3 Promising ASX Penny Stocks With At Least A$200M Market Cap

Reviewed by Simply Wall St

The Australian market is poised for a cautious start, with the ASX200 expected to open lower following declines in major US indices amid investor apprehension ahead of the Federal Reserve's policy decision. Penny stocks, though considered a throwback term, continue to offer intriguing opportunities for investors willing to explore beyond established names. These smaller or newer companies can present significant growth potential when backed by strong financials and solid fundamentals.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Rewards & Risks |

| CTI Logistics (ASX:CLX) | A$1.69 | A$131.84M | ✅ 4 ⚠️ 2 View Analysis > |

| MotorCycle Holdings (ASX:MTO) | A$1.88 | A$138.76M | ✅ 4 ⚠️ 2 View Analysis > |

| Accent Group (ASX:AX1) | A$1.785 | A$1.01B | ✅ 4 ⚠️ 1 View Analysis > |

| EZZ Life Science Holdings (ASX:EZZ) | A$1.51 | A$71.23M | ✅ 4 ⚠️ 2 View Analysis > |

| IVE Group (ASX:IGL) | A$2.29 | A$354.7M | ✅ 4 ⚠️ 2 View Analysis > |

| GTN (ASX:GTN) | A$0.62 | A$121.75M | ✅ 3 ⚠️ 2 View Analysis > |

| Bisalloy Steel Group (ASX:BIS) | A$3.20 | A$151.84M | ✅ 3 ⚠️ 2 View Analysis > |

| Regal Partners (ASX:RPL) | A$2.84 | A$952.53M | ✅ 4 ⚠️ 3 View Analysis > |

| Southern Cross Electrical Engineering (ASX:SXE) | A$1.515 | A$400.37M | ✅ 4 ⚠️ 1 View Analysis > |

| NRW Holdings (ASX:NWH) | A$2.81 | A$1.28B | ✅ 5 ⚠️ 1 View Analysis > |

Click here to see the full list of 982 stocks from our ASX Penny Stocks screener.

Let's uncover some gems from our specialized screener.

Austin Engineering (ASX:ANG)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Austin Engineering Limited, with a market cap of A$272.86 million, operates in the industrial and resources sectors by manufacturing, repairing, overhauling, and supplying mining attachment products and related services.

Operations: The company generates its revenue from various regions, with A$169.08 million coming from Asia-Pacific, A$117.15 million from North America, and A$53.59 million from South America.

Market Cap: A$272.86M

Austin Engineering, with a market cap of A$272.86 million, has shown consistent earnings growth over the past five years, becoming profitable and achieving a 34.8% annual increase in earnings. Despite recent volatility in net income and EPS, the company maintains strong financial health with short-term assets exceeding liabilities and satisfactory debt levels supported by robust cash flow coverage. The management team is experienced, contributing to stable operations amidst industry challenges. Recent half-year results showcased revenue growth to A$170.15 million from A$143.57 million year-on-year, although net income slightly decreased to A$10.02 million from A$12.22 million.

- Unlock comprehensive insights into our analysis of Austin Engineering stock in this financial health report.

- Gain insights into Austin Engineering's outlook and expected performance with our report on the company's earnings estimates.

Catapult Group International (ASX:CAT)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Catapult Group International Ltd is a sports science and analytics company offering technologies to enhance athlete performance, prevent injuries, and aid recovery for teams and athletes globally, with a market cap of A$913.48 million.

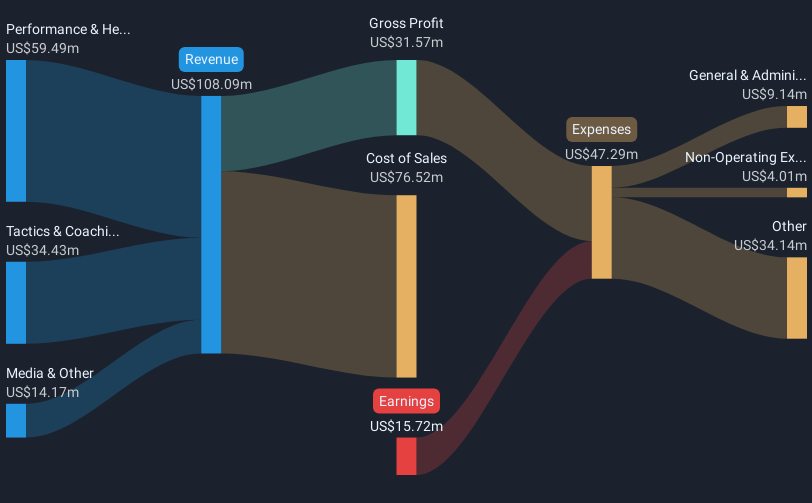

Operations: The company generates revenue through three main segments: Performance & Health ($59.49 million), Tactics & Coaching ($34.43 million), and Media & Other ($14.17 million).

Market Cap: A$913.48M

Catapult Group International Ltd, with a market cap of A$913.48 million, focuses on sports analytics and technology but remains unprofitable, with increasing losses over the past five years at 20.4% annually. Despite this, it has a sufficient cash runway for over three years due to positive free cash flow and more cash than total debt. Revenue is forecast to grow by 14.77% per year across its segments: Performance & Health (A$59.49 million), Tactics & Coaching (A$34.43 million), and Media & Other (A$14.17 million). The management team and board are experienced, aiding in strategic stability despite financial challenges.

- Get an in-depth perspective on Catapult Group International's performance by reading our balance sheet health report here.

- Review our growth performance report to gain insights into Catapult Group International's future.

Nanosonics (ASX:NAN)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Nanosonics Limited is a global infection prevention company with a market cap of A$1.35 billion.

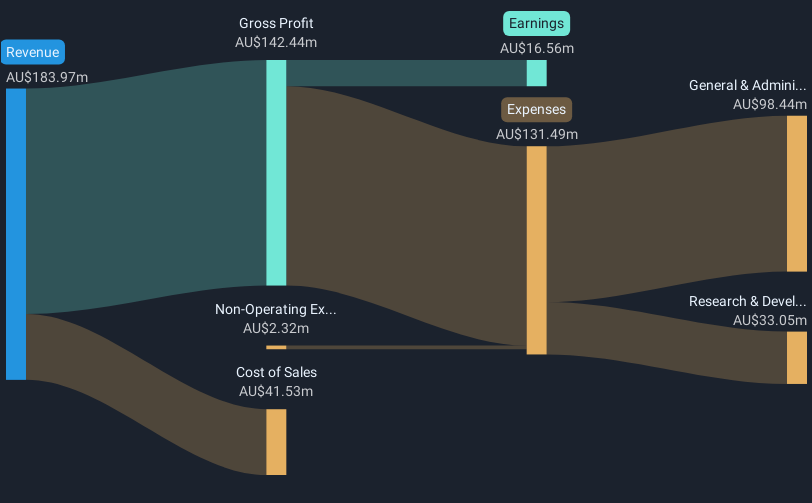

Operations: The company generates revenue of A$183.97 million from its Healthcare Equipment segment.

Market Cap: A$1.35B

Nanosonics Limited, with a market cap of A$1.35 billion, reported half-year sales of A$93.6 million and net income of A$9.76 million, showing growth compared to the previous year. Despite earnings growth lagging behind the industry average, the company has no debt and strong short-term assets exceeding liabilities. Revenue guidance was revised upwards for early 2025, indicating confidence in future performance. The board and management team are experienced, supported by recent strategic appointments like Gerard Dalbosco as an Independent Non-Executive Director. Nanosonics trades below its estimated fair value but maintains high-quality earnings with stable weekly volatility.

- Click here to discover the nuances of Nanosonics with our detailed analytical financial health report.

- Explore Nanosonics' analyst forecasts in our growth report.

Seize The Opportunity

- Navigate through the entire inventory of 982 ASX Penny Stocks here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:ANG

Austin Engineering

Manufactures, repairs, overhauls, and supplies mining attachment products, and other related products and services for the industrial and resources-related business sectors.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives