Does Auswide Bank's (ASX:ABA) CEO Salary Compare Well With Industry Peers?

Martin Barrett became the CEO of Auswide Bank Ltd (ASX:ABA) in 2013, and we think it's a good time to look at the executive's compensation against the backdrop of overall company performance. This analysis will also evaluate the appropriateness of CEO compensation when taking into account the earnings and shareholder returns of the company.

See our latest analysis for Auswide Bank

Comparing Auswide Bank Ltd's CEO Compensation With the industry

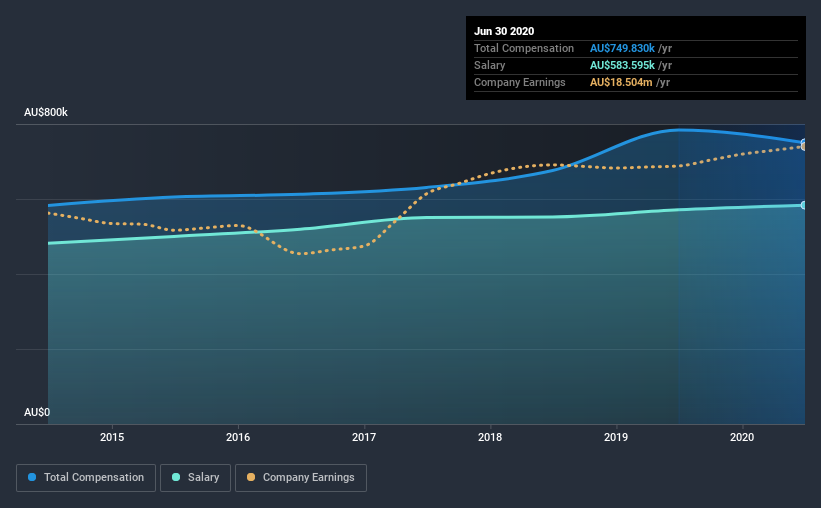

Our data indicates that Auswide Bank Ltd has a market capitalization of AU$267m, and total annual CEO compensation was reported as AU$750k for the year to June 2020. That's a slight decrease of 4.4% on the prior year. In particular, the salary of AU$583.6k, makes up a huge portion of the total compensation being paid to the CEO.

On examining similar-sized companies in the industry with market capitalizations between AU$130m and AU$520m, we discovered that the median CEO total compensation of that group was AU$1.0m. So it looks like Auswide Bank compensates Martin Barrett in line with the median for the industry. Moreover, Martin Barrett also holds AU$1.3m worth of Auswide Bank stock directly under their own name.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | AU$584k | AU$571k | 78% |

| Other | AU$166k | AU$213k | 22% |

| Total Compensation | AU$750k | AU$784k | 100% |

Talking in terms of the industry, salary represented approximately 78% of total compensation out of all the companies we analyzed, while other remuneration made up 22% of the pie. Although there is a difference in how total compensation is set, Auswide Bank more or less reflects the market in terms of setting the salary. If total compensation veers towards salary, it suggests that the variable portion - which is generally tied to performance, is lower.

Auswide Bank Ltd's Growth

Over the past three years, Auswide Bank Ltd has seen its earnings per share (EPS) grow by 5.0% per year. Its revenue is up 7.1% over the last year.

We would argue that the improvement in revenue is good, but isn't particularly impressive, but the modest improvement in EPS is good. Considering these factors we'd say performance has been pretty decent, though not amazing. Moving away from current form for a second, it could be important to check this free visual depiction of what analysts expect for the future.

Has Auswide Bank Ltd Been A Good Investment?

Most shareholders would probably be pleased with Auswide Bank Ltd for providing a total return of 37% over three years. This strong performance might mean some shareholders don't mind if the CEO were to be paid more than is normal for a company of its size.

In Summary...

As we noted earlier, Auswide Bank pays its CEO in line with similar-sized companies belonging to the same industry. But the business isn't reporting great numbers in terms of EPS growth. At the same time, shareholder returns have remained strong over the same period. We would like to see EPS growth from the business, although we wouldn't say the CEO compensation is high.

While it is important to pay attention to CEO remuneration, investors should also consider other elements of the business. We did our research and spotted 1 warning sign for Auswide Bank that investors should look into moving forward.

Switching gears from Auswide Bank, if you're hunting for a pristine balance sheet and premium returns, this free list of high return, low debt companies is a great place to look.

If you decide to trade Auswide Bank, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

If you're looking to trade Auswide Bank, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About ASX:ABA

Auswide Bank

Provides various personal and business banking products and services in Australia.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives