When AJ Lucas Group Limited (ASX:AJL) reported its results to June 2021 its auditors, Ernst & Young LLP could not be sure that it would be able to continue as a going concern in the next year. Thus we can say that, based on the results to that date, the company should raise capital or otherwise raise cash, without much delay.

Given its situation, it may not be in a good position to raise capital on favorable terms. So shareholders should absolutely be taking a close look at how risky the balance sheet is. The big consideration is whether it can repay its debt, since in the worst case scenario, creditors could force the company to bankruptcy.

See our latest analysis for AJ Lucas Group

What Is AJ Lucas Group's Debt?

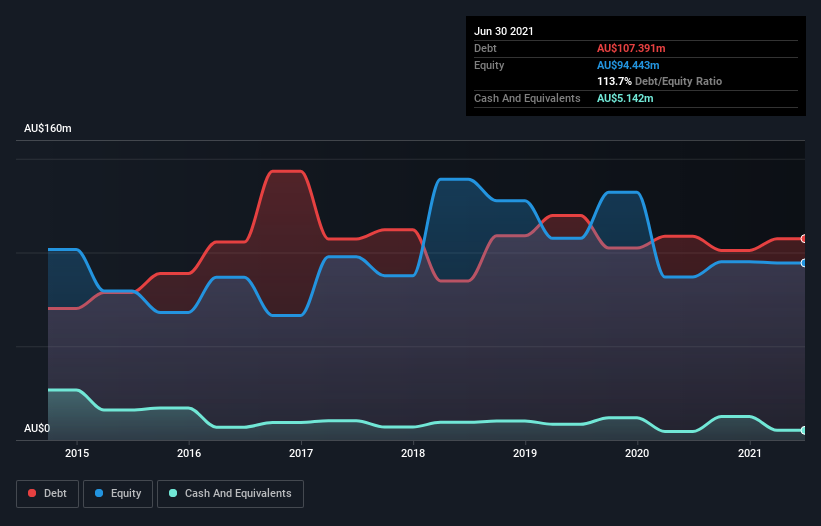

The chart below, which you can click on for greater detail, shows that AJ Lucas Group had AU$107.4m in debt in June 2021; about the same as the year before. However, it also had AU$5.14m in cash, and so its net debt is AU$102.2m.

How Healthy Is AJ Lucas Group's Balance Sheet?

We can see from the most recent balance sheet that AJ Lucas Group had liabilities of AU$59.2m falling due within a year, and liabilities of AU$78.3m due beyond that. Offsetting these obligations, it had cash of AU$5.14m as well as receivables valued at AU$19.4m due within 12 months. So its liabilities outweigh the sum of its cash and (near-term) receivables by AU$113.0m.

The deficiency here weighs heavily on the AU$37.1m company itself, as if a child were struggling under the weight of an enormous back-pack full of books, his sports gear, and a trumpet. So we'd watch its balance sheet closely, without a doubt. After all, AJ Lucas Group would likely require a major re-capitalisation if it had to pay its creditors today.

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). This way, we consider both the absolute quantum of the debt, as well as the interest rates paid on it.

While AJ Lucas Group's debt to EBITDA ratio (4.9) suggests that it uses some debt, its interest cover is very weak, at 1.0, suggesting high leverage. So shareholders should probably be aware that interest expenses appear to have really impacted the business lately. Another concern for investors might be that AJ Lucas Group's EBIT fell 17% in the last year. If things keep going like that, handling the debt will about as easy as bundling an angry house cat into its travel box. When analysing debt levels, the balance sheet is the obvious place to start. But you can't view debt in total isolation; since AJ Lucas Group will need earnings to service that debt. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. So we clearly need to look at whether that EBIT is leading to corresponding free cash flow. In the last three years, AJ Lucas Group created free cash flow amounting to 3.3% of its EBIT, an uninspiring performance. That limp level of cash conversion undermines its ability to manage and pay down debt.

Our View

To be frank both AJ Lucas Group's interest cover and its track record of staying on top of its total liabilities make us rather uncomfortable with its debt levels. And furthermore, its net debt to EBITDA also fails to instill confidence. Considering all the factors previously mentioned, we think that AJ Lucas Group really is carrying too much debt. To us, that makes the stock rather risky, like walking through a dog park with your eyes closed. But some investors may feel differently. While some investors may specialize in these sort of situations, it's simply too risky and complicated for us to want to invest in a company after an auditor has expressed doubts about its ability to continue as a going concern. We prefer to invest in companies that ensure the balance sheet remains healthier than that. The balance sheet is clearly the area to focus on when you are analysing debt. However, not all investment risk resides within the balance sheet - far from it. Be aware that AJ Lucas Group is showing 3 warning signs in our investment analysis , and 1 of those makes us a bit uncomfortable...

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

If you decide to trade AJ Lucas Group, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About ASX:AJL

Slight risk and slightly overvalued.

Similar Companies

Market Insights

Community Narratives