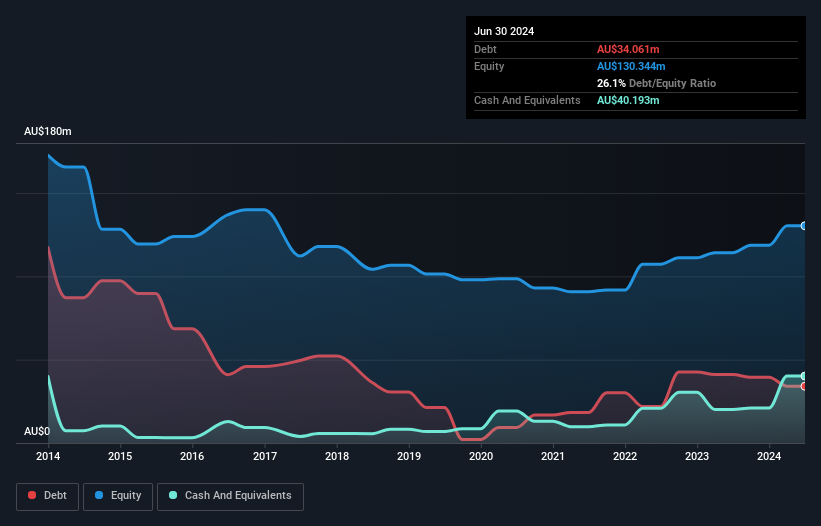

Austin Engineering Limited, with a market cap of A$319.37 million, shows promising aspects as a penny stock. The company has more cash than total debt and its short-term assets exceed both short and long-term liabilities, indicating strong liquidity. Its earnings growth of 317.3% over the past year surpasses industry averages, while maintaining high-quality earnings and a high Return on Equity at 22.8%. Additionally, interest payments are well covered by EBIT at 17.1 times coverage. Despite these positives, investors should be cautious of its unstable dividend track record and increased debt-to-equity ratio over five years from 21% to 26.1%.

- Click to explore a detailed breakdown of our findings in Austin Engineering's financial health report.

- Evaluate Austin Engineering's prospects by accessing our earnings growth report.

Comet Ridge (ASX:COI)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Comet Ridge Limited is involved in oil and gas exploration, appraisal, and development activities in Australia with a market cap of A$155.47 million.

Operations: Currently, there are no reported revenue segments for the company.

Market Cap: A$155.47M

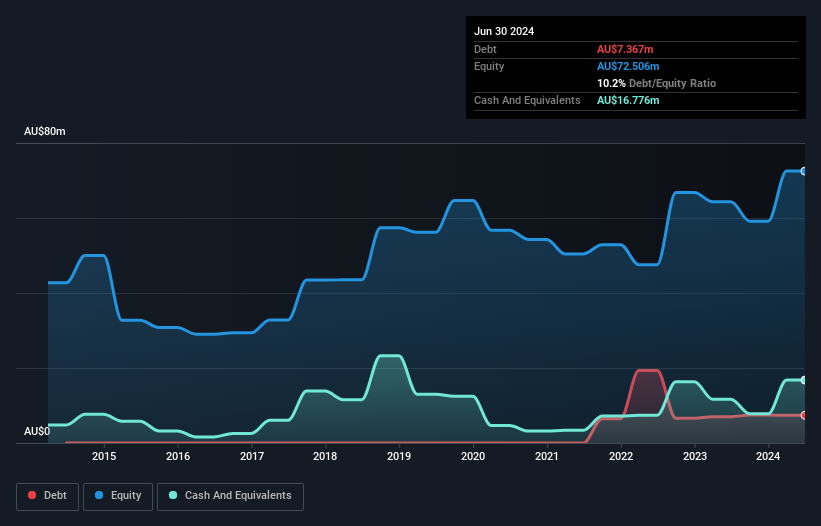

Comet Ridge Limited, with a market cap of A$155.47 million, is pre-revenue and currently unprofitable, facing challenges typical for early-stage exploration companies. Despite having more cash than total debt and short-term assets exceeding long-term liabilities, the company struggles with liquidity as its short-term liabilities surpass short-term assets. The recent follow-on equity offering raised A$12.03 million to bolster its financial position temporarily. While the seasoned management team and board provide stability, Comet Ridge's negative return on equity and increased debt-to-equity ratio highlight ongoing financial hurdles as it seeks profitability in the volatile oil and gas sector.

- Jump into the full analysis health report here for a deeper understanding of Comet Ridge.

- Assess Comet Ridge's future earnings estimates with our detailed growth reports.

Helloworld Travel (ASX:HLO)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Helloworld Travel Limited is a travel distribution company operating in Australia, New Zealand, and internationally with a market cap of A$327.26 million.

Operations: The company's revenue is derived from Travel Operations in Australia (A$158.66 million), New Zealand (A$37.71 million), and the Rest of the World (A$3.74 million), as well as Transport, Logistics, and Warehousing services (A$16.74 million).

Market Cap: A$327.26M

Helloworld Travel Limited, with a market cap of A$327.26 million, shows financial resilience with short-term assets of A$253.7 million exceeding both its short and long-term liabilities. The company is debt-free and has experienced significant earnings growth of 59.4% over the past year, surpassing industry averages. Despite a low return on equity at 9.4%, Helloworld's high-quality earnings and improved profit margins reflect strong operational performance. Trading at a substantial discount to estimated fair value, it offers good relative value compared to peers, though its dividend history remains unstable. Analysts anticipate further stock price appreciation by 43.8%.

- Dive into the specifics of Helloworld Travel here with our thorough balance sheet health report.

- Examine Helloworld Travel's earnings growth report to understand how analysts expect it to perform.

Seize The Opportunity

- Jump into our full catalog of 1,029 ASX Penny Stocks here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:COI

Comet Ridge

Engages in the oil and gas exploration, appraisal, and development activities in Australia.

Good value with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives