As the Australian market navigates a period of uncertainty, with fluctuating ASX 200 futures and mixed signals from both local and international economic indicators, investors are on the lookout for opportunities that can offer stability amid volatility. Penny stocks, though an older term, remain relevant as they highlight smaller or emerging companies that might provide significant value at lower entry points. By focusing on those with strong financials and growth potential, investors can uncover hidden gems in this often-overlooked segment of the market.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Financial Health Rating |

| Embark Early Education (ASX:EVO) | A$0.79 | A$144.95M | ★★★★☆☆ |

| EZZ Life Science Holdings (ASX:EZZ) | A$1.97 | A$92.93M | ★★★★★★ |

| LaserBond (ASX:LBL) | A$0.58 | A$67.47M | ★★★★★★ |

| SHAPE Australia (ASX:SHA) | A$2.99 | A$250.39M | ★★★★★★ |

| Austin Engineering (ASX:ANG) | A$0.485 | A$300.77M | ★★★★★☆ |

| IVE Group (ASX:IGL) | A$2.22 | A$346.95M | ★★★★☆☆ |

| Helloworld Travel (ASX:HLO) | A$2.08 | A$340.29M | ★★★★★★ |

| MaxiPARTS (ASX:MXI) | A$1.81 | A$101.78M | ★★★★★★ |

| GTN (ASX:GTN) | A$0.55 | A$108.01M | ★★★★★★ |

| SKS Technologies Group (ASX:SKS) | A$2.11 | A$226.38M | ★★★★★★ |

Click here to see the full list of 1,033 stocks from our ASX Penny Stocks screener.

Let's dive into some prime choices out of the screener.

AXP Energy (ASX:AXP)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: AXP Energy Limited is an oil and gas production and development company operating in the United States with a market cap of A$11.65 million.

Operations: AXP Energy's revenue is primarily generated from its operations in the Denver-Julesburg Basin, amounting to $0.64 million.

Market Cap: A$11.65M

AXP Energy Limited, with a market cap of A$11.65 million, is navigating its pre-revenue phase while leveraging strategic partnerships to unlock potential value from its assets. The company recently executed a Joint Development Agreement with Blackhart Technologies to utilize stranded natural gas for off-grid power generation and data processing operations at its Pathfinder Field in Colorado. This initiative aligns with AXP's strategy to capitalize on innovative gas-to-power solutions. Despite high volatility and limited revenue of US$0.64 million, the experienced management team and recent capital raise provide some stability as they pursue growth opportunities in the U.S. market.

- Navigate through the intricacies of AXP Energy with our comprehensive balance sheet health report here.

- Gain insights into AXP Energy's past trends and performance with our report on the company's historical track record.

EVZ (ASX:EVZ)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: EVZ Limited, with a market cap of A$21.85 million, operates in the engineering services sectors across Australia and Asia through its subsidiaries.

Operations: The company's revenue is derived from its Building Products segment, contributing A$38.96 million, and its Energy and Resources segment, generating A$79.96 million.

Market Cap: A$21.85M

EVZ Limited, with a market cap of A$21.85 million, has shown promising earnings growth of 47.9% over the past year, surpassing the construction industry's average. The company's revenue streams from its Building Products and Energy and Resources segments are robust, contributing A$38.96 million and A$79.96 million respectively. EVZ's financial health is supported by high-quality earnings and a strong balance sheet with short-term assets exceeding both short- and long-term liabilities. Additionally, its debt-free status enhances financial flexibility while maintaining shareholder value as no significant dilution occurred recently despite low return on equity at 6.5%.

- Get an in-depth perspective on EVZ's performance by reading our balance sheet health report here.

- Explore historical data to track EVZ's performance over time in our past results report.

Judo Capital Holdings (ASX:JDO)

Simply Wall St Financial Health Rating: ★★★★☆☆

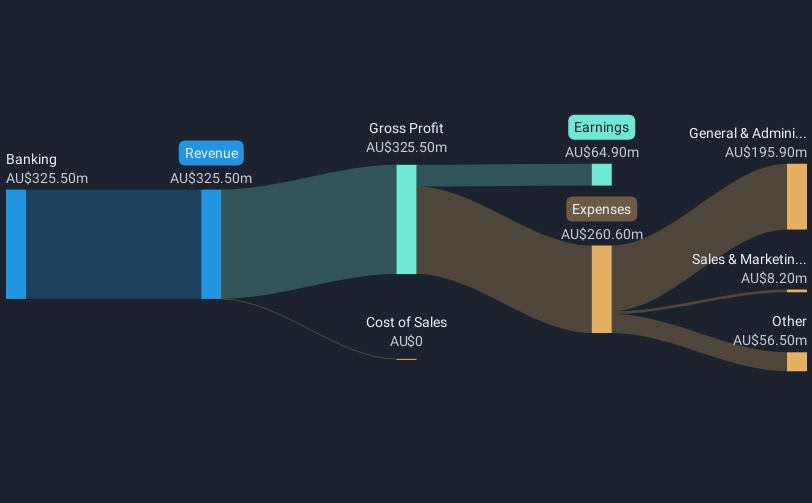

Overview: Judo Capital Holdings Limited, with a market cap of A$2.16 billion, provides a range of banking products and services specifically tailored for small and medium businesses in Australia through its subsidiaries.

Operations: Judo Capital Holdings Limited does not report specific revenue segments.

Market Cap: A$2.16B

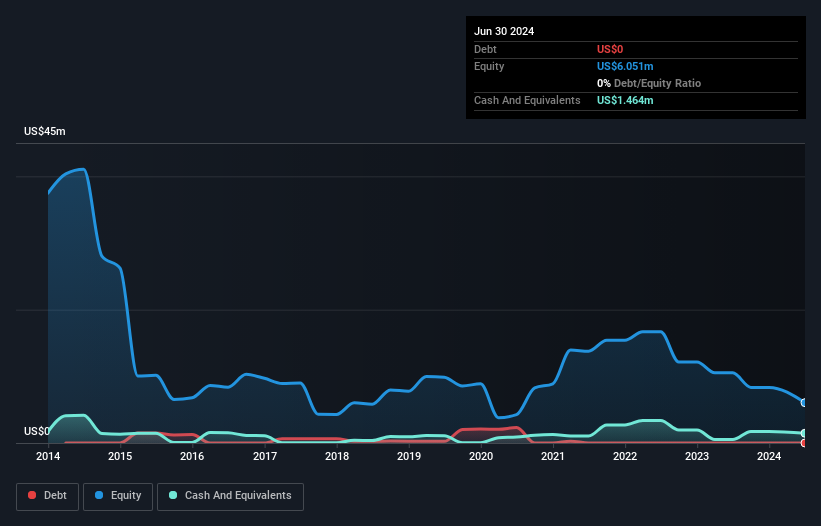

Judo Capital Holdings, with a market cap of A$2.16 billion, has faced challenges with negative earnings growth of -22% over the past year and declining net profit margins from 25.3% to 19.9%. Despite these setbacks, the company maintains an appropriate loans to deposits ratio at 118%, while its management and board are experienced with average tenures of three years or more. The recent appointment of Brad Cooper as an Independent Non-Executive Director brings additional strategic leadership experience. Judo's liabilities are primarily low-risk, supported by customer deposits, though it contends with a high level of bad loans at 2.8%.

- Dive into the specifics of Judo Capital Holdings here with our thorough balance sheet health report.

- Assess Judo Capital Holdings' future earnings estimates with our detailed growth reports.

Key Takeaways

- Explore the 1,033 names from our ASX Penny Stocks screener here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:JDO

Judo Capital Holdings

Through its subsidiaries, engages in the provision of various banking products and services for small and medium businesses in Australia.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives