Emirates Integrated Telecommunications Company PJSC (DFM:DU) Is Due To Pay A Dividend Of AED0.20

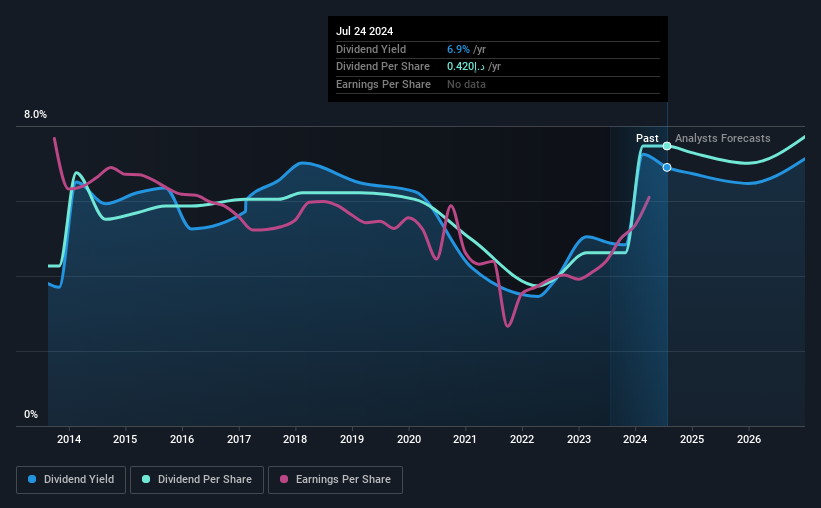

Emirates Integrated Telecommunications Company PJSC (DFM:DU) has announced that it will pay a dividend of AED0.20 per share on the 1st of January. This takes the dividend yield to 6.9%, which shareholders will be pleased with.

Check out our latest analysis for Emirates Integrated Telecommunications Company PJSC

Emirates Integrated Telecommunications Company PJSC's Dividend Is Well Covered By Earnings

We like to see robust dividend yields, but that doesn't matter if the payment isn't sustainable. The last payment made up 81% of earnings, but cash flows were much higher. In general, cash flows are more important than earnings, so we are comfortable that the dividend will be sustainable going forward, especially with so much cash left over for reinvestment.

Earnings per share is forecast to rise by 13.2% over the next year. Assuming the dividend continues along recent trends, our estimates say the payout ratio could reach 84% - on the higher side, but we wouldn't necessarily say this is unsustainable.

Dividend Volatility

The company has a long dividend track record, but it doesn't look great with cuts in the past. The dividend has gone from an annual total of AED0.24 in 2014 to the most recent total annual payment of AED0.42. This works out to be a compound annual growth rate (CAGR) of approximately 5.8% a year over that time. We have seen cuts in the past, so while the growth looks promising we would be a little bit cautious about its track record.

Emirates Integrated Telecommunications Company PJSC May Find It Hard To Grow The Dividend

Growing earnings per share could be a mitigating factor when considering the past fluctuations in the dividend. Earnings have grown at around 2.4% a year for the past five years, which isn't massive but still better than seeing them shrink. Emirates Integrated Telecommunications Company PJSC's earnings per share has barely grown, which is not ideal - perhaps this is why the company pays out the majority of its earnings to shareholders. When the rate of return on reinvestment opportunities falls below a certain minimum level, companies often elect to pay a larger dividend instead. This is why many mature companies often have larger dividend yields.

Our Thoughts On Emirates Integrated Telecommunications Company PJSC's Dividend

Overall, we always like to see the dividend being raised, but we don't think Emirates Integrated Telecommunications Company PJSC will make a great income stock. In the past, the payments have been unstable, but over the short term the dividend could be reliable, with the company generating enough cash to cover it. We don't think Emirates Integrated Telecommunications Company PJSC is a great stock to add to your portfolio if income is your focus.

Investors generally tend to favour companies with a consistent, stable dividend policy as opposed to those operating an irregular one. Meanwhile, despite the importance of dividend payments, they are not the only factors our readers should know when assessing a company. For instance, we've picked out 1 warning sign for Emirates Integrated Telecommunications Company PJSC that investors should take into consideration. If you are a dividend investor, you might also want to look at our curated list of high yield dividend stocks.

Valuation is complex, but we're here to simplify it.

Discover if Emirates Integrated Telecommunications Company PJSC might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About DFM:DU

Emirates Integrated Telecommunications Company PJSC

Provides carrier, data hub, internet exchange facilities, and satellite service primarily in the United Arab Emirates.

Outstanding track record with excellent balance sheet and pays a dividend.

Market Insights

Community Narratives