Erste Group Bank's(VIE:EBS) Share Price Is Down 28% Over The Past Three Years.

Erste Group Bank AG (VIE:EBS) shareholders should be happy to see the share price up 24% in the last month. But that cannot eclipse the less-than-impressive returns over the last three years. In fact, the share price is down 28% in the last three years, falling well short of the market return.

View our latest analysis for Erste Group Bank

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

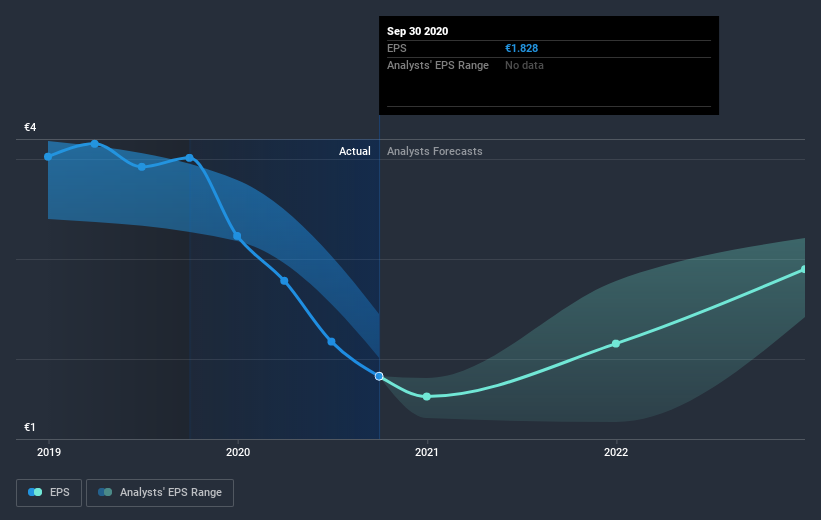

During the three years that the share price fell, Erste Group Bank's earnings per share (EPS) dropped by 9.4% each year. This change in EPS is reasonably close to the 10% average annual decrease in the share price. So it seems that investor expectations of the company are staying pretty steady, despite the disappointment. It seems like the share price is reflecting the declining earnings per share.

You can see below how EPS has changed over time (discover the exact values by clicking on the image).

It's probably worth noting that the CEO is paid less than the median at similar sized companies. It's always worth keeping an eye on CEO pay, but a more important question is whether the company will grow earnings throughout the years. It might be well worthwhile taking a look at our free report on Erste Group Bank's earnings, revenue and cash flow.

What About Dividends?

When looking at investment returns, it is important to consider the difference between total shareholder return (TSR) and share price return. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. Arguably, the TSR gives a more comprehensive picture of the return generated by a stock. As it happens, Erste Group Bank's TSR for the last 3 years was -22%, which exceeds the share price return mentioned earlier. This is largely a result of its dividend payments!

A Different Perspective

We regret to report that Erste Group Bank shareholders are down 21% for the year (even including dividends). Unfortunately, that's worse than the broader market decline of 7.9%. Having said that, it's inevitable that some stocks will be oversold in a falling market. The key is to keep your eyes on the fundamental developments. Longer term investors wouldn't be so upset, since they would have made 0.7%, each year, over five years. It could be that the recent sell-off is an opportunity, so it may be worth checking the fundamental data for signs of a long term growth trend. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. To that end, you should be aware of the 3 warning signs we've spotted with Erste Group Bank .

We will like Erste Group Bank better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on AT exchanges.

When trading Erste Group Bank or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Erste Group Bank might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About WBAG:EBS

Erste Group Bank

Provides a range of banking and other financial services to retail, corporate, and public sector customers.

Adequate balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives