- United Arab Emirates

- /

- Real Estate

- /

- DFM:UPP

Atlantic Navigation Holdings (Singapore) And 2 Promising Penny Stocks To Watch

Reviewed by Simply Wall St

As global markets react to the recent U.S. election results, with major indices like the S&P 500 and Russell 2000 experiencing significant gains, investors are exploring diverse opportunities across various sectors. Penny stocks, though often considered niche investments, continue to attract attention for their potential growth prospects in smaller or newer companies. In this article, we will examine three penny stocks that may offer a blend of financial stability and long-term potential amid current market dynamics.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| BP Plastics Holding Bhd (KLSE:BPPLAS) | MYR1.24 | MYR349.03M | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.83 | HK$526.87M | ★★★★★★ |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.495 | MYR2.44B | ★★★★★★ |

| Rexit Berhad (KLSE:REXIT) | MYR0.79 | MYR135.97M | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.76 | A$138.53M | ★★★★☆☆ |

| Polar Capital Holdings (AIM:POLR) | £4.955 | £477.59M | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.87 | MYR292.11M | ★★★★★★ |

| Shoe Zone (AIM:SHOE) | £1.525 | £70.5M | ★★★★★★ |

| Kelington Group Berhad (KLSE:KGB) | MYR2.96 | MYR2.07B | ★★★★★☆ |

| Next 15 Group (AIM:NFG) | £3.80 | £377.93M | ★★★★☆☆ |

Click here to see the full list of 5,742 stocks from our Penny Stocks screener.

Here's a peek at a few of the choices from the screener.

Atlantic Navigation Holdings (Singapore) (Catalist:5UL)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Atlantic Navigation Holdings (Singapore) Limited is an investment holding company offering marine logistics, ship repair, fabrication, and other marine services primarily in Qatar, Saudi Arabia, Oman, and internationally with a market cap of SGD177.99 million.

Operations: The company's revenue is primarily derived from Marine Logistics Services (MLS) at $99.15 million and Ship Repair, Fabrication, and Other Marine Services (SRM) at $2.87 million.

Market Cap: SGD177.99M

Atlantic Navigation Holdings (Singapore) Limited has demonstrated significant earnings growth, with recent half-year sales reaching US$53.22 million and net income doubling to US$21.55 million compared to the previous year. The company shows a strong financial position with its EBIT covering interest payments 5.1 times over, despite high debt levels and short-term liabilities exceeding short-term assets by US$15.8 million. Recent strategic moves include a proposed sale of 20 offshore vessels for US$183 million and special dividends totaling approximately SGD75.62 million, indicating efforts to return capital to shareholders while maintaining operational stability through ship management agreements post-sale.

- Click to explore a detailed breakdown of our findings in Atlantic Navigation Holdings (Singapore)'s financial health report.

- Gain insights into Atlantic Navigation Holdings (Singapore)'s historical outcomes by reviewing our past performance report.

Union Properties (DFM:UPP)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Union Properties PJSC, along with its subsidiaries, is involved in investing in, developing, managing, maintaining, and selling real estate properties mainly in the United Arab Emirates and has a market cap of AED1.51 billion.

Operations: The company's revenue is derived from three main segments: Contracting (AED33.26 million), Real Estate (AED47.46 million), and Goods and Services (AED452.07 million).

Market Cap: AED1.51B

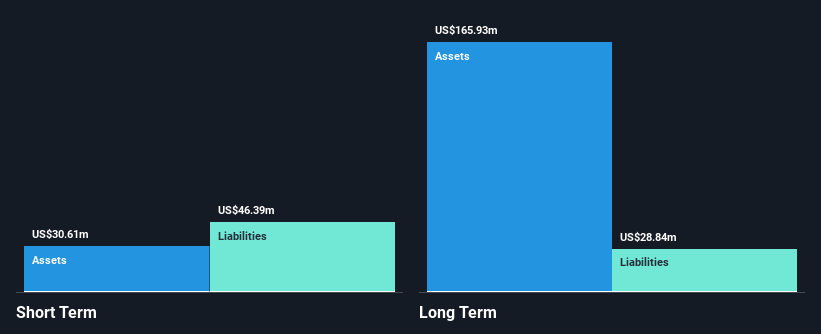

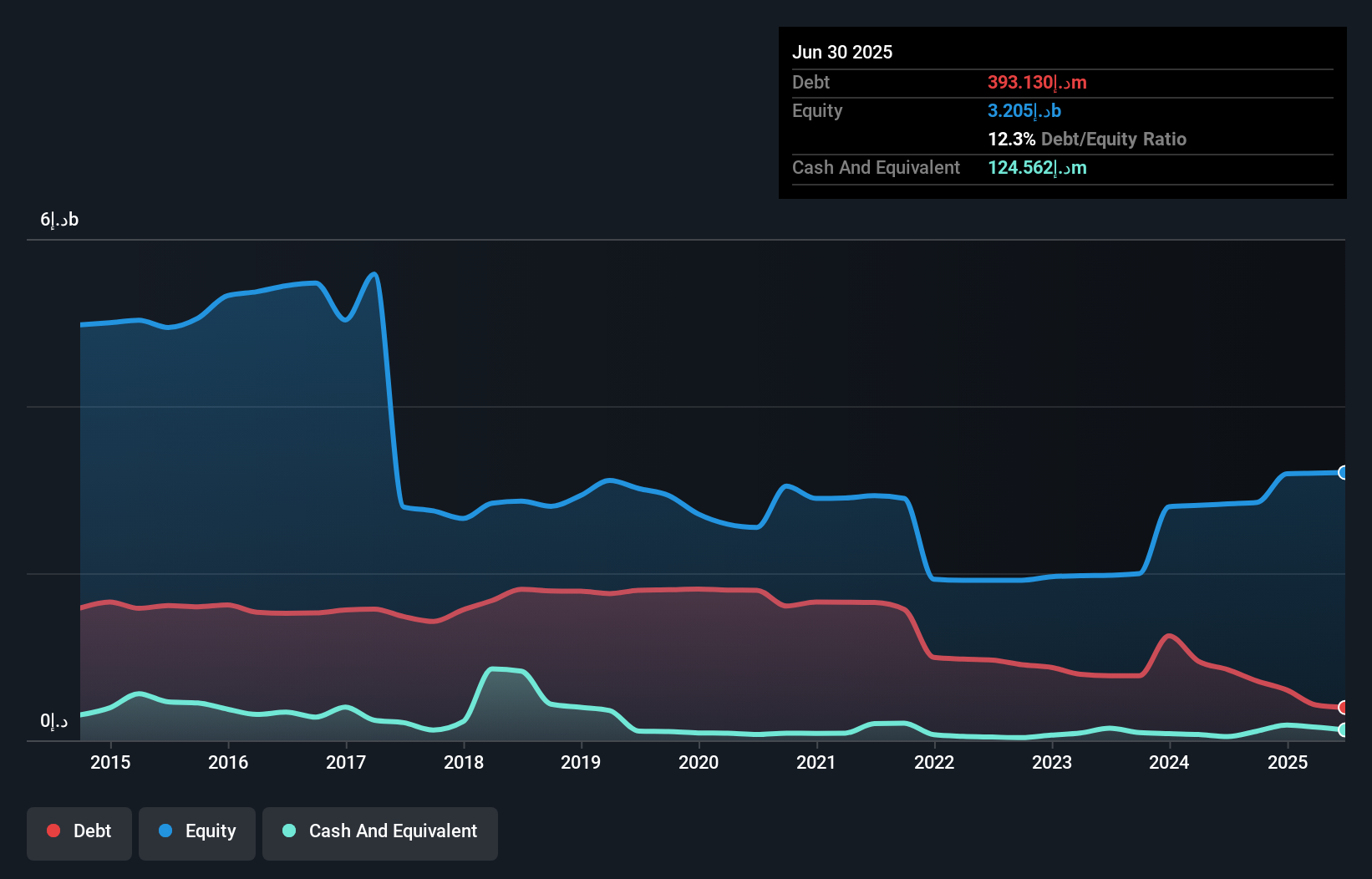

Union Properties has shown robust earnings growth, with a 983% increase over the past year, significantly surpassing the real estate industry average. The company's price-to-earnings ratio of 1.8x suggests it is trading at a favorable value compared to its peers and the broader AE market. Despite high non-cash earnings and a satisfactory net debt to equity ratio of 21%, its operating cash flow remains negative, indicating potential challenges in covering debt. While short-term assets exceed both short-term and long-term liabilities, interest payments are not well covered by EBIT, highlighting financial vulnerabilities despite profit growth acceleration.

- Dive into the specifics of Union Properties here with our thorough balance sheet health report.

- Examine Union Properties' earnings growth report to understand how analysts expect it to perform.

Town Health International Medical Group (SEHK:3886)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Town Health International Medical Group Limited is an investment holding company that offers healthcare and related services in the People’s Republic of China and Hong Kong, with a market cap of HK$1.73 billion.

Operations: The company generates revenue from Hong Kong Medical Services (HK$826.41 million), Hong Kong Managed Medical Network Business (HK$510.13 million), and Mainland Hospital Management and Medical Services (HK$533.79 million).

Market Cap: HK$1.73B

Town Health International Medical Group faces challenges as it reported a net loss of HK$47.68 million for the first half of 2024, contrasting with a profit in the same period last year. Despite having more cash than total debt and sufficient short-term assets to cover liabilities, its negative return on equity and increasing losses over five years raise concerns about profitability. The company is trading significantly below estimated fair value but remains unprofitable, though it benefits from a stable cash runway exceeding three years due to positive free cash flow growth. The management team and board lack experience, potentially impacting strategic direction.

- Get an in-depth perspective on Town Health International Medical Group's performance by reading our balance sheet health report here.

- Assess Town Health International Medical Group's previous results with our detailed historical performance reports.

Turning Ideas Into Actions

- Explore the 5,742 names from our Penny Stocks screener here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About DFM:UPP

High growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives