Valuing Raiffeisen Bank International (WBAG:RBI) After Major Leadership Changes and the Appointment of a New CFO

Reviewed by Kshitija Bhandaru

Raiffeisen Bank International (WBAG:RBI) has announced several leadership changes, including the appointment of Kamila Makhmudova as CFO effective January 2026. These Management Board adjustments may influence the company’s future direction and governance priorities.

See our latest analysis for Raiffeisen Bank International.

Behind these leadership shifts, Raiffeisen Bank International has maintained notable momentum this year, with a year-to-date share price return of 56.78% and an impressive 1-year total shareholder return of 70.62%. While fresh strategic roles and new partnerships are making headlines, investors have already seen multi-year gains. This suggests building confidence in both the company’s outlook and its execution on recent initiatives.

If this renewed momentum in the banking sector has you interested in uncovering the next strong performer, now is an opportune moment to broaden your search and discover fast growing stocks with high insider ownership

With shares up nearly 71% over the past year and the price still sitting at a premium to analyst targets, the question is whether the current optimism leaves room for further gains or if future growth is already fully priced in.

Most Popular Narrative: 5% Overvalued

The most widely followed narrative sets Raiffeisen Bank International’s fair value at €28.43, just below its last close price of €29.96. This reflects a modest premium in investor optimism. These figures hint at expert assumptions about future profits and risks, capturing diverging views on how much upside remains.

Bullish analysts have raised price targets, reflecting increased confidence in the bank's underlying business trends. Improvements in core operating performance are highlighted. Some expect consensus estimates to underestimate future earnings potential.

Want to know what’s driving this valuation call? The most surprising part of the narrative lies in bold profit forecasts and a future earnings multiple that banks rarely achieve. Wondering if margin gains and revenue projections truly justify this premium? Dive in to uncover the exact metrics that shape this standout fair value estimate.

Result: Fair Value of €28.43 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent geopolitical uncertainties and legal challenges in core markets could quickly undermine the positive outlook and prompt a reassessment of future expectations.

Find out about the key risks to this Raiffeisen Bank International narrative.

Another View: Discounted Cash Flow Suggests A Different Story

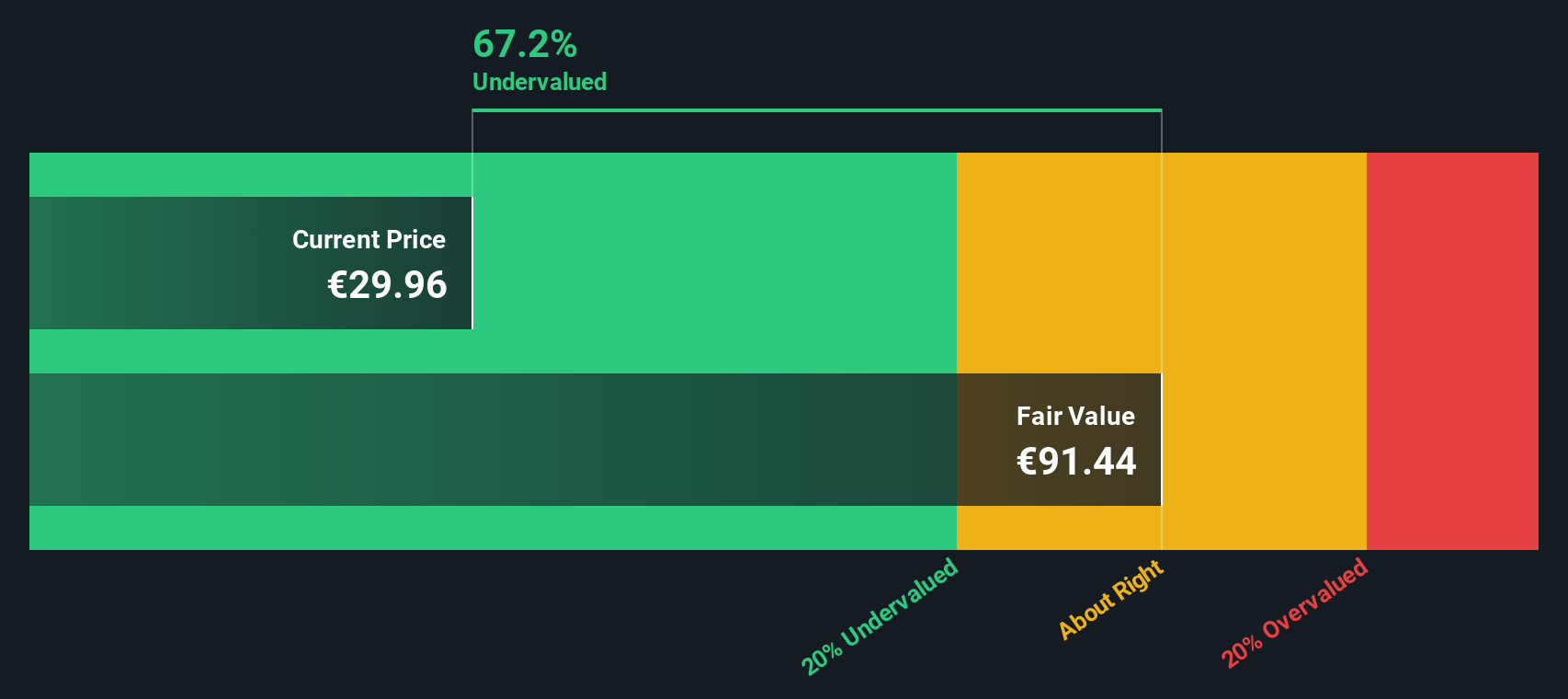

Taking a step back from analyst price targets, the SWS DCF model points to a much higher fair value for Raiffeisen Bank International, estimating it at €91.44 per share. This figure is more than triple the current market price and challenges the notion that shares are overvalued. Does this huge gap highlight an opportunity that the market is missing, or do the risks reveal why the price remains far below this estimated value?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Raiffeisen Bank International for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Raiffeisen Bank International Narrative

If you want to take a hands-on approach or see the numbers from your own angle, craft your own valuation narrative in just a few minutes. Do it your way

A great starting point for your Raiffeisen Bank International research is our analysis highlighting 2 key rewards and 6 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t let opportunity pass you by. Use these powerful tools to uncover stocks and sectors primed for tomorrow’s growth and hidden advantages, and make your next move count.

- Boost your income potential by scanning these 18 dividend stocks with yields > 3%, which consistently offer yields over 3% and reward patient investors with reliable payouts.

- Spot emerging trends and game-changing companies by reviewing these 26 quantum computing stocks, leading advancements in quantum computing and the future of technology.

- Capitalize on powerful shifts in healthcare by evaluating these 33 healthcare AI stocks, which is accelerating innovation through artificial intelligence breakthroughs in medicine.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About WBAG:RBI

Raiffeisen Bank International

Offers banking services to corporate, private, and institutional customers.

Adequate balance sheet with slight risk.

Similar Companies

Market Insights

Community Narratives