- United Arab Emirates

- /

- Insurance

- /

- DFM:NGI

National General Insurance Co. (P.J.S.C.) (DFM:NGI) Stock Catapults 30% Though Its Price And Business Still Lag The Market

National General Insurance Co. (P.J.S.C.) (DFM:NGI) shareholders would be excited to see that the share price has had a great month, posting a 30% gain and recovering from prior weakness. Longer-term shareholders would be thankful for the recovery in the share price since it's now virtually flat for the year after the recent bounce.

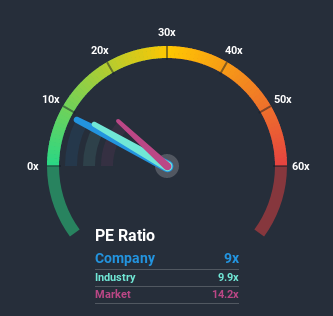

Although its price has surged higher, National General Insurance (P.J.S.C.) may still be sending bullish signals at the moment with its price-to-earnings (or "P/E") ratio of 9x, since almost half of all companies in the United Arab Emirates have P/E ratios greater than 15x and even P/E's higher than 32x are not unusual. However, the P/E might be low for a reason and it requires further investigation to determine if it's justified.

Recent times have been quite advantageous for National General Insurance (P.J.S.C.) as its earnings have been rising very briskly. One possibility is that the P/E is low because investors think this strong earnings growth might actually underperform the broader market in the near future. If that doesn't eventuate, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

See our latest analysis for National General Insurance (P.J.S.C.)

Is There Any Growth For National General Insurance (P.J.S.C.)?

In order to justify its P/E ratio, National General Insurance (P.J.S.C.) would need to produce sluggish growth that's trailing the market.

Taking a look back first, we see that the company grew earnings per share by an impressive 171% last year. EPS has also lifted 26% in aggregate from three years ago, mostly thanks to the last 12 months of growth. Therefore, it's fair to say the earnings growth recently has been respectable for the company.

Weighing that recent medium-term earnings trajectory against the broader market's one-year forecast for expansion of 26% shows it's noticeably less attractive on an annualised basis.

In light of this, it's understandable that National General Insurance (P.J.S.C.)'s P/E sits below the majority of other companies. Apparently many shareholders weren't comfortable holding on to something they believe will continue to trail the bourse.

The Final Word

The latest share price surge wasn't enough to lift National General Insurance (P.J.S.C.)'s P/E close to the market median. Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

As we suspected, our examination of National General Insurance (P.J.S.C.) revealed its three-year earnings trends are contributing to its low P/E, given they look worse than current market expectations. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. If recent medium-term earnings trends continue, it's hard to see the share price rising strongly in the near future under these circumstances.

It is also worth noting that we have found 2 warning signs for National General Insurance (P.J.S.C.) (1 is a bit unpleasant!) that you need to take into consideration.

If P/E ratios interest you, you may wish to see this free collection of other companies that have grown earnings strongly and trade on P/E's below 20x.

If you’re looking to trade National General Insurance (P.J.S.C.), open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if National General Insurance (P.J.S.C.) might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About DFM:NGI

National General Insurance (P.J.S.C.)

Engages in underwriting various classes of life and general insurance, and reinsurance businesses in the United Arab Emirates.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives