- United Arab Emirates

- /

- Real Estate

- /

- DFM:UPP

Discovering Opportunities: Al Khaleej Investment P.J.S.C Among 3 Middle Eastern Penny Stocks

Reviewed by Simply Wall St

The Middle Eastern stock market has been experiencing notable activity, with Dubai's main share index reaching new record highs amid a wave of business agreements and strategic advancements. This vibrant landscape provides an intriguing backdrop for exploring investment opportunities in penny stocks, which despite their somewhat outdated moniker, remain relevant for investors seeking affordability combined with growth potential. By focusing on those companies that exhibit strong financial health and promising fundamentals, investors can uncover hidden gems within this often-overlooked segment of the market.

Top 10 Penny Stocks In The Middle East

| Name | Share Price | Market Cap | Rewards & Risks |

| Thob Al Aseel (SASE:4012) | SAR4.18 | SAR1.67B | ✅ 2 ⚠️ 1 View Analysis > |

| Keir International (SASE:9542) | SAR3.95 | SAR474M | ✅ 2 ⚠️ 3 View Analysis > |

| Alarum Technologies (TASE:ALAR) | ₪3.07 | ₪215M | ✅ 4 ⚠️ 2 View Analysis > |

| Terminal X Online (TASE:TRX) | ₪4.54 | ₪576.6M | ✅ 2 ⚠️ 1 View Analysis > |

| Oil Refineries (TASE:ORL) | ₪0.912 | ₪2.84B | ✅ 1 ⚠️ 2 View Analysis > |

| Tgi Infrastructures (TASE:TGI) | ₪2.207 | ₪164.07M | ✅ 2 ⚠️ 2 View Analysis > |

| Sharjah Cement and Industrial Development (PJSC) (ADX:SCIDC) | AED0.703 | AED427.6M | ✅ 2 ⚠️ 2 View Analysis > |

| Dubai National Insurance & Reinsurance (P.S.C.) (DFM:DNIR) | AED2.88 | AED332.64M | ✅ 2 ⚠️ 5 View Analysis > |

| E7 Group PJSC (ADX:E7) | AED0.997 | AED2B | ✅ 3 ⚠️ 2 View Analysis > |

| Dubai Investments PJSC (DFM:DIC) | AED2.39 | AED10.16B | ✅ 2 ⚠️ 3 View Analysis > |

Click here to see the full list of 93 stocks from our Middle Eastern Penny Stocks screener.

Let's uncover some gems from our specialized screener.

Al Khaleej Investment P.J.S.C (ADX:KICO)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Al Khaleej Investment P.J.S.C., with a market cap of AED404.25 million, operates as a real estate and investment company in the United Arab Emirates.

Operations: Revenue segments for the company have not been reported.

Market Cap: AED404.25M

Al Khaleej Investment P.J.S.C., with a market cap of AED404.25 million, operates in the real estate and investment sector in the UAE but lacks significant revenue streams, with recent quarterly sales at AED3.1 million and a net loss of AED1.88 million. Despite being debt-free, the company has experienced negative earnings growth over the past year and volatile share prices recently. Changes to its board include appointing Omar Siraj M Qandeel as an independent member amidst ongoing operational adjustments. The company's financial stability is supported by assets exceeding liabilities, though profit margins have declined compared to last year.

- Jump into the full analysis health report here for a deeper understanding of Al Khaleej Investment P.J.S.C.

- Gain insights into Al Khaleej Investment P.J.S.C's historical outcomes by reviewing our past performance report.

Phoenix Group (ADX:PHX)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Phoenix Group Plc, with a market cap of AED5.85 billion, offers crypto and cloud mining services across the United Arab Emirates, Oman, CIS, Canada, the United States, and other international markets.

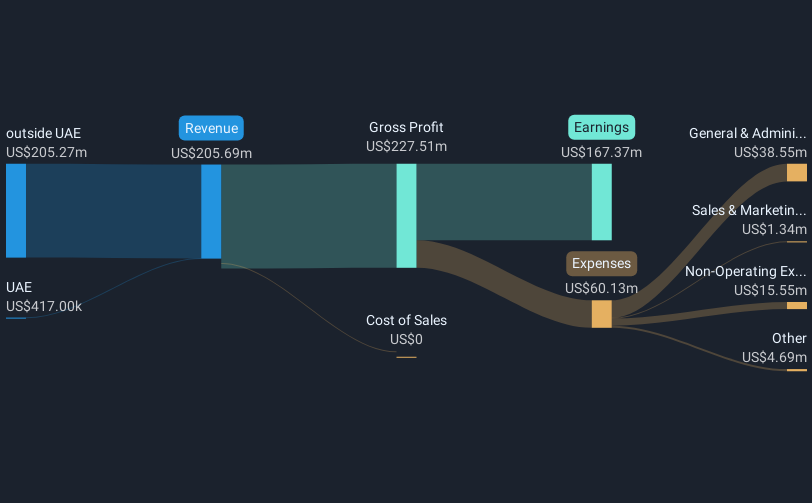

Operations: The company generates revenue from its data processing segment, totaling $168.01 million.

Market Cap: AED5.85B

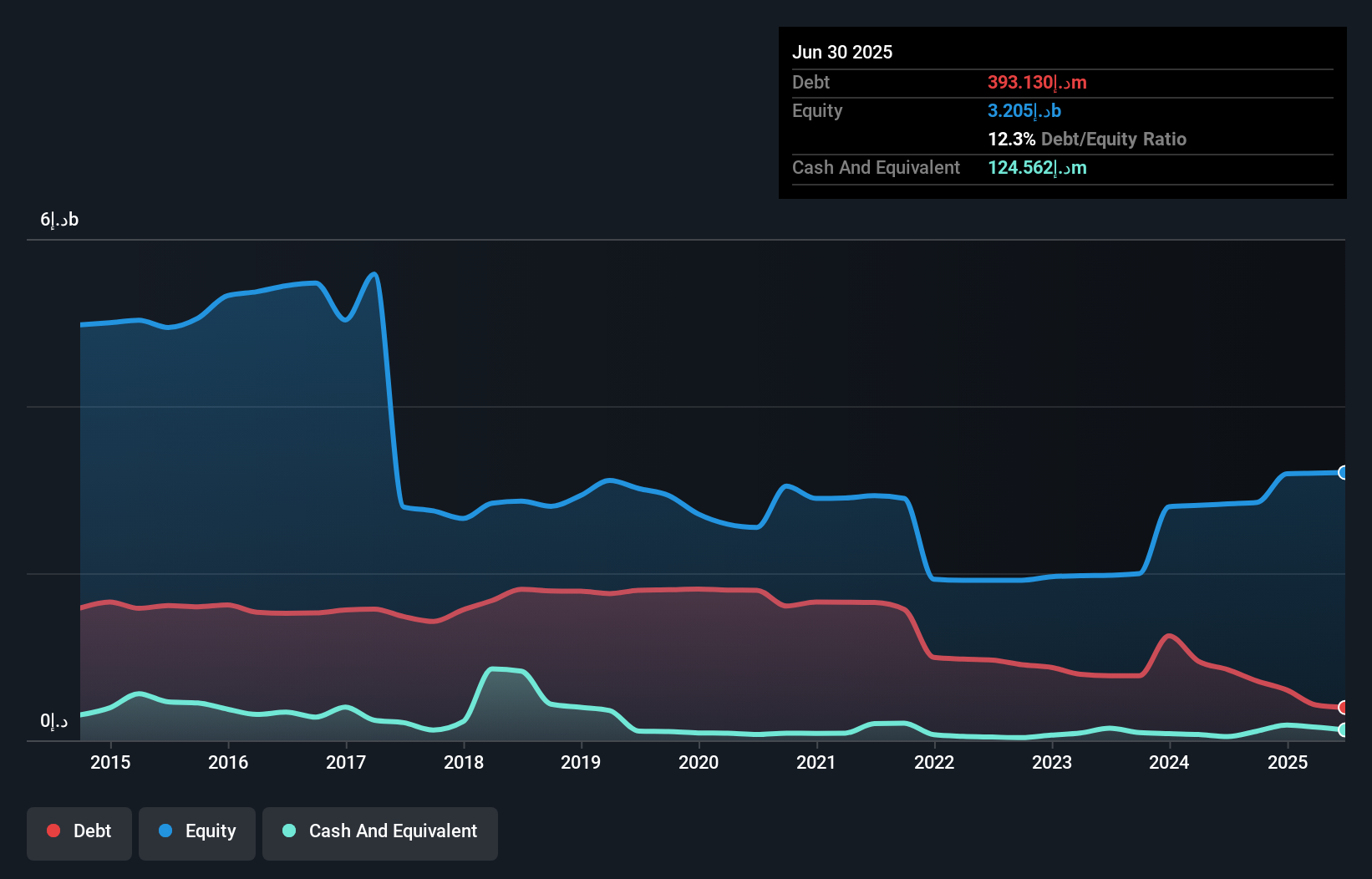

Phoenix Group Plc, with a market cap of AED5.85 billion, is experiencing financial volatility despite its significant global presence in crypto and cloud mining. The company reported Q1 2025 sales of US$31.26 million, a sharp decline from the previous year's US$68.93 million, alongside a net loss of US$153.6 million compared to a prior net income. However, Phoenix Group's strategic expansion in Ethiopia increases its mining capacity to over 500 MW globally and emphasizes sustainable operations using renewable hydropower sources for 90% of its energy needs—highlighting their commitment to responsible growth amidst challenging financial conditions.

- Click here to discover the nuances of Phoenix Group with our detailed analytical financial health report.

- Examine Phoenix Group's earnings growth report to understand how analysts expect it to perform.

Union Properties (DFM:UPP)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Union Properties Public Joint Stock Company is involved in property investment and development, with a market cap of AED2.32 billion.

Operations: The company's revenue is derived from three main segments: Contracting (AED29.39 million), Real Estate (AED54.50 million), and Goods and Services (AED470.00 million).

Market Cap: AED2.32B

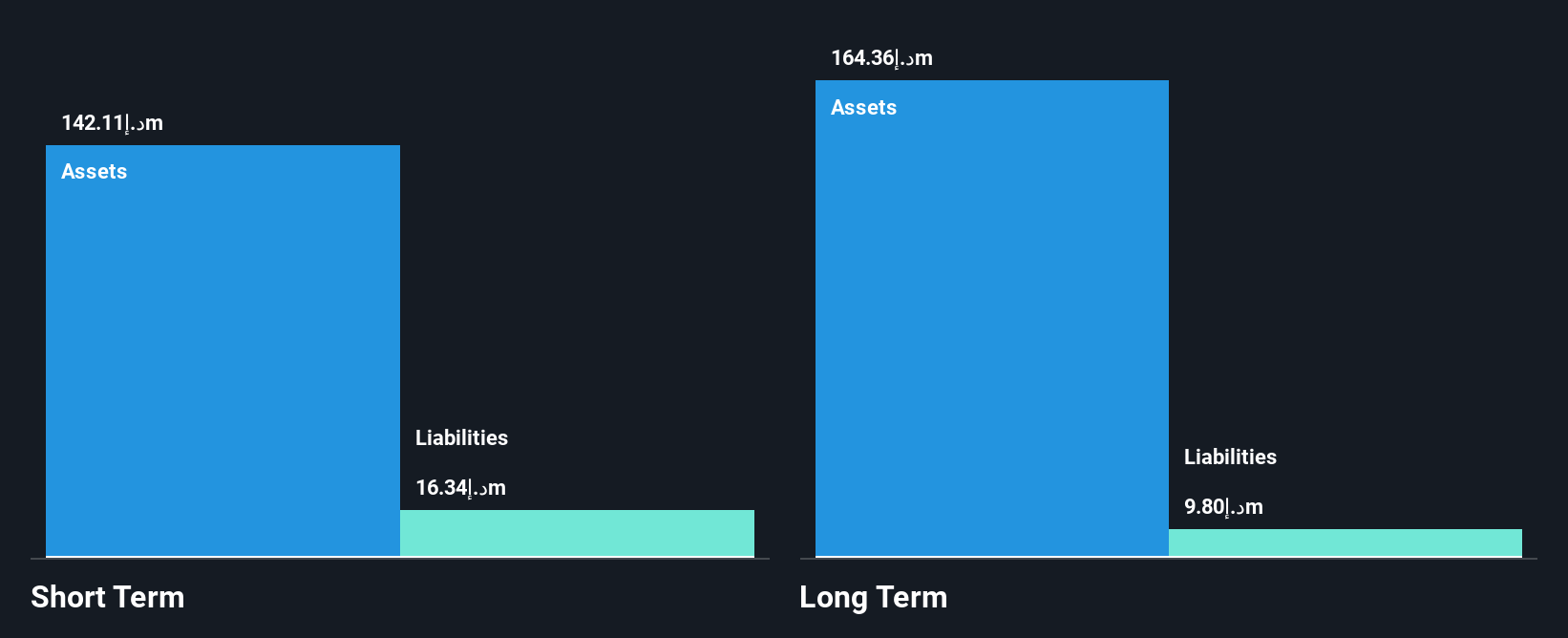

Union Properties, with a market cap of AED2.32 billion, has shown mixed financial performance as a penny stock. Despite becoming profitable over the past five years with earnings growth of 35.5% annually, recent results for Q1 2025 reveal sales of AED163.23 million and net income dropping to AED5.81 million from AED16.47 million the previous year. The company benefits from strong asset coverage over liabilities and reduced debt levels, but its operating cash flow remains negative, impacting debt coverage capabilities. Its price-to-earnings ratio (8.8x) suggests good value compared to peers despite lower profit margins and stable weekly volatility at 6%.

- Click to explore a detailed breakdown of our findings in Union Properties' financial health report.

- Understand Union Properties' earnings outlook by examining our growth report.

Summing It All Up

- Reveal the 93 hidden gems among our Middle Eastern Penny Stocks screener with a single click here.

- Ready For A Different Approach? The latest GPUs need a type of rare earth metal called Dysprosium and there are only 23 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Union Properties, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About DFM:UPP

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives