Investors Still Aren't Entirely Convinced By AT & S Austria Technologie & Systemtechnik Aktiengesellschaft's (VIE:ATS) Revenues Despite 40% Price Jump

AT & S Austria Technologie & Systemtechnik Aktiengesellschaft (VIE:ATS) shareholders would be excited to see that the share price has had a great month, posting a 40% gain and recovering from prior weakness. Looking back a bit further, it's encouraging to see the stock is up 40% in the last year.

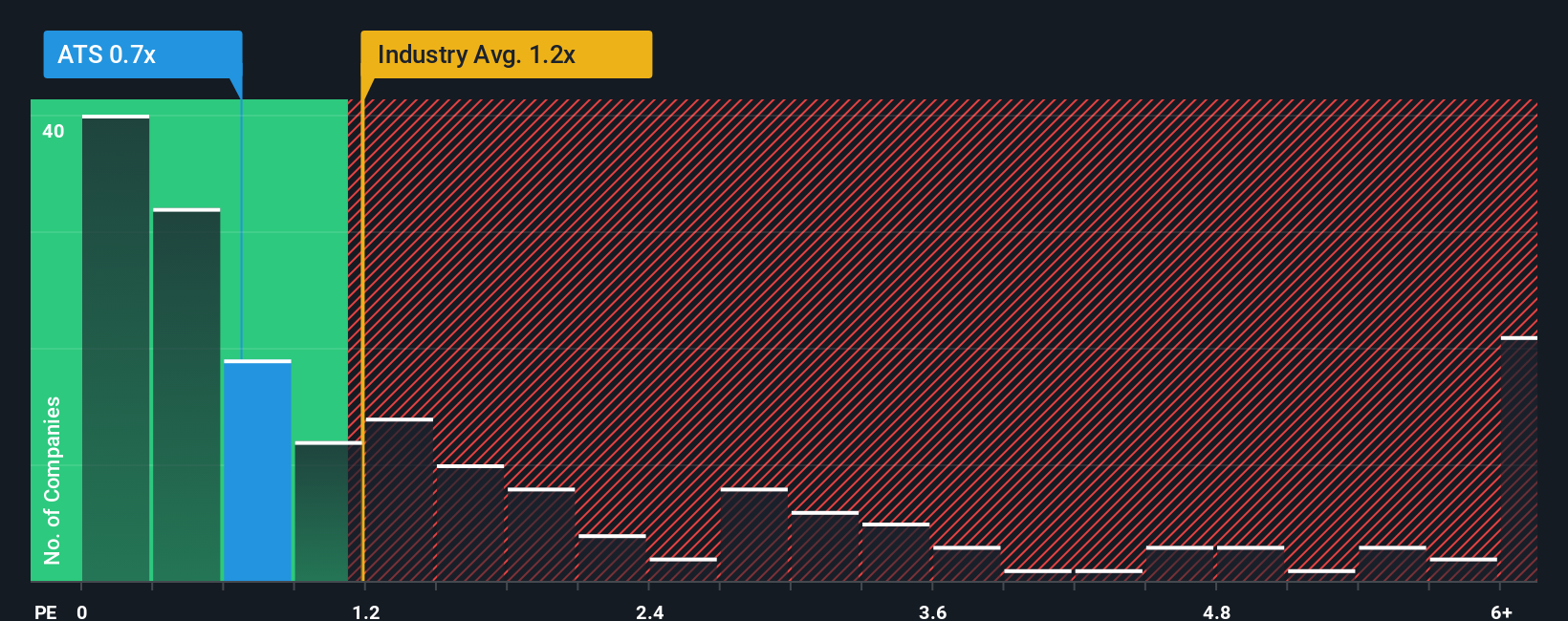

Although its price has surged higher, when close to half the companies operating in Austria's Electronic industry have price-to-sales ratios (or "P/S") above 1.2x, you may still consider AT & S Austria Technologie & Systemtechnik as an enticing stock to check out with its 0.7x P/S ratio. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for AT & S Austria Technologie & Systemtechnik

What Does AT & S Austria Technologie & Systemtechnik's Recent Performance Look Like?

There hasn't been much to differentiate AT & S Austria Technologie & Systemtechnik's and the industry's revenue growth lately. One possibility is that the P/S ratio is low because investors think this modest revenue performance may begin to slide. If not, then existing shareholders have reason to be optimistic about the future direction of the share price.

Keen to find out how analysts think AT & S Austria Technologie & Systemtechnik's future stacks up against the industry? In that case, our free report is a great place to start.What Are Revenue Growth Metrics Telling Us About The Low P/S?

There's an inherent assumption that a company should underperform the industry for P/S ratios like AT & S Austria Technologie & Systemtechnik's to be considered reasonable.

If we review the last year of revenue growth, the company posted a worthy increase of 6.6%. However, this wasn't enough as the latest three year period has seen an unpleasant 7.6% overall drop in revenue. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Turning to the outlook, the next year should generate growth of 11% as estimated by the four analysts watching the company. Meanwhile, the rest of the industry is forecast to only expand by 9.3%, which is noticeably less attractive.

With this in consideration, we find it intriguing that AT & S Austria Technologie & Systemtechnik's P/S sits behind most of its industry peers. It looks like most investors are not convinced at all that the company can achieve future growth expectations.

What Does AT & S Austria Technologie & Systemtechnik's P/S Mean For Investors?

The latest share price surge wasn't enough to lift AT & S Austria Technologie & Systemtechnik's P/S close to the industry median. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

AT & S Austria Technologie & Systemtechnik's analyst forecasts revealed that its superior revenue outlook isn't contributing to its P/S anywhere near as much as we would have predicted. The reason for this depressed P/S could potentially be found in the risks the market is pricing in. It appears the market could be anticipating revenue instability, because these conditions should normally provide a boost to the share price.

Having said that, be aware AT & S Austria Technologie & Systemtechnik is showing 2 warning signs in our investment analysis, you should know about.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About WBAG:ATS

AT & S Austria Technologie & Systemtechnik

Manufactures, distributes, and sells printed circuit boards in Austria, Germany, rest of Europe, China, rest of Asia, and the Americas.

Undervalued with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Butler National (Buks) outperforms.

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)