- Austria

- /

- Energy Services

- /

- WBAG:SBO

3 Stocks Estimated To Be Up To 47.3% Below Intrinsic Value

Reviewed by Simply Wall St

As global markets experience a rebound, driven by easing core inflation in the U.S. and strong bank earnings, investors are increasingly focused on value stocks, which have outperformed growth shares recently. In this environment of cautious optimism and potential rate cuts on the horizon, identifying undervalued stocks becomes crucial for those seeking to capitalize on market opportunities.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Avant Group (TSE:3836) | ¥1891.00 | ¥3777.22 | 49.9% |

| Atlantic Union Bankshares (NYSE:AUB) | US$37.87 | US$75.59 | 49.9% |

| Berkshire Hills Bancorp (NYSE:BHLB) | US$28.50 | US$56.99 | 50% |

| Gaming Realms (AIM:GMR) | £0.36 | £0.72 | 49.9% |

| Equity Bancshares (NYSE:EQBK) | US$43.13 | US$86.04 | 49.9% |

| CYND (TSE:4256) | ¥1055.00 | ¥2104.74 | 49.9% |

| Greenworks (Jiangsu) (SZSE:301260) | CN¥14.00 | CN¥27.83 | 49.7% |

| QD Laser (TSE:6613) | ¥299.00 | ¥597.20 | 49.9% |

| LifeMD (NasdaqGM:LFMD) | US$4.90 | US$9.77 | 49.8% |

| Shinko Electric Industries (TSE:6967) | ¥5879.00 | ¥11701.41 | 49.8% |

Let's take a closer look at a couple of our picks from the screened companies.

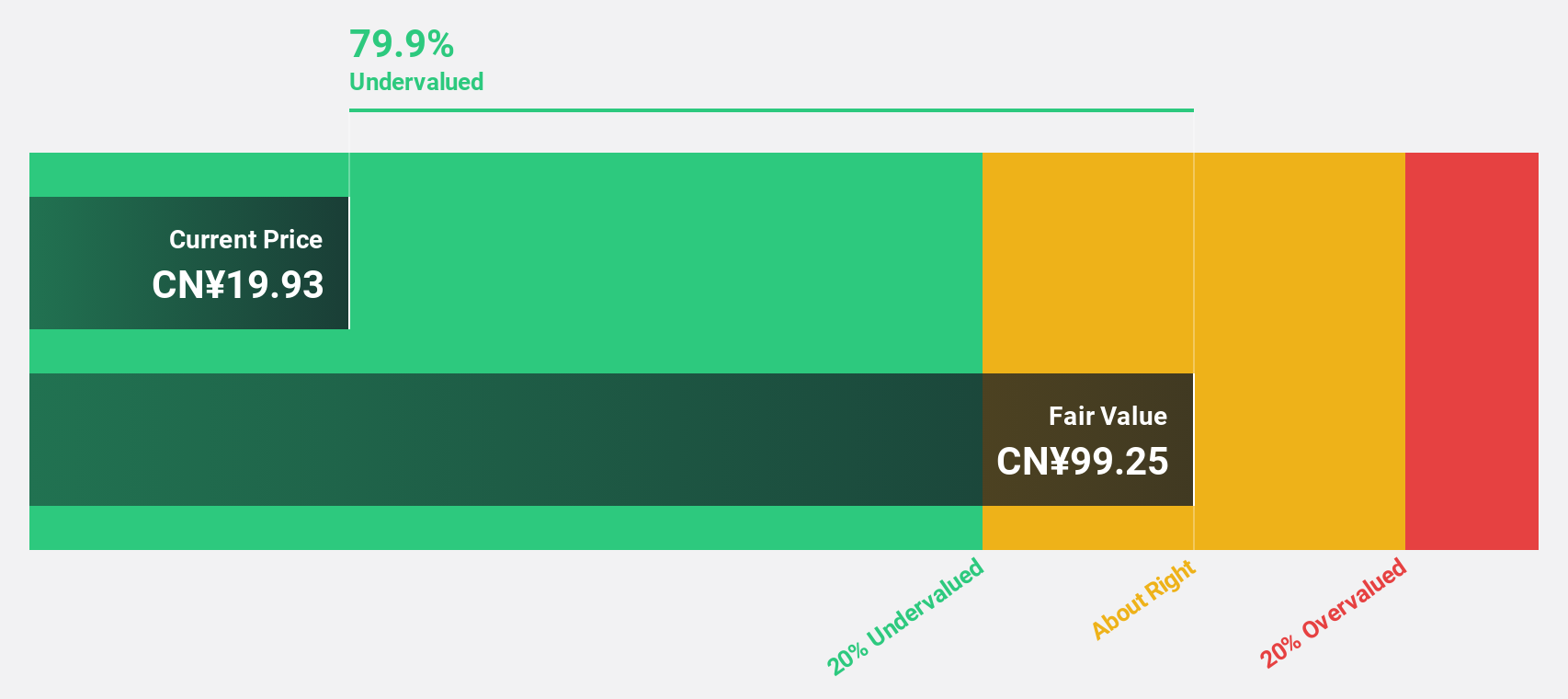

Suwen Electric Energy TechnologyLtd (SZSE:300982)

Overview: Suwen Electric Energy Technology Co., Ltd. operates in the electric energy technology sector and has a market capitalization of CN¥3.40 billion.

Operations: Suwen Electric Energy Technology Co., Ltd. generates its revenue from various segments within the electric energy technology sector.

Estimated Discount To Fair Value: 38.5%

Suwen Electric Energy Technology Ltd. is trading at CN¥17.39, significantly below its estimated fair value of CN¥28.28, indicating it may be undervalued based on cash flows. Despite a recent drop from the S&P Global BMI Index and declining earnings, revenue is forecast to grow rapidly at 34.8% annually, outpacing the market average. The company has completed a share buyback worth CN¥100.07 million, which could enhance shareholder value despite current profitability challenges.

- Our comprehensive growth report raises the possibility that Suwen Electric Energy TechnologyLtd is poised for substantial financial growth.

- Click to explore a detailed breakdown of our findings in Suwen Electric Energy TechnologyLtd's balance sheet health report.

Rakus (TSE:3923)

Overview: Rakus Co., Ltd., along with its subsidiaries, offers cloud services in Japan and has a market cap of ¥318.41 billion.

Operations: The company generates revenue through its Cloud Business, which accounts for ¥37.28 billion, and its IT Outsourcing Business, contributing ¥6.49 billion.

Estimated Discount To Fair Value: 13.8%

Rakus Co., Ltd. is trading at ¥1,789.5, below its estimated fair value of ¥2,075.25, suggesting potential undervaluation based on cash flows. Earnings are projected to grow significantly at 25.6% annually over the next three years, surpassing market averages. Recent strategic expansion into Indonesia aims to leverage regional talent for cloud services development, potentially enhancing future growth prospects despite current valuation challenges and modest revenue growth forecasts of 16.7% per year.

- Our earnings growth report unveils the potential for significant increases in Rakus' future results.

- Unlock comprehensive insights into our analysis of Rakus stock in this financial health report.

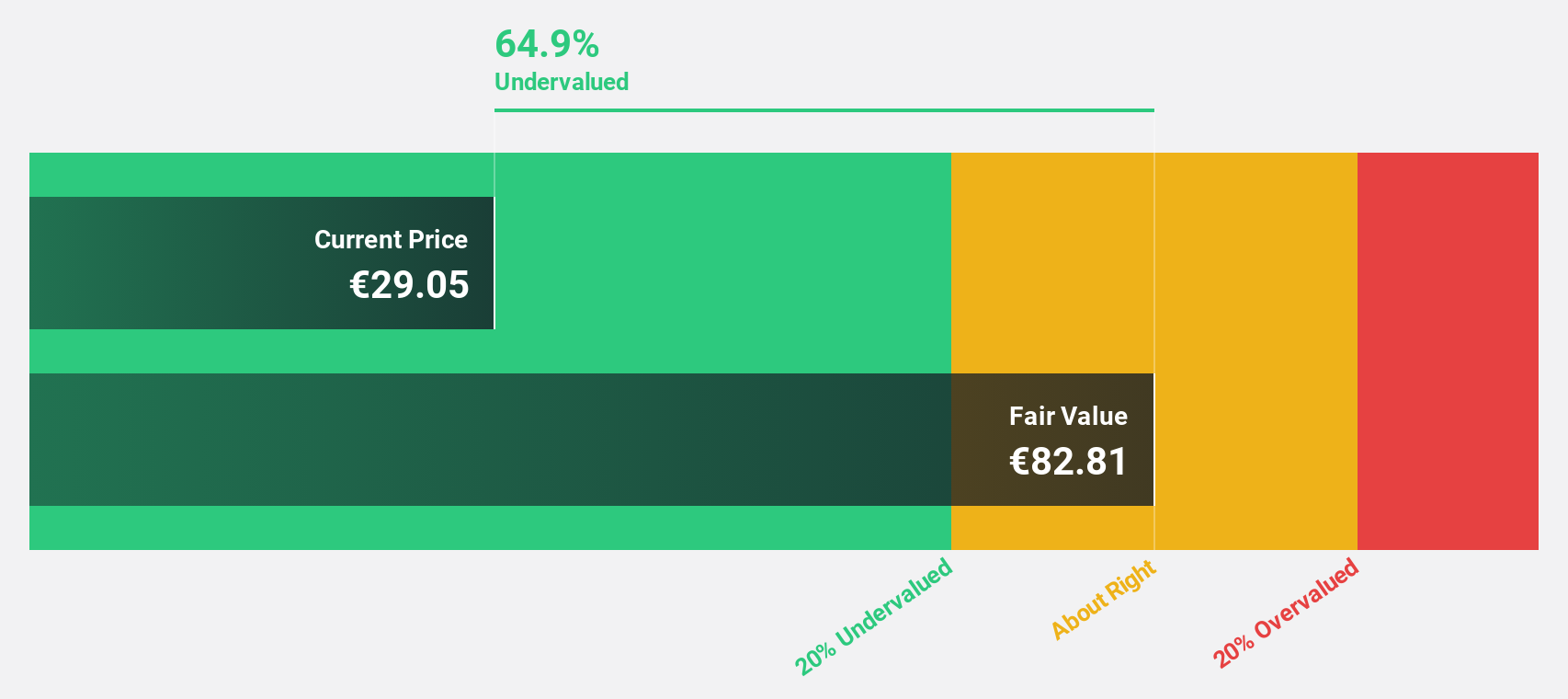

Schoeller-Bleckmann Oilfield Equipment (WBAG:SBO)

Overview: Schoeller-Bleckmann Oilfield Equipment Aktiengesellschaft manufactures and sells steel products globally, with a market cap of €536.61 million.

Operations: The company's revenue segments include Oilfield Equipment generating €305.97 million and Advanced Manufacturing & Services contributing €418.15 million.

Estimated Discount To Fair Value: 47.3%

Schoeller-Bleckmann Oilfield Equipment is trading at €34.05, significantly below its estimated fair value of €64.6, indicating potential undervaluation based on cash flows. Despite a decline in recent earnings and profit margins, the company's earnings are forecast to grow 20.7% annually over the next three years, outpacing the Austrian market's growth rate. However, revenue growth remains modest at 3.8% per year with a low forecasted return on equity of 14.2%.

- Our expertly prepared growth report on Schoeller-Bleckmann Oilfield Equipment implies its future financial outlook may be stronger than recent results.

- Click here and access our complete balance sheet health report to understand the dynamics of Schoeller-Bleckmann Oilfield Equipment.

Make It Happen

- Investigate our full lineup of 874 Undervalued Stocks Based On Cash Flows right here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About WBAG:SBO

Excellent balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives