- Turkey

- /

- Capital Markets

- /

- IBSE:A1CAP

Middle Eastern Penny Stocks To Watch In March 2025

Reviewed by Simply Wall St

As global trade tensions escalate, most Gulf markets have seen declines, with Saudi Aramco's recent earnings report adding to the cautious sentiment among investors. Despite these challenges, the Middle East continues to offer opportunities for those willing to explore lesser-known avenues in the stock market. Penny stocks, while often considered a relic of earlier market days, still represent smaller or newer companies that can offer growth potential when supported by strong financials. In this article, we highlight three penny stocks from the region that may stand out for their financial health and potential upside.

Top 10 Penny Stocks In The Middle East

| Name | Share Price | Market Cap | Financial Health Rating |

| Alarum Technologies (TASE:ALAR) | ₪2.16 | ₪149.78M | ★★★★★★ |

| Oil Refineries (TASE:ORL) | ₪1.019 | ₪3.17B | ★★★★★★ |

| Thob Al Aseel (SASE:4012) | SAR4.01 | SAR1.6B | ★★★★★★ |

| Tgi Infrastructures (TASE:TGI) | ₪2.251 | ₪167.34M | ★★★★★☆ |

| Big Tech 50 R&D-Limited Partnership (TASE:BIGT) | ₪1.603 | ₪17.01M | ★★★★★★ |

| Hub Girisim Sermayesi Yatirim Ortakligi (IBSE:HUBVC) | TRY1.80 | TRY504M | ★★★★★★ |

| Dubai Investments PJSC (DFM:DIC) | AED2.26 | AED9.57B | ★★★★★☆ |

| Yesil Yapi Endüstrisi (IBSE:YYAPI) | TRY1.52 | TRY1.3B | ★★★★★☆ |

| Peninsula Group (TASE:PEN) | ₪2.415 | ₪537.12M | ★★★★☆☆ |

| Orad (TASE:ORAD) | ₪0.807 | ₪75.3M | ★★★★★★ |

Click here to see the full list of 92 stocks from our Middle Eastern Penny Stocks screener.

Let's explore several standout options from the results in the screener.

Islamic Arab Insurance (Salama) PJSC (DFM:SALAMA)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Islamic Arab Insurance Co. (Salama) PJSC, with a market cap of AED368.18 million, offers a variety of general, family, health, and auto takaful solutions across Africa and Asia through its subsidiaries.

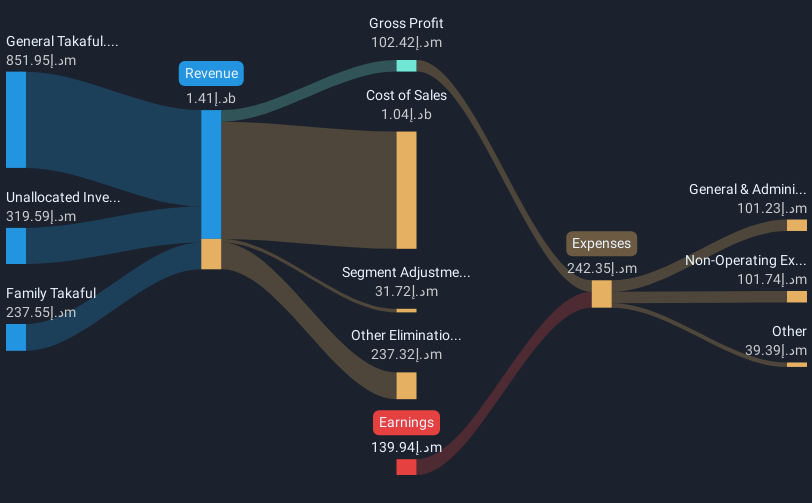

Operations: The company's revenue is derived from Family Takaful at AED237.55 million and General Takaful at AED851.95 million.

Market Cap: AED368.18M

Islamic Arab Insurance Co. (Salama) PJSC, with a market cap of AED368.18 million, operates in the takaful sector across Africa and Asia. Despite being unprofitable with a negative return on equity of -19.53%, Salama is debt-free and maintains a stable cash runway for over three years, supported by positive free cash flow. However, its short-term assets of AED914 million do not cover long-term liabilities totaling AED2.9 billion, posing financial challenges. The board is experienced with an average tenure of 3.7 years, yet earnings have consistently declined by 62.9% annually over the past five years as losses increase further.

- Click here and access our complete financial health analysis report to understand the dynamics of Islamic Arab Insurance (Salama) PJSC.

- Evaluate Islamic Arab Insurance (Salama) PJSC's historical performance by accessing our past performance report.

A1 Capital Yatirim Menkul Degerler (IBSE:A1CAP)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: A1 Capital Yatirim Menkul Degerler A.S. operates as a brokerage company with a market capitalization of TRY3.06 billion.

Operations: No specific revenue segments are reported for this brokerage company.

Market Cap: TRY3.06B

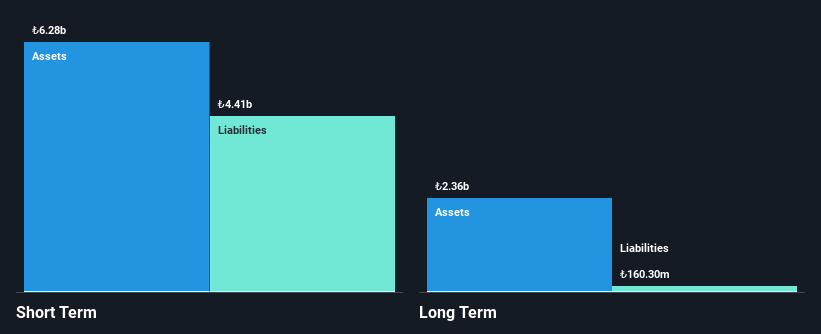

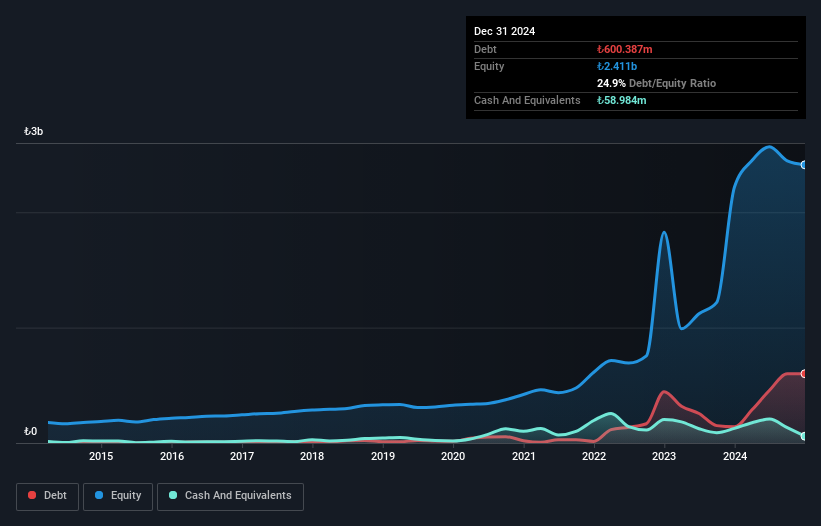

A1 Capital Yatirim Menkul Degerler A.S., with a market cap of TRY3.06 billion, demonstrates robust financial health as its short-term assets (TRY7.9 billion) comfortably cover both short and long-term liabilities. The company has shown remarkable earnings growth of 965.7% over the past year, significantly outpacing the industry average, although its return on equity remains low at 2.3%. While operating cash flow is negative, debt levels are manageable with more cash than total debt, and recent earnings announcements reveal a substantial shift to net income of TRY369.89 million from a previous net loss, highlighting improving profitability trends.

- Get an in-depth perspective on A1 Capital Yatirim Menkul Degerler's performance by reading our balance sheet health report here.

- Gain insights into A1 Capital Yatirim Menkul Degerler's past trends and performance with our report on the company's historical track record.

Ege Seramik Sanayi ve Ticaret (IBSE:EGSER)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Ege Seramik Sanayi ve Ticaret A.S. is a company that produces and sells ceramic floor and wall tiles globally, with a market cap of TRY2.37 billion.

Operations: Ege Seramik Sanayi ve Ticaret A.S. does not report specific revenue segments.

Market Cap: TRY2.37B

Ege Seramik Sanayi ve Ticaret A.S., with a market cap of TRY2.37 billion, reported a significant decline in sales to TRY2.69 billion for 2024 from TRY3.95 billion the previous year, alongside an increased net loss of TRY890 million. Despite being unprofitable and experiencing growing losses over five years, its short-term assets exceed both short and long-term liabilities, indicating solid liquidity management. The company's debt is well covered by operating cash flow, but the rising debt-to-equity ratio suggests increasing leverage risks. Both board and management exhibit strong experience with average tenures of 3.2 and 15.1 years respectively.

- Click to explore a detailed breakdown of our findings in Ege Seramik Sanayi ve Ticaret's financial health report.

- Review our historical performance report to gain insights into Ege Seramik Sanayi ve Ticaret's track record.

Key Takeaways

- Discover the full array of 92 Middle Eastern Penny Stocks right here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade A1 Capital Yatirim Menkul Degerler, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About IBSE:A1CAP

Solid track record with adequate balance sheet.