- Austria

- /

- Aerospace & Defense

- /

- WBAG:FACC

Unveiling 3 European Stocks Possibly Priced Below Intrinsic Value

Reviewed by Simply Wall St

As the pan-European STOXX Europe 600 Index recently snapped a two-week losing streak, hopes of increased government spending have buoyed investor sentiment, despite ongoing concerns about U.S. tariffs. In this context of mixed market signals and cautious central bank policies, identifying stocks that may be priced below their intrinsic value involves focusing on those with strong fundamentals and potential resilience amid economic uncertainties.

Top 10 Undervalued Stocks Based On Cash Flows In Europe

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Absolent Air Care Group (OM:ABSO) | SEK260.00 | SEK511.61 | 49.2% |

| Somec (BIT:SOM) | €10.30 | €20.55 | 49.9% |

| Romsdal Sparebank (OB:ROMSB) | NOK130.30 | NOK259.95 | 49.9% |

| Vimi Fasteners (BIT:VIM) | €0.97 | €1.91 | 49.2% |

| Gesco (XTRA:GSC1) | €15.60 | €31.15 | 49.9% |

| Deutsche Beteiligungs (XTRA:DBAN) | €26.60 | €53.06 | 49.9% |

| dormakaba Holding (SWX:DOKA) | CHF682.00 | CHF1357.16 | 49.7% |

| Carasent (OM:CARA) | SEK20.70 | SEK41.06 | 49.6% |

| Komplett (OB:KOMPL) | NOK11.05 | NOK21.97 | 49.7% |

| Xplora Technologies (OB:XPLRA) | NOK27.50 | NOK53.55 | 48.6% |

Here's a peek at a few of the choices from the screener.

Millenium Hospitality Real Estate SOCIMI (BME:YMHRE)

Overview: Millenium Hospitality Real Estate SOCIMI (BME:YMHRE) focuses on investing in high-quality hotel properties across prime locations, with a market cap of €289.15 million.

Operations: The company's revenue is primarily derived from hotel leases (€17.37 million) and other activities (€9.02 million).

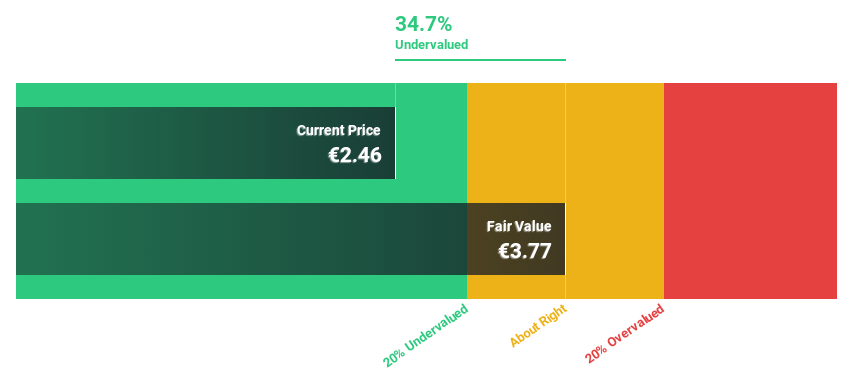

Estimated Discount To Fair Value: 34.5%

Millenium Hospitality Real Estate SOCIMI is trading at €2.5, significantly below its estimated fair value of €3.82, and 34.5% under our valuation estimate, indicating undervaluation based on cash flows. Despite a dividend yield of 4.64% not being well-covered by earnings or free cash flow, the company has recently become profitable with net income reaching €11.15 million for 2024 from a prior loss and forecasts suggest robust annual earnings growth of 27.55%.

- According our earnings growth report, there's an indication that Millenium Hospitality Real Estate SOCIMI might be ready to expand.

- Dive into the specifics of Millenium Hospitality Real Estate SOCIMI here with our thorough financial health report.

Ponsse Oyj (HLSE:PON1V)

Overview: Ponsse Oyj is a manufacturer of cut-to-length forest machines with operations in Northern, Central, and Southern Europe, as well as North and South America, and has a market cap of €778.34 million.

Operations: The company's revenue is primarily derived from its Forest Machines and Maintenance Services segment, totaling €750.43 million.

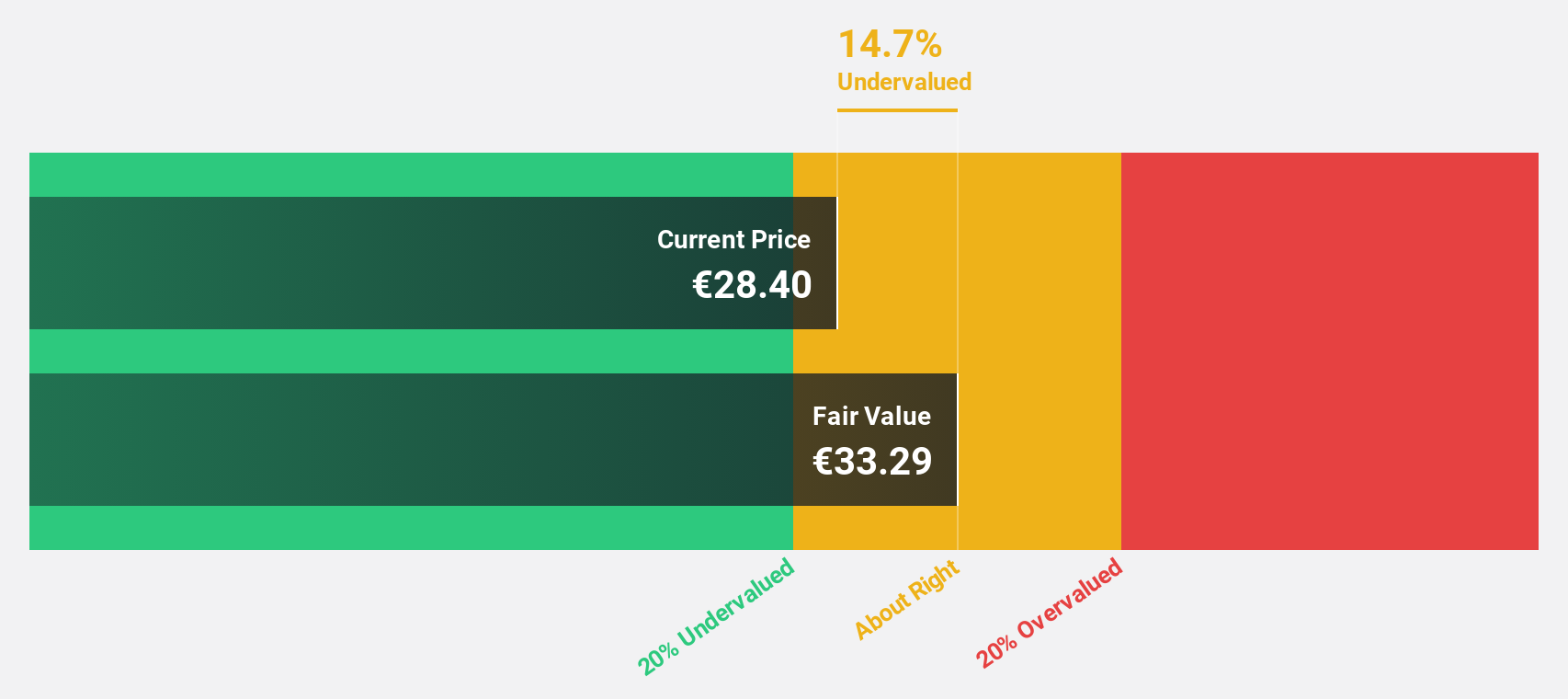

Estimated Discount To Fair Value: 24.6%

Ponsse Oyj is trading at €27.8, below its estimated fair value of €36.89, highlighting undervaluation based on cash flows. Despite a decline in full-year sales to €750.43 million from the previous year, net income for Q4 improved to €12.18 million from €7.6 million a year ago, and earnings are projected to grow significantly at 30.8% annually over the next three years, outpacing the Finnish market's growth rate of 11.6%.

- The analysis detailed in our Ponsse Oyj growth report hints at robust future financial performance.

- Click here to discover the nuances of Ponsse Oyj with our detailed financial health report.

FACC (WBAG:FACC)

Overview: FACC AG, with a market cap of €356.25 million, develops, produces, and maintains aircraft components and systems globally through its subsidiaries.

Operations: The company's revenue is derived from three main segments: Aerostructures (€332.57 million), Cabin Interiors (€374.19 million), and Engines & Nacelles (€158.24 million).

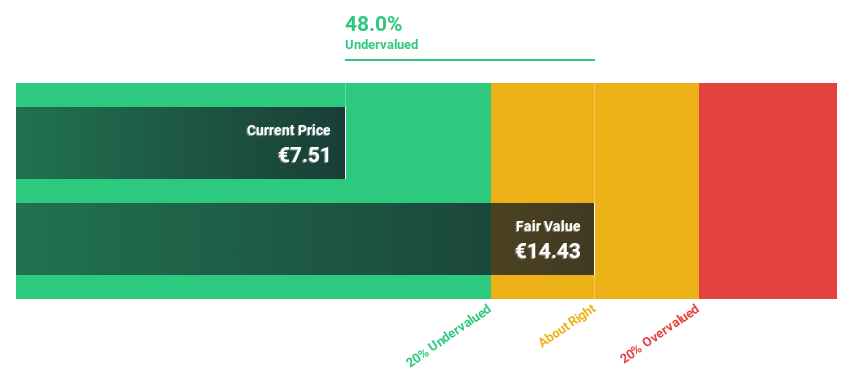

Estimated Discount To Fair Value: 47.2%

FACC is trading at €7.78, significantly below its estimated fair value of €14.73, indicating strong undervaluation based on cash flows. The company's earnings grew substantially by over 700% last year and are projected to increase by 43.25% annually, surpassing the Austrian market's growth rate of 8.9%. Despite low forecasted return on equity of 13.5%, FACC's revenue is expected to grow faster than the broader Austrian market at 7.6% per year.

- Upon reviewing our latest growth report, FACC's projected financial performance appears quite optimistic.

- Unlock comprehensive insights into our analysis of FACC stock in this financial health report.

Taking Advantage

- Unlock our comprehensive list of 209 Undervalued European Stocks Based On Cash Flows by clicking here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About WBAG:FACC

FACC

Engages in the development, production, and maintenance of aircraft components and systems worldwide.

Undervalued with solid track record.

Market Insights

Community Narratives