How Investors Are Reacting To Commonwealth Bank of Australia (ASX:CBA) Amid Union Action Over Offshoring

Reviewed by Simply Wall St

- Earlier this week, the Finance Sector Union lodged formal action against Commonwealth Bank of Australia at the Fair Work Commission, alleging the bank breached its enterprise agreement by offshoring hundreds of Australian jobs to its Indian subsidiary.

- This development highlights increasing scrutiny over local job security and business practices, prompting public debate about the responsibilities of major financial institutions.

- We'll assess how union action and concerns over offshoring may influence the Commonwealth Bank's investment narrative and future risk profile.

Commonwealth Bank of Australia Investment Narrative Recap

To own shares in Commonwealth Bank of Australia (CBA), investors generally need confidence in the bank's balance sheet strength, technology investments, and ability to maintain strong customer satisfaction amid evolving industry risks. The recent union action alleging offshoring of jobs brings fresh regulatory and reputational focus, but its immediate impact on the most important short-term catalyst, continued earnings and dividend stability, appears limited, while the biggest current risk remains rising costs from technology investment relative to short-term revenue growth.

Among recent developments, CBA's half-year results stand out, with net income reaching A$5,134 million and a dividend hike reflecting confidence in its earnings capacity. Although these results reinforce the bank’s resilience as a major catalyst, ongoing scrutiny over workforce changes and operational practices may influence longer-term risk considerations as regulatory and public expectations evolve.

In contrast, regulatory and reputational risks tied to employment practices are factors investors should not overlook, as they...

Read the full narrative on Commonwealth Bank of Australia (it's free!)

Commonwealth Bank of Australia's narrative projects A$31.3 billion revenue and A$10.9 billion earnings by 2028. This requires 5.4% yearly revenue growth and a A$1.1 billion earnings increase from A$9.8 billion today.

Exploring Other Perspectives

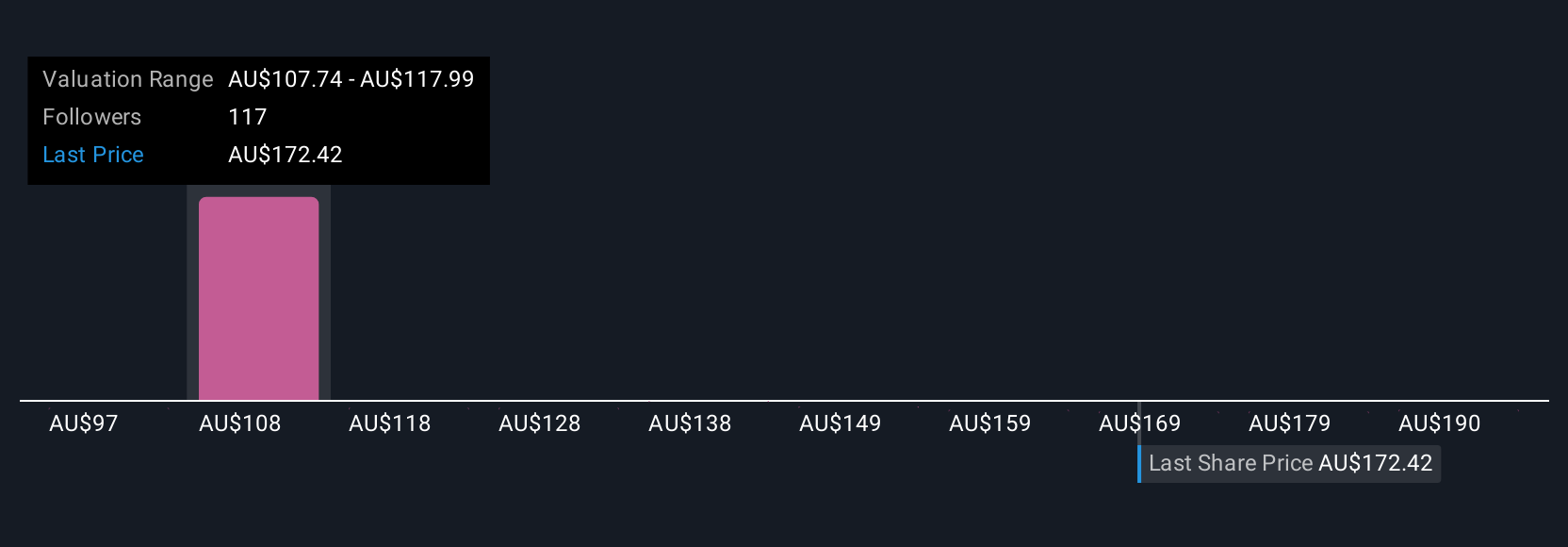

Seventeen members of the Simply Wall St Community have provided fair value estimates for CBA, ranging widely from A$97.49 to A$200 per share. While opinions differ, many are weighing cost pressures from ongoing technology upgrades and operational shifts that could affect future profits, inviting you to weigh alternative views.

Build Your Own Commonwealth Bank of Australia Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Commonwealth Bank of Australia research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Commonwealth Bank of Australia research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Commonwealth Bank of Australia's overall financial health at a glance.

No Opportunity In Commonwealth Bank of Australia?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- These 17 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Outshine the giants: these 19 early-stage AI stocks could fund your retirement.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:CBA

Commonwealth Bank of Australia

Provides retail and commercial banking services in Australia, New Zealand, and internationally.

Excellent balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives