- United Arab Emirates

- /

- Real Estate

- /

- DFM:DEYAAR

What Kind Of Shareholders Own Deyaar Development PJSC (DFM:DEYAAR)?

If you want to know who really controls Deyaar Development PJSC (DFM:DEYAAR), then you'll have to look at the makeup of its share registry. Insiders often own a large chunk of younger, smaller, companies while huge companies tend to have institutions as shareholders. We also tend to see lower insider ownership in companies that were previously publicly owned.

Deyaar Development PJSC is not a large company by global standards. It has a market capitalization of د.إ1.7b, which means it wouldn't have the attention of many institutional investors. Our analysis of the ownership of the company, below, shows that institutions own shares in the company. Let's delve deeper into each type of owner, to discover more about Deyaar Development PJSC.

Check out our latest analysis for Deyaar Development PJSC

What Does The Institutional Ownership Tell Us About Deyaar Development PJSC?

Institutional investors commonly compare their own returns to the returns of a commonly followed index. So they generally do consider buying larger companies that are included in the relevant benchmark index.

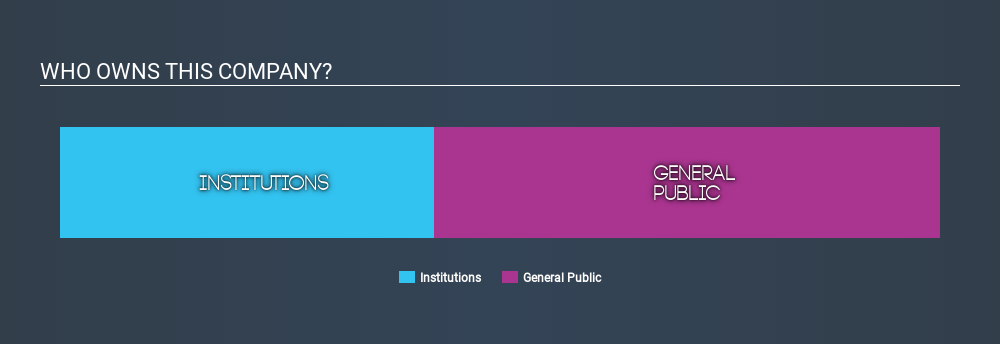

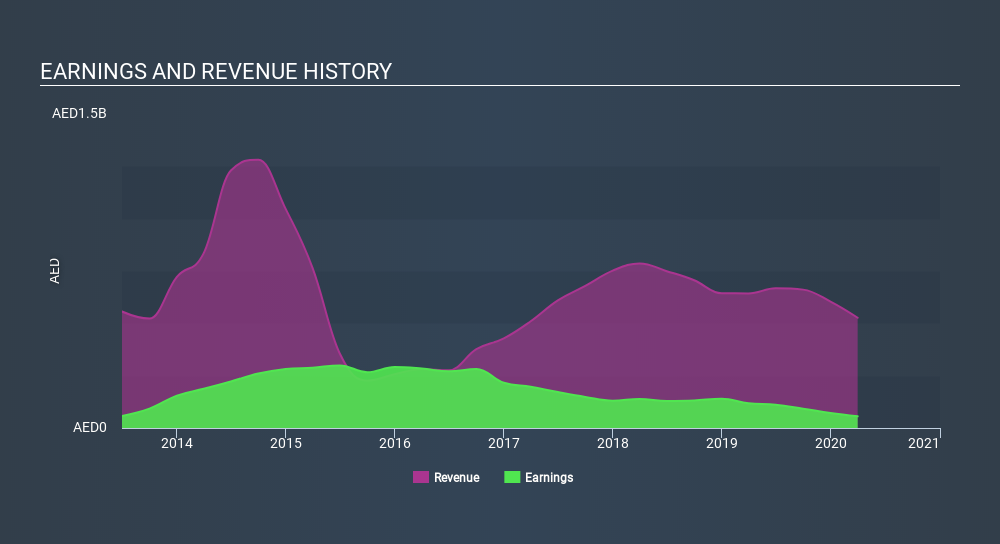

Deyaar Development PJSC already has institutions on the share registry. Indeed, they own 43% of the company. This can indicate that the company has a certain degree of credibility in the investment community. However, it is best to be wary of relying on the supposed validation that comes with institutional investors. They too, get it wrong sometimes. It is not uncommon to see a big share price drop if two large institutional investors try to sell out of a stock at the same time. So it is worth checking the past earnings trajectory of Deyaar Development PJSC, (below). Of course, keep in mind that there are other factors to consider, too.

Deyaar Development PJSC is not owned by hedge funds. Dubai Islamic Bank PJSC, Asset Management Arm is currently the largest shareholder, with 41% of shares outstanding. Next, we have The Vanguard Group, Inc. and BlackRock, Inc. as the second and third largest shareholders, holding 0.9% and 0.6%, of the shares outstanding, respectively.

On studying our ownership data, we found that 7 of the top shareholders collectively own less than 50% of the share register, implying that no single individual has a majority interest.

Researching institutional ownership is a good way to gauge and filter a stock's expected performance. The same can be achieved by studying analyst sentiments. While there is some analyst coverage, the company is probably not widely covered. So it could gain more attention, down the track.

Insider Ownership Of Deyaar Development PJSC

While the precise definition of an insider can be subjective, almost everyone considers board members to be insiders. The company management answer to the board; and the latter should represent the interests of shareholders. Notably, sometimes top-level managers are on the board, themselves.

Most consider insider ownership a positive because it can indicate the board is well aligned with other shareholders. However, on some occasions too much power is concentrated within this group.

Our data cannot confirm that board members are holding shares personally. Given we are not picking up on insider ownership, we may have missing data. Therefore, it would be interesting to assess the CEO compensation and tenure, here.

General Public Ownership

The general public, mostly retail investors, hold a substantial 57% stake in DEYAAR, suggesting it is a fairly popular stock. This level of ownership gives retail investors the power to sway key policy decisions such as board composition, executive compensation, and the dividend payout ratio.

Next Steps:

While it is well worth considering the different groups that own a company, there are other factors that are even more important. Case in point: We've spotted 2 warning signs for Deyaar Development PJSC you should be aware of.

If you would prefer discover what analysts are predicting in terms of future growth, do not miss this free report on analyst forecasts.

NB: Figures in this article are calculated using data from the last twelve months, which refer to the 12-month period ending on the last date of the month the financial statement is dated. This may not be consistent with full year annual report figures.

Love or hate this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned. Thank you for reading.

About DFM:DEYAAR

Deyaar Development PJSC

Provides property investment, development, leasing, and management services in the United Arab Emirates and internationally.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Butler National (Buks) outperforms.

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)