This article will reflect on the compensation paid to Melos Sulicich who has served as CEO of MyState Limited (ASX:MYS) since 2014. This analysis will also assess whether MyState pays its CEO appropriately, considering recent earnings growth and total shareholder returns.

Check out our latest analysis for MyState

Comparing MyState Limited's CEO Compensation With the industry

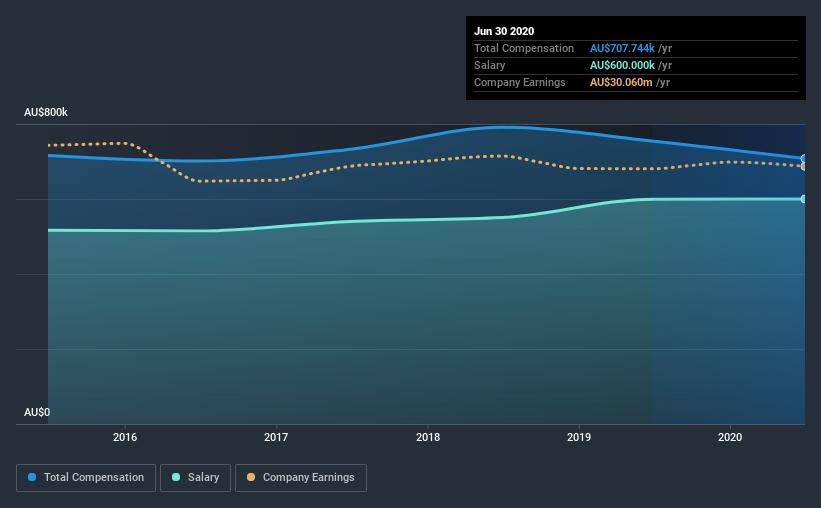

At the time of writing, our data shows that MyState Limited has a market capitalization of AU$479m, and reported total annual CEO compensation of AU$708k for the year to June 2020. We note that's a small decrease of 6.2% on last year. We note that the salary portion, which stands at AU$600.0k constitutes the majority of total compensation received by the CEO.

On examining similar-sized companies in the industry with market capitalizations between AU$259m and AU$1.0b, we discovered that the median CEO total compensation of that group was AU$1.2m. In other words, MyState pays its CEO lower than the industry median. What's more, Melos Sulicich holds AU$651k worth of shares in the company in their own name.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | AU$600k | AU$600k | 85% |

| Other | AU$108k | AU$155k | 15% |

| Total Compensation | AU$708k | AU$754k | 100% |

On an industry level, roughly 78% of total compensation represents salary and 22% is other remuneration. MyState is largely mirroring the industry average when it comes to the share a salary enjoys in overall compensation. If salary is the major component in total compensation, it suggests that the CEO receives a higher fixed proportion of the total compensation, regardless of performance.

MyState Limited's Growth

Over the last three years, MyState Limited has shrunk its earnings per share by 1.2% per year. It achieved revenue growth of 2.7% over the last year.

A lack of EPS improvement is not good to see. The fairly low revenue growth fails to impress given that the EPS is down. It's hard to argue the company is firing on all cylinders, so shareholders might be averse to high CEO remuneration. Moving away from current form for a second, it could be important to check this free visual depiction of what analysts expect for the future.

Has MyState Limited Been A Good Investment?

MyState Limited has generated a total shareholder return of 21% over three years, so most shareholders would be reasonably content. But they probably wouldn't be so happy as to think the CEO should be paid more than is normal, for companies around this size.

To Conclude...

As previously discussed, Melos is compensated less than what is normal for CEOs of companies of similar size, and which belong to the same industry. While we have not been overly impressed by shareholder returns, EPS growth has been negative over the last three years, a real headache for the company. It's tough for us to say that Melos is earning a high compensation, but any bump in pay is unlikely at this stage since shareholders will likely hold off support until performance improves.

We can learn a lot about a company by studying its CEO compensation trends, along with looking at other aspects of the business. We did our research and identified 2 warning signs (and 1 which is potentially serious) in MyState we think you should know about.

Switching gears from MyState, if you're hunting for a pristine balance sheet and premium returns, this free list of high return, low debt companies is a great place to look.

If you decide to trade MyState, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About ASX:MYS

MyState

Through its subsidiaries, provides banking, trustee, and managed fund products and services in Australia.

Excellent balance sheet with moderate growth potential.